- United States

- /

- Transportation

- /

- NasdaqGS:JBHT

Exploring J.B. Hunt (JBHT) Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

J.B. Hunt Transport Services (JBHT) shares have seen some movement lately, which has caught the eye of market watchers. Investors are now weighing the company’s recent performance along with official results to get a clearer sense of what’s next.

See our latest analysis for J.B. Hunt Transport Services.

The share price of J.B. Hunt Transport Services has jumped 22.6% over the past month, helping reverse some of its earlier declines this year. Even with recent momentum, however, the 1-year total shareholder return is still down 9.5%. The long-term picture reflects modest growth with periods of volatility.

If JBHT’s recent rally has you thinking about where else opportunity could emerge, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

The question now becomes whether J.B. Hunt Transport Services is trading at a discount and offers untapped value, or if recent gains already reflect expectations for future growth and leave limited room for upside.

Most Popular Narrative: 2% Overvalued

With J.B. Hunt Transport Services closing at $169.26, the most-followed narrative suggests a fair value of $166, putting the share price just above what is deemed reasonable. Analyst sentiment blends recent operational progress with cautious optimism, but not everyone agrees on how the outlook translates to valuation.

Operational execution, especially in the intermodal and dedicated segments, drove notable earnings outperformance in Q3. This underscores the early benefits of cost initiatives.

Want to know which operating trends tipped the scales? The story behind this price tag revolves around ambitious margin expansion and a future profit multiple few expect in this sector. Which bold projections are hiding in plain sight? Don’t miss the unexpected foundation behind this fair value.

Result: Fair Value of $166 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation and continued softness in freight demand could challenge JBHT’s margin gains, which may potentially block the company’s optimistic growth trajectory.

Find out about the key risks to this J.B. Hunt Transport Services narrative.

Another View: What Does the SWS DCF Model Say?

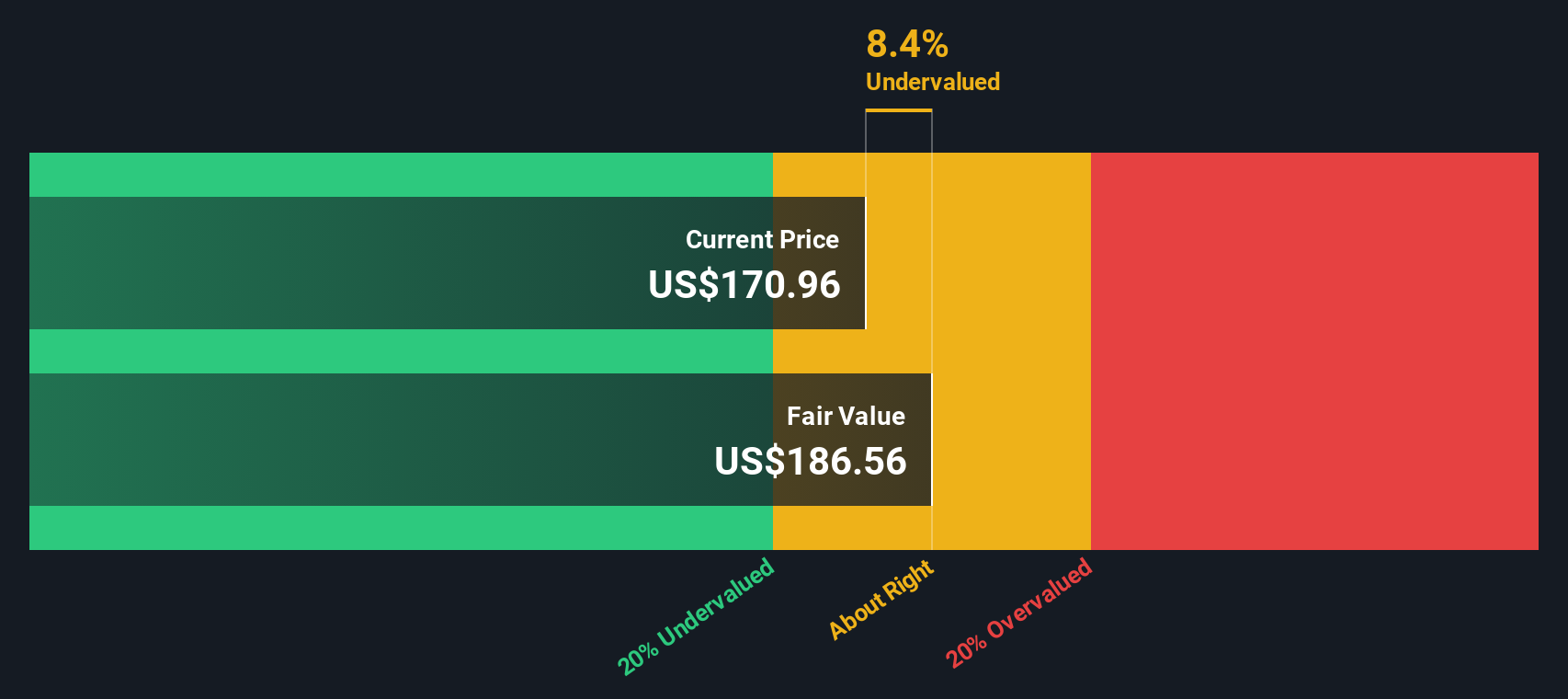

Switching gears, the SWS DCF model suggests J.B. Hunt Transport Services could be undervalued, placing fair value at $186.24, which is well above today's share price. While the market focuses on recent earnings multiples, this approach evaluates the company's future cash flows and long-term growth. Is the market overlooking JBHT’s true potential, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own J.B. Hunt Transport Services Narrative

If these conclusions leave you unconvinced or you want to dive into the numbers yourself, you can build your own story in just a few minutes by using Do it your way.

A great starting point for your J.B. Hunt Transport Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Now is your chance to get ahead by uncovering stocks other investors might miss. Here are three unique ideas curated to match today's market trends. Do not let these opportunities slip by.

- Supercharge your income potential with strong yields by tapping into these 14 dividend stocks with yields > 3% offering reliable returns above 3%.

- Ride the next wave of technological disruption with these 27 quantum computing stocks and see which innovators are pushing quantum computing forward.

- Seize tomorrow’s breakthroughs by finding these 32 healthcare AI stocks transforming the future of medicine with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBHT

J.B. Hunt Transport Services

Provides surface transportation, delivery, and logistic services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives