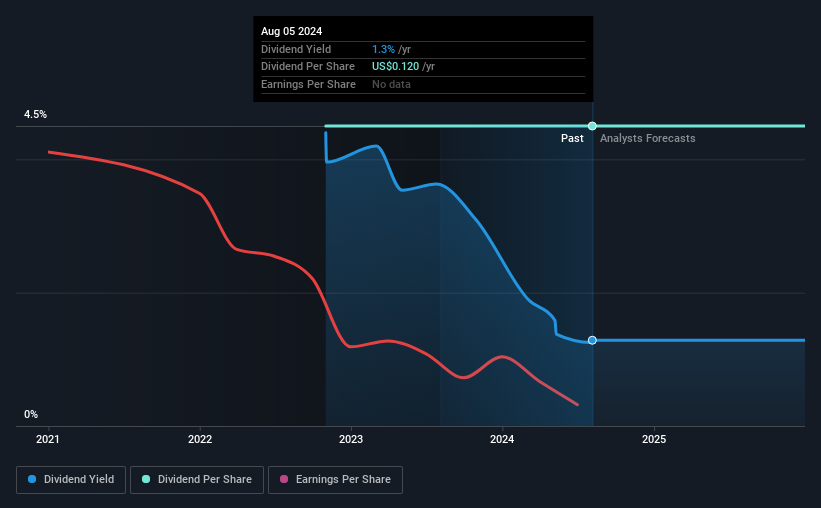

FTAI Infrastructure Inc. (NASDAQ:FIP) has announced that it will pay a dividend of $0.03 per share on the 20th of August. This means the annual payment will be 1.3% of the current stock price, which is lower than the industry average.

View our latest analysis for FTAI Infrastructure

FTAI Infrastructure's Distributions May Be Difficult To Sustain

Even a low dividend yield can be attractive if it is sustained for years on end. Even though FTAI Infrastructure is not generating a profit, it is still paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Looking forward, earnings per share is forecast to rise by 47.4% over the next year. This is the right direction to be moving, but it is not enough to achieve profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

FTAI Infrastructure Is Still Building Its Track Record

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The most recent annual payment of $0.12 is about the same as the annual payment 2 years ago. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Earnings per share has been sinking by 31% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

FTAI Infrastructure's Dividend Doesn't Look Great

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, this doesn't get us very excited from an income standpoint.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, FTAI Infrastructure has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIP

FTAI Infrastructure

Engages in the acquiring, developing, and operating assets and businesses that represent infrastructure for customers in the transportation, energy, and industrial products industries in North America.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026