- United States

- /

- Marine and Shipping

- /

- NasdaqCM:ESEA

US Market's 3 Undiscovered Gems for Your Portfolio

Reviewed by Simply Wall St

Over the past year, the United States market has experienced a notable 10% increase, although it has remained flat over the last week. In this environment where earnings are expected to grow by 15% annually, identifying stocks that offer unique value and potential for growth can be key to enhancing your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Euroseas (ESEA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Euroseas Ltd. offers ocean-going transportation services globally and has a market cap of $320.13 million.

Operations: Euroseas Ltd. generates revenue primarily from providing ocean-going transportation services, operating a fleet of container ships. The company's cost structure includes expenses related to vessel operations, maintenance, and crew wages. Its financial performance is influenced by fluctuating charter rates and operational costs. Net profit margin trends can provide insights into its profitability dynamics over time.

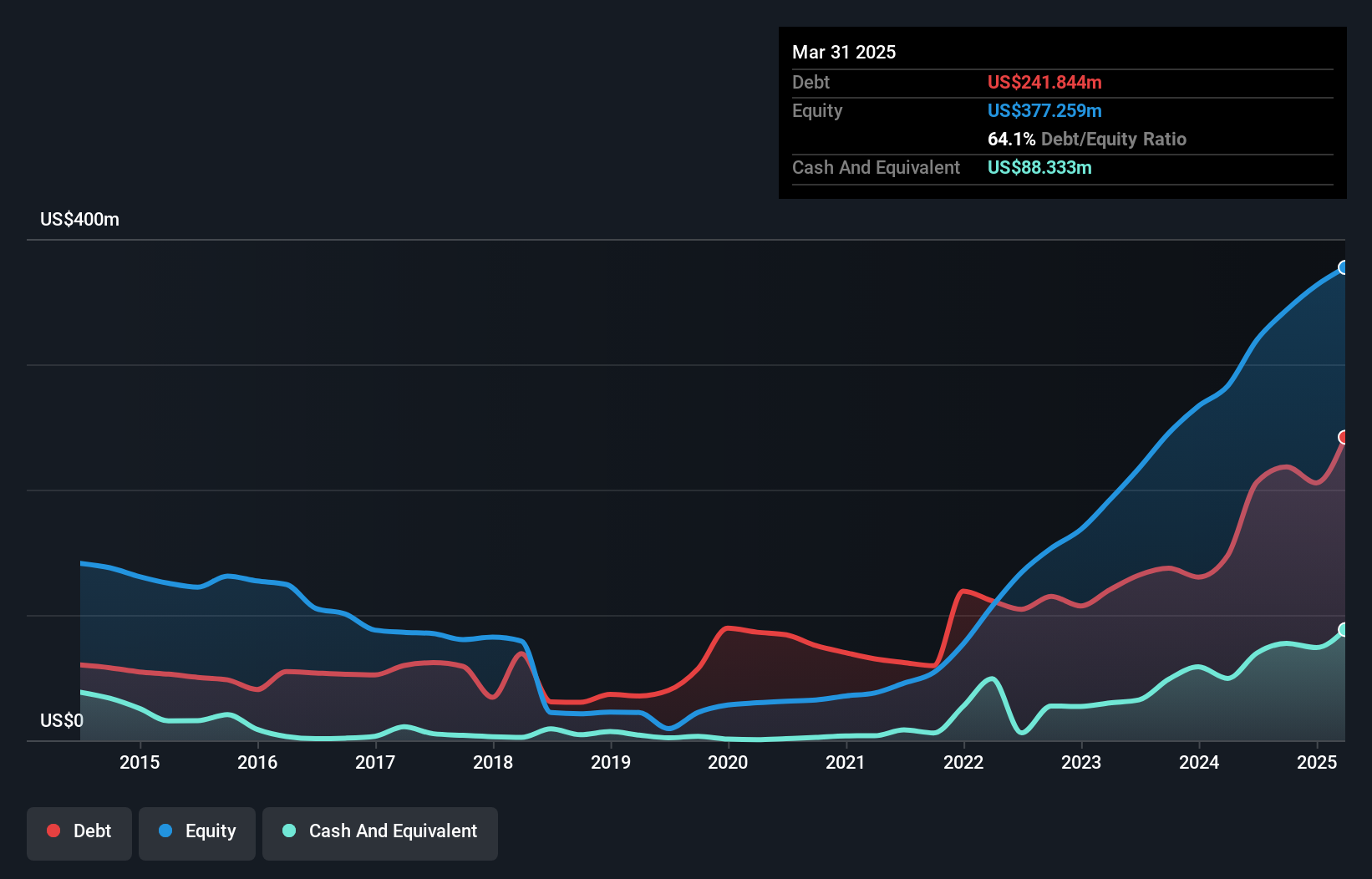

Euroseas, a noteworthy player in the shipping industry, has shown impressive financial performance with its debt-to-equity ratio dropping from 288.1% to 64.1% over five years. The company's earnings surged by 22.6% last year, outpacing the broader shipping industry's -5.3%. Despite a high net debt to equity ratio of 40.7%, Euroseas' interest payments are well-covered at 14 times EBIT, reflecting strong operational management. Recent strategic moves include repurchasing shares worth US$1.32 million and securing lucrative long-term charters that bolster future cash flows and earnings visibility amidst industry challenges and geopolitical uncertainties.

