Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Hawaiian Holdings, Inc. (NASDAQ:HA) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Hawaiian Holdings

How Much Debt Does Hawaiian Holdings Carry?

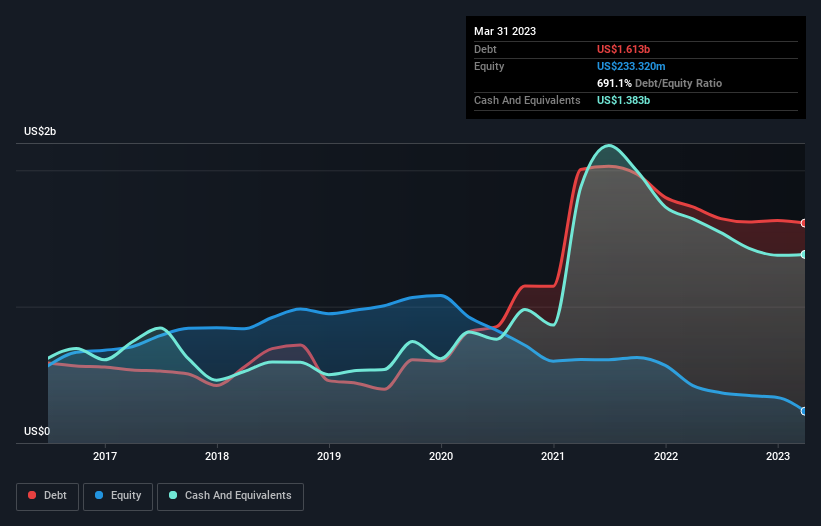

The image below, which you can click on for greater detail, shows that Hawaiian Holdings had debt of US$1.61b at the end of March 2023, a reduction from US$1.73b over a year. However, because it has a cash reserve of US$1.38b, its net debt is less, at about US$229.6m.

A Look At Hawaiian Holdings' Liabilities

We can see from the most recent balance sheet that Hawaiian Holdings had liabilities of US$1.29b falling due within a year, and liabilities of US$2.61b due beyond that. Offsetting this, it had US$1.38b in cash and US$103.3m in receivables that were due within 12 months. So it has liabilities totalling US$2.41b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the US$392.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Hawaiian Holdings would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Hawaiian Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Hawaiian Holdings wasn't profitable at an EBIT level, but managed to grow its revenue by 47%, to US$2.8b. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Hawaiian Holdings managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost a very considerable US$154m at the EBIT level. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Sure, the company might have a nice story about how they are going on to a brighter future. But the reality is that it is low on liquid assets relative to liabilities, and it burned through US$106m in the last year. So is this a high risk stock? We think so, and we'd avoid it. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Hawaiian Holdings you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking to trade Hawaiian Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hawaiian Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HA

Hawaiian Holdings

Through its subsidiary, Hawaiian Airlines, Inc., engages in the scheduled air transportation of passengers and cargo.

Slightly overvalued very low.

Market Insights

Community Narratives