- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

Grab Holdings (NasdaqGS:GRAB) Falls 13% Despite Sales Rising to US$2,797 Million

Reviewed by Simply Wall St

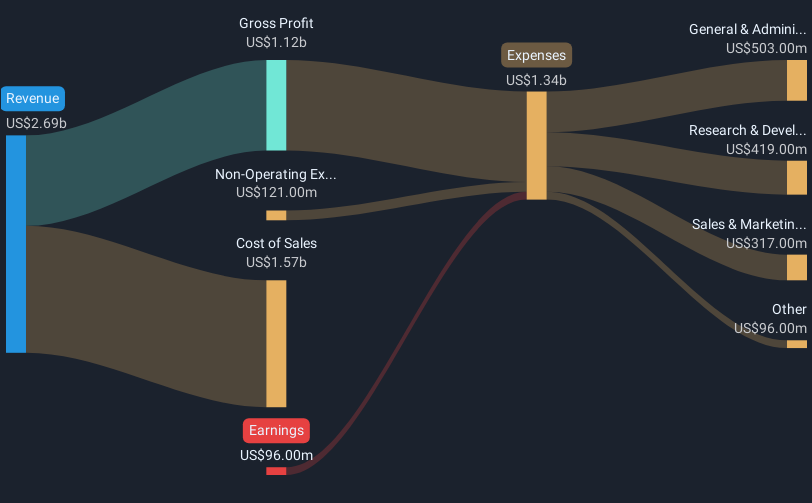

Grab Holdings (NasdaqGS:GRAB) reported its full-year 2024 earnings with sales rising to USD 2,797 million from the previous USD 2,359 million, and reduced its net loss significantly to USD 105 million. Despite positive financial strides, the company's share price fell 12.9% over the last week. This decline occurred even as Grab completed a share buyback program aimed at enhancing shareholder value. The broader market faced volatility, with major indexes like the Nasdaq dropping 4% amid heightened tariff concerns following announcements from the Trump administration. Inflation fears and potential economic recession exacerbated investor caution across various sectors, contributing to the overall market decline of 4.6%. This backdrop likely influenced GRAB's stock performance, as adverse market conditions often impact investor sentiment toward companies, despite positive internal developments. The company's future revenue guidance for 2025 may provide some hope for investors, pending broader economic stability and easing of tariff-induced apprehensions.

Unlock comprehensive insights into our analysis of Grab Holdings stock here.

Over the last three years, Grab Holdings has achieved a total return of 36.42%, indicating robust performance despite challenges in becoming profitable. This performance places Grab ahead of the US Transportation industry over the past year, which saw a return of −3.9%, and the US Market, which returned 12.1%. Key factors contributing to Grab's long-term performance include its progressive steps toward profitability, with losses reducing at a rate of 45.2% per year over the past five years.

Additionally, corporate actions such as share buybacks, with a total of 67.5 million shares repurchased for US$226.5 million, have played a significant role in supporting shareholder returns. Grab's forward-looking guidance, anticipating revenue growth above the US market rate, signals potential continued strength. Lastly, rumors of potential mergers, like the advanced discussions with PT GoTo Gojek Tokopedia Tbk, highlight strategic considerations that may enhance future profitability and investor confidence.

- Analyze Grab Holdings' fair value against its market price in our detailed valuation report—access it here.

- Explore the potential challenges for Grab Holdings in our thorough risk analysis report.

- Already own Grab Holdings? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Grab Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives