- United States

- /

- Airlines

- /

- NasdaqGS:JBLU

JetBlue's (NASDAQ:JBLU) Potential Acquisition is Bringing More Short-Term Pain

Although many airlines struggled to recover after the crash of 2020, JetBlue Airways Corporation (NASDAQ: JBLU) was one of the rare companies that achieved this in just over a year.

Yet, the stock failed to remain at that valuation, losing 40% in the next 12 months. We will examine the latest fundamental updates as we move toward the next earnings report on April 26.

View our latest analysis for JetBlue Airways

Potential Acquisition, Expansion, and a New Partnership

JetBlue just offered $33/share (total US$3.6b) for Spirit Airlines (NYSE: SAVE), 40% higher than Frontier Airlines (NasdaqGS: ULCC) offered in February.

An acquisition would mark JetBlue's expansion into the budget segment in an attempt to compete against the 4 dominant airliners in the domestic market. Six years ago the company tried buying Virgin America but got outbid by Alaska Air Group (NYSE: ALK).

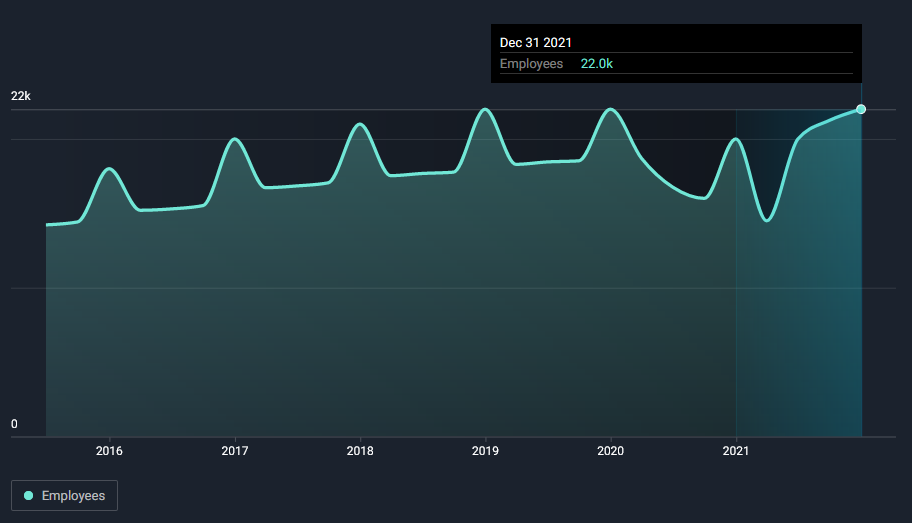

Meanwhile, the company announced a plan to add 5,000 jobs across its operations in New York. This is a strong boost to the workforce which grew by 50% just in the second half of 2021.

Finally, the company is expanding its partnership with Qatar Airways to strengthen its global network. This partnership would especially benefit the customers that fly through New York's JFK airport which is the focus city for both airlines.

How Far Away is Profitability?

Thirteen of the American Airlines analysts anticipate the company to incur a final loss in 2022, before generating positive profits of US$442m in 2023. The company is therefore projected to break even just over a year from now.

How fast will the company have to grow each year in order to reach the breakeven point by 2023? Working backward from analyst estimates, it turns out that they expect the company to grow 65% year-on-year, on average. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

We're not going to go through company-specific developments for JetBlue Airways given that this is a high-level summary, but, bear in mind that typically a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

One thing we would like to bring into light with JetBlue Airways is its relatively high level of debt. Generally, the rule of thumb is debt shouldn’t exceed 40% of your equity, which in JetBlue Airways' case is 95%. Note that a higher debt obligation increases the risk in investing in a loss-making company.

How can this impact the investors?

According to JetBlue, the deal with Spirit Airlines would deliver about US$600-700m in net annual synergies, translating into approximately US$12b of revenues (based on 2019 data).

Yet, while Spirit Airlines soared 22% on the news, Jet Blue sold off, gapping down more than 4%. As already mentioned, this is not its first attempt to expand the operation, but combining two low-cost carriers might be too much for anti-trust regulators, who are already calling for a further investigation by the Department of Justice.

In case the deal goes through, there is a breakup fee for the ongoing acquisition by Frontier, which is US$94m – not an amount to ignore when both companies still aren't consistently profitable. For a more comprehensive look at JetBlue Airways, take a look at JetBlue Airways' company page on Simply Wall St.

If you're looking to trade JetBlue Airways, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:JBLU

Undervalued very low.

Market Insights

Community Narratives