- United States

- /

- Logistics

- /

- NasdaqGS:HUBG

Hub Group (HUBG): Evaluating Valuation Following Landmark Essendant Partnership and New Two-Day Delivery Initiative

Reviewed by Simply Wall St

Hub Group (HUBG) has just announced a three-year partnership with Essendant, combining their transportation networks to launch a two-day warehouse delivery model across nearly all major US markets. This move is getting attention from investors who are curious about its impact on logistics efficiency.

See our latest analysis for Hub Group.

While Hub Group’s two-day delivery partnership with Essendant has sparked renewed interest in its logistics capabilities, the market’s reaction has been fairly measured. The latest share price sits at $35.62. Although there has been a recent uptick with a 1-month share price return of 2.86%, momentum has faded over the year as seen in the negative 19.36% year-to-date share price return and a 1-year total shareholder return of negative 16.77%. That said, long-term investors still sit on a notable 45.2% five-year total return, highlighting how the company’s story can shift significantly over different horizons.

If this kind of strategic move makes you curious about what else is out there, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The real question, then, is whether Hub Group’s transformation offers investors a genuine bargain at current prices, or if the stock already reflects all the growth this logistics partnership might bring.

Most Popular Narrative: 10.8% Undervalued

At $35.62 per share, Hub Group trades below the most widely followed narrative’s fair value estimate of $39.94. This signals upside potential if the narrative’s numbers play out, yet the gap between price and target is relatively modest, hinting at a mixed outlook.

“Ongoing investments in digital transformation and automation, such as AI-driven decision-making platforms and tech upgrades across business lines, are enabling improved operational efficiencies, scalable customer onboarding, and network optimization. These initiatives are leading to cost reductions and supporting meaningful net margin expansion over time.”

Want to know the math powering this valuation? The key twist involves ambitious assumptions about profit expansion and a future market multiple above the industry standard. Discover what bold projections and strategic bets drive this narrative’s case for upside.

Result: Fair Value of $39.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in revenue and rising digital competition could quickly derail this optimistic scenario. These factors make future growth less certain for Hub Group.

Find out about the key risks to this Hub Group narrative.

Another View: Is the Market Ratio Signaling a Risk?

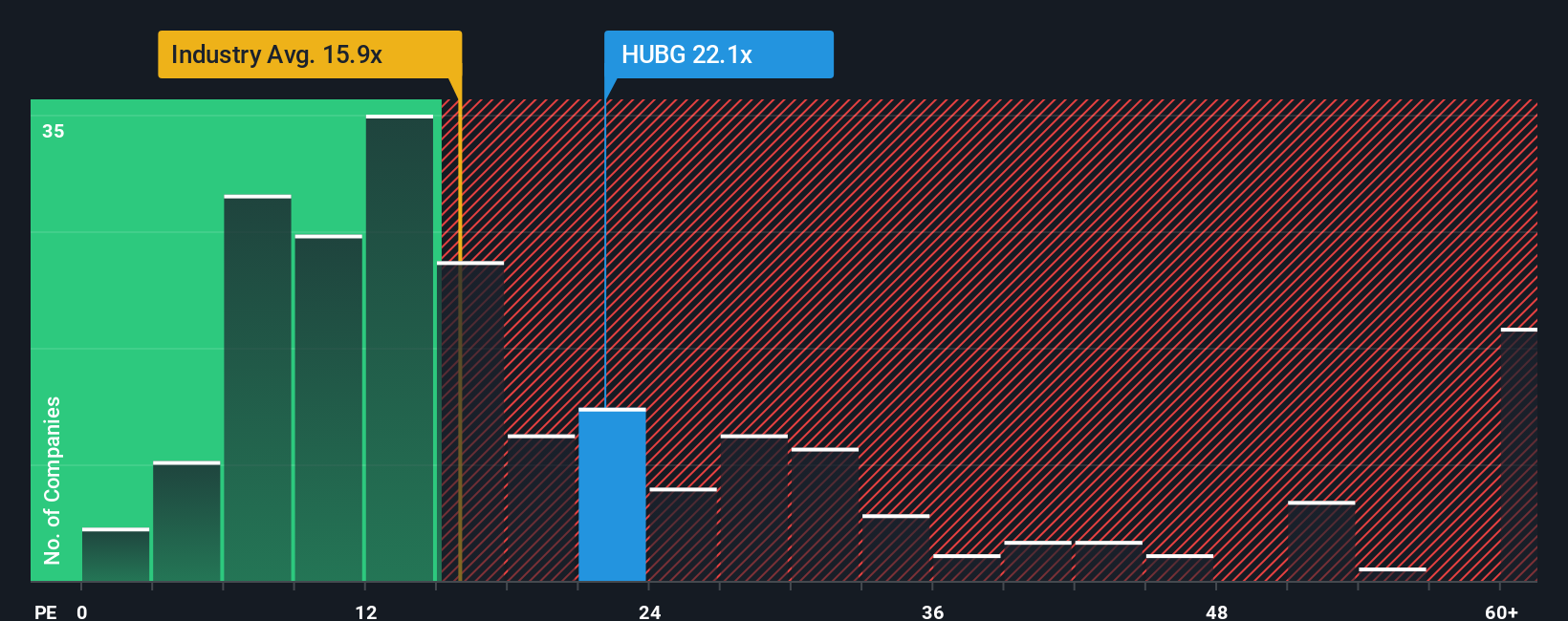

Looking from a different angle, the company’s current price-to-earnings ratio stands at 21.8x. This figure is not only much higher than the global logistics industry average of 16.1x, but is also almost double the estimated fair ratio for Hub Group at 11.7x. While it remains cheap compared to peers averaging 40.6x, this premium over the industry and the fair ratio could mean investors are pricing in more future growth than is realistically probable. Is the market too optimistic about Hub Group’s upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hub Group Narrative

If you see things differently or want to dig into the numbers yourself, you can easily craft a narrative shaped by your own research and insights in just a couple of minutes, all at your own pace. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hub Group.

Looking for More Smart Investing Opportunities?

Sharpen your investment edge by tapping into top-performing stocks and emerging trends trusted by savvy investors worldwide. Don’t miss opportunities others wish they’d found sooner.

- Capture overlooked potential and build your portfolio with confidence using these 877 undervalued stocks based on cash flows, which are flying under Wall Street’s radar.

- Strengthen your income stream by tapping into steady cash flow and growth with these 17 dividend stocks with yields > 3%, delivering yields above 3%.

- Spot the next big thing in artificial intelligence as you back innovation leaders through these 27 AI penny stocks, shaping tomorrow’s markets today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hub Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUBG

Hub Group

A supply chain solutions provider, offers transportation and logistics management services in North America.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives