- United States

- /

- Airlines

- /

- NasdaqCM:JTAI

Jet.AI Inc. (NASDAQ:JTAI) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Jet.AI Inc. (NASDAQ:JTAI) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 93% share price decline.

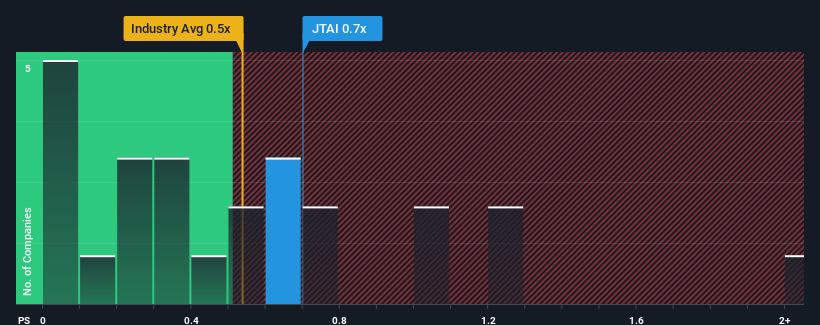

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Jet.AI's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Airlines industry in the United States is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Jet.AI

What Does Jet.AI's P/S Mean For Shareholders?

Jet.AI hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Jet.AI will help you uncover what's on the horizon.How Is Jet.AI's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jet.AI's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 44% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Looking ahead now, revenue is anticipated to climb by 77% per annum during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 93% per annum, which is noticeably more attractive.

With this information, we find it interesting that Jet.AI is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Jet.AI's P/S?

Following Jet.AI's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Jet.AI's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Jet.AI has 6 warning signs (and 5 which don't sit too well with us) we think you should know about.

If these risks are making you reconsider your opinion on Jet.AI, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JTAI

Jet.AI

Primarily engages in the development and operation of private aviation platforms.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives