- United States

- /

- Airlines

- /

- NasdaqCM:JTAI

Jet.AI Inc.'s (NASDAQ:JTAI) Shares Climb 39% But Its Business Is Yet to Catch Up

Those holding Jet.AI Inc. (NASDAQ:JTAI) shares would be relieved that the share price has rebounded 39% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 88% share price decline over the last year.

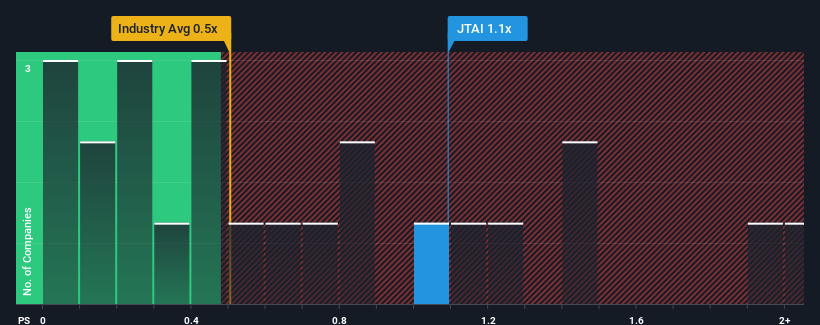

Since its price has surged higher, you could be forgiven for thinking Jet.AI is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.1x, considering almost half the companies in the United States' Airlines industry have P/S ratios below 0.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Jet.AI

How Has Jet.AI Performed Recently?

Jet.AI could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Jet.AI will help you uncover what's on the horizon.How Is Jet.AI's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Jet.AI's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 49%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 102% per annum over the next three years. With the industry predicted to deliver 94% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Jet.AI's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Jet.AI's P/S

Jet.AI's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting Jet.AI's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Don't forget that there may be other risks. For instance, we've identified 6 warning signs for Jet.AI (5 are a bit unpleasant) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JTAI

Jet.AI

Primarily engages in the development and operation of private aviation platforms.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives