- United States

- /

- Transportation

- /

- NasdaqGS:JBHT

J.B. Hunt (JBHT) Valuation: Is the Recent Rebound Signaling Hidden Value?

Reviewed by Simply Wall St

See our latest analysis for J.B. Hunt Transport Services.

The momentum behind J.B. Hunt’s recent run is starting to stand out, with a 20% three-month share price return that contrasts sharply with its lower long-term total shareholder returns. While gains in recent weeks have caught the market’s interest, the stock’s mixed longer-term total returns show that sentiment is still in a period of transition, as new optimism is balanced against past challenges.

If you’re watching how momentum is shifting in the transport sector, it’s a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares rebounding over the last three months, yet still trailing on longer-term returns, the key question emerges: is J.B. Hunt trading below its true value, or has the market already factored in all anticipated growth?

Most Popular Narrative: 5.1% Overvalued

According to the leading narrative, J.B. Hunt’s fair value sits just below its recent share price, highlighting a premium that the market is willing to pay. With analysts settling on a discount rate narrowly above 8%, the valuation relies on measured optimism about the company’s growth path.

Strategic investments in technology and capacity expansion may provide a platform for long-term revenue growth by better serving large addressable markets. Successful bid season outcomes, including modest rate increases and filling costly empty lanes, could drive better revenue and profitability metrics.

Want to see the real story driving this high valuation? The narrative centers around margin improvement, operational optimization, and growth assumptions that might surprise you. Think you know what’s fueling the premium? The full narrative spells out bold expectations for both profits and revenue in the years ahead. Click through for the details that could shake up your outlook.

Result: Fair Value of $165.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing inflationary pressures and persistent uncertainty in freight demand could challenge the company’s margin improvement and earnings outlook in the future.

Find out about the key risks to this J.B. Hunt Transport Services narrative.

Another View: DCF Suggests a Different Story

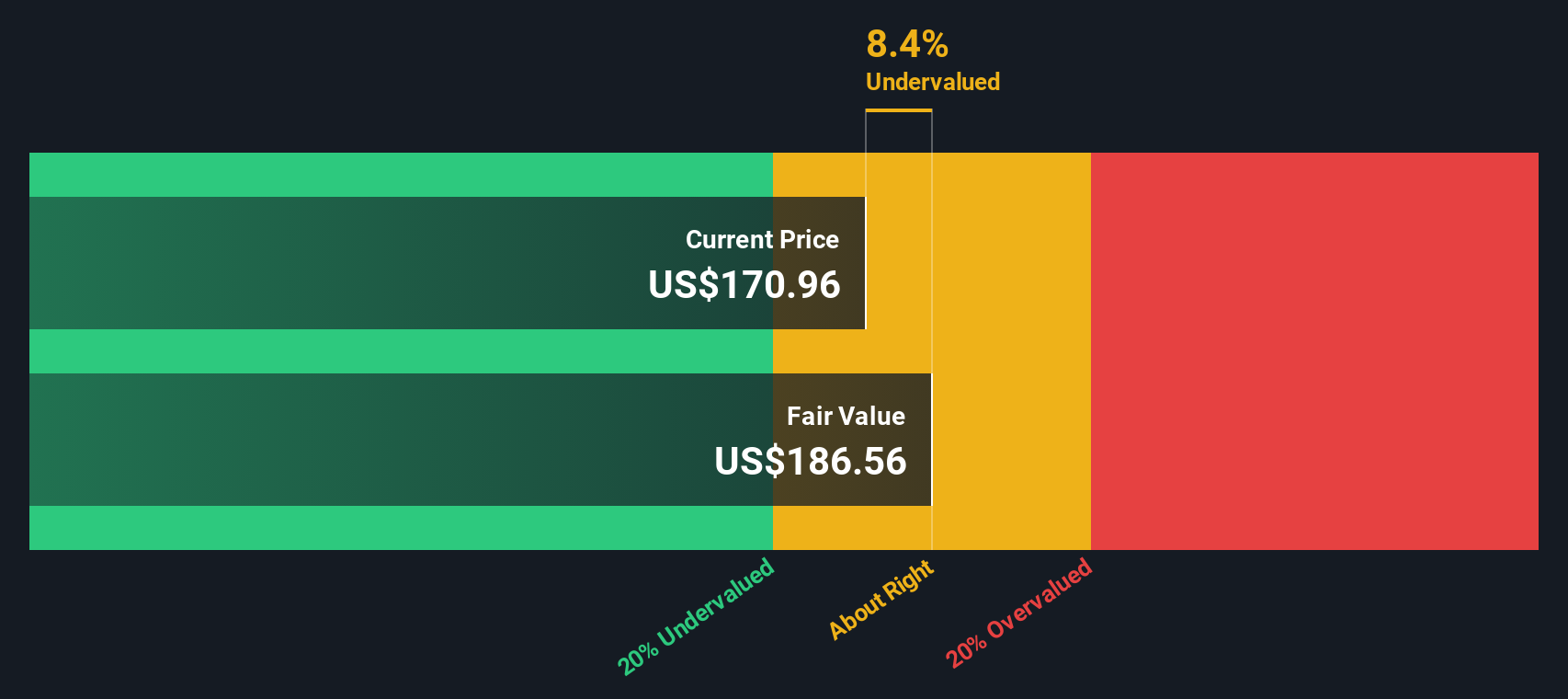

While the current valuation signals J.B. Hunt trades at a premium, our SWS DCF model points in a different direction. The DCF analysis estimates a fair value above today’s share price. This suggests the stock could actually be undervalued if future cash flows meet expectations. Could the market be underestimating J.B. Hunt’s earnings potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out J.B. Hunt Transport Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own J.B. Hunt Transport Services Narrative

If you want to examine the data from your own perspective or challenge these views, crafting a personalized narrative is easier than you might think. Give it a try and Do it your way.

A great starting point for your J.B. Hunt Transport Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don't let a hot stock pass you by when breakthrough investments are just a click away. Expand your horizons and unlock new ways to build wealth.

- Tap into tomorrow's technology by scanning these 25 AI penny stocks which is setting the pace for artificial intelligence innovation and smart automation trends.

- Secure passive income by reviewing these 15 dividend stocks with yields > 3% offering robust yields and consistent cash flow for your portfolio.

- Capitalize on overlooked value with these 913 undervalued stocks based on cash flows that reveals companies trading below their intrinsic worth and potentially positioned for future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBHT

J.B. Hunt Transport Services

Provides surface transportation, delivery, and logistic services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026