- United States

- /

- Transportation

- /

- NasdaqGS:HTZ

Reassessing Hertz (HTZ) Valuation After Analyst Downgrades and Bearish Brokerage Calls

Reviewed by Simply Wall St

Recent analyst downgrades and cautious calls from several brokerages have put fresh pressure on Hertz Global Holdings (HTZ). The stock has slid as sentiment soured, despite no new operational headlines from the company itself.

See our latest analysis for Hertz Global Holdings.

Those bearish calls landed just as the stock was trying to stabilize, and despite a recent bounce, the share price return is still negative over the last three months. The year to date share price return remains strongly positive, which hints that longer term momentum is cooling rather than accelerating.

If this shift in sentiment around Hertz has you reassessing the auto space, it might be worth exploring other listed auto manufacturers to see how the market is pricing different risk reward profiles right now.

With analysts leaning cautious despite a still solid year to date gain, the key debate now is whether Hertz’s recent pullback leaves the shares undervalued or if the market is already pricing in any realistic recovery in growth.

Most Popular Narrative: 18.8% Overvalued

With Hertz Global Holdings last closing at $5.22 against a narrative fair value of $4.39, the narrative suggests the recent rally is running ahead of fundamentals.

The analysts have a consensus price target of $4.014 for Hertz Global Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $3.0.

Want to see what is powering that gap between rising earnings, modest revenue growth and a surprisingly low future profit multiple? The full narrative unpacks the exact financial path that has to play out for today’s price to make sense, step by step, in numbers.

Result: Fair Value of $4.39 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Hertz’s younger fleet and digital partnerships could accelerate margin improvement and challenge today’s cautious assumptions if utilization and pricing trends surprise on the upside.

Find out about the key risks to this Hertz Global Holdings narrative.

Another View: Market Ratios Tell a Different Story

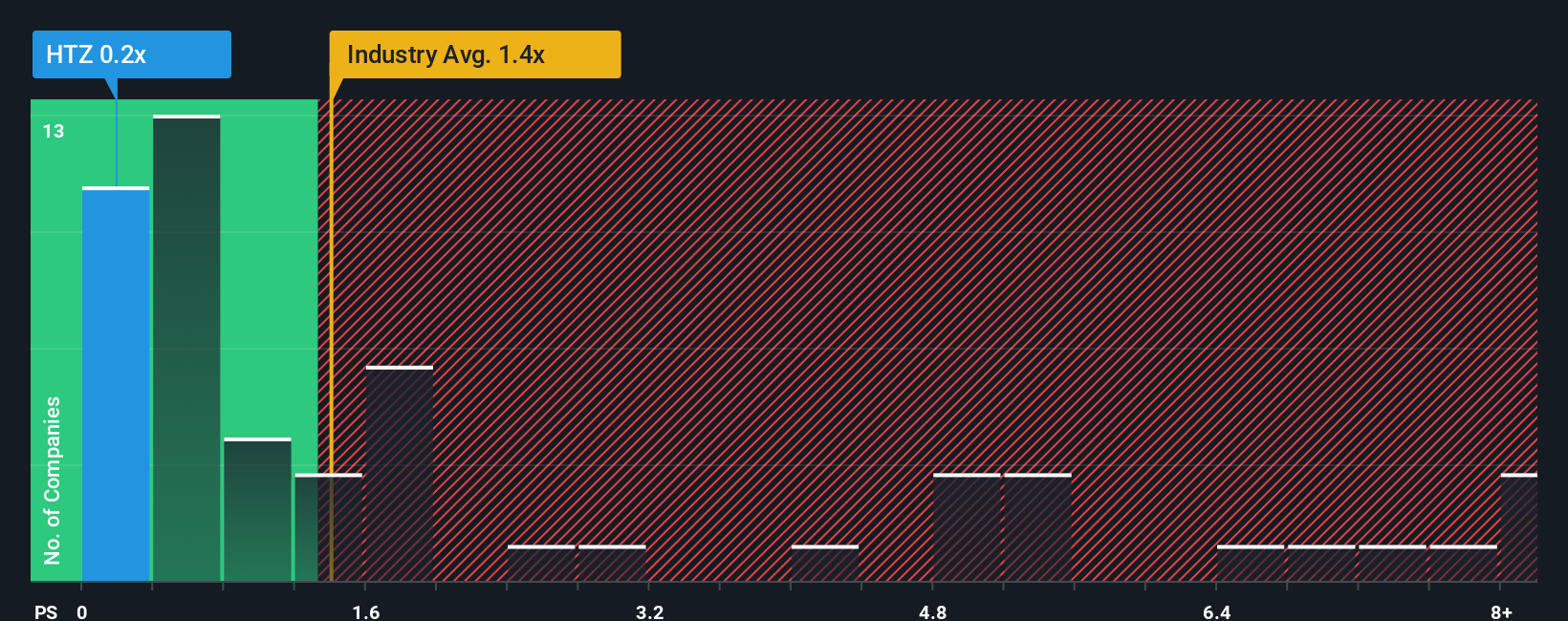

While the narrative fair value flags Hertz as 18.8% overvalued, its price to sales ratio of just 0.2 times looks unusually low compared with the US transportation average of 1.1 times and a fair ratio of 0.4 times. This may hint at upside if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hertz Global Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in just minutes. Do it your way.

A great starting point for your Hertz Global Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research with Hertz. Sharpen your edge with targeted stock ideas in minutes using our powerful Simply Wall Street screener.

- Capture early stage growth potential by reviewing these 3573 penny stocks with strong financials that already show stronger balance sheets and fundamentals than most of their tiny cap peers.

- Position your portfolio at the heart of the innovation wave by scanning these 26 AI penny stocks benefitting from real world demand for automation and intelligent software.

- Strengthen your income stream by focusing on these 14 dividend stocks with yields > 3% that offer attractive yields with the financials to sustain regular payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hertz Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTZ

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026