John Marshall Bancorp (JMSB)

Simply Wall St Value Rating: ★★★★★★

Overview: John Marshall Bancorp, Inc. is a bank holding company for John Marshall Bank, offering a range of banking products and financial services in the United States, with a market capitalization of $252.83 million.

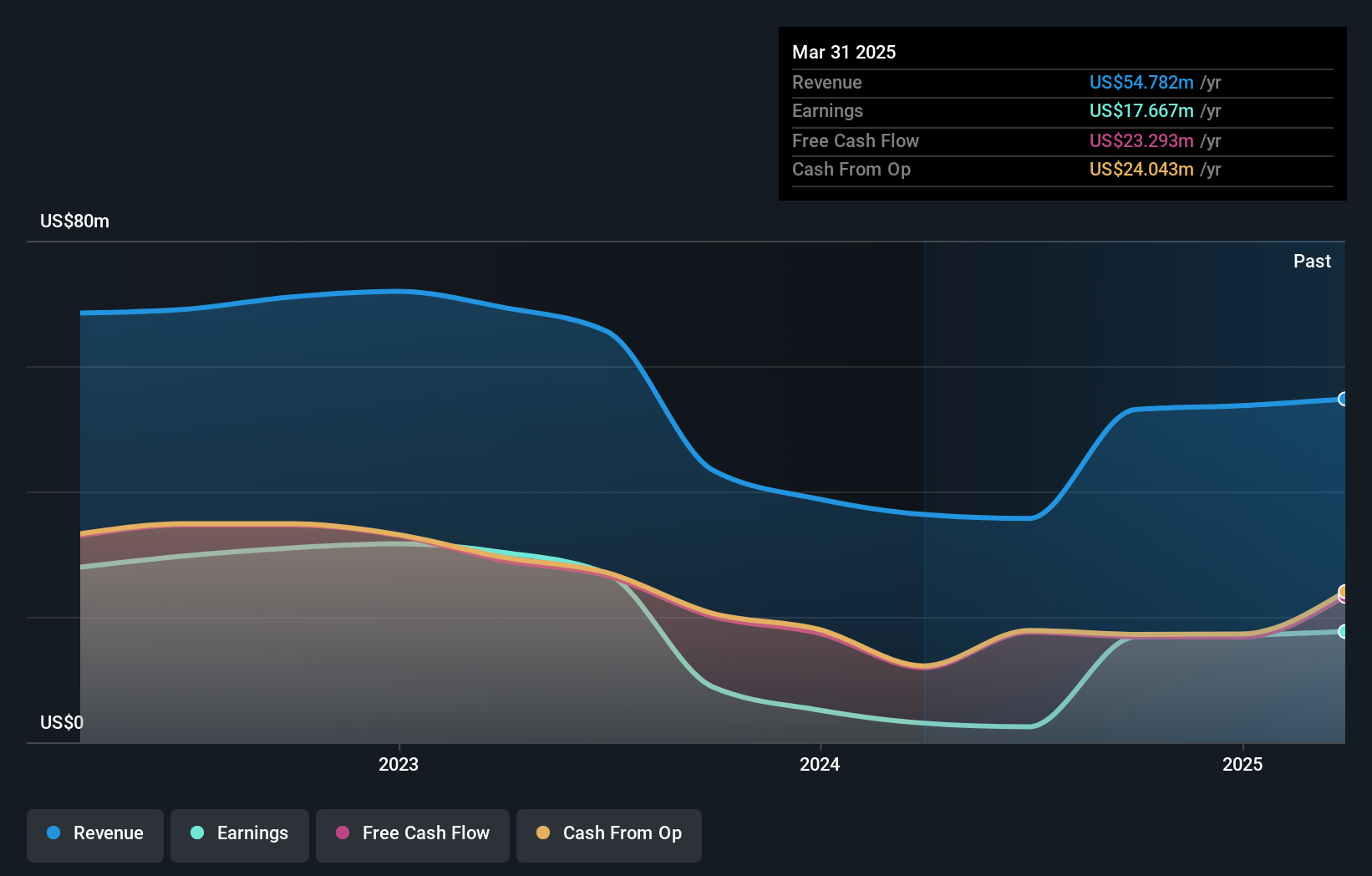

Operations: JMSB generates revenue primarily from its banking segment, amounting to $54.78 million.

John Marshall Bancorp, a financial entity with total assets of US$2.3 billion and equity of US$253 million, showcases robust health through its primarily low-risk funding structure where 95% of liabilities are customer deposits. The company has an appropriate level of bad loans at 0.5% and a sufficient allowance for these at 188%. Despite earnings declining by 8.9% annually over five years, recent growth spiked by an impressive 479.2%, outpacing the industry average significantly. Trading at nearly 23% below fair value, JMSB appears undervalued while maintaining positive free cash flow and increasing dividends by 20%.

Crawford (CRD.B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Crawford & Company offers claims management and outsourcing solutions for insurance carriers, brokers, and corporations across various regions including the United States, the United Kingdom, Europe, Canada, Australia, Asia, and Latin America with a market capitalization of approximately $499.85 million.

Operations: Crawford generates revenue through four main segments: Broadspire ($390.16 million), Platform Solutions ($173.29 million), International Operations ($424.91 million), and North America Loss Adjusting ($314.53 million). The company's diverse regional presence contributes to its financial performance across these sectors.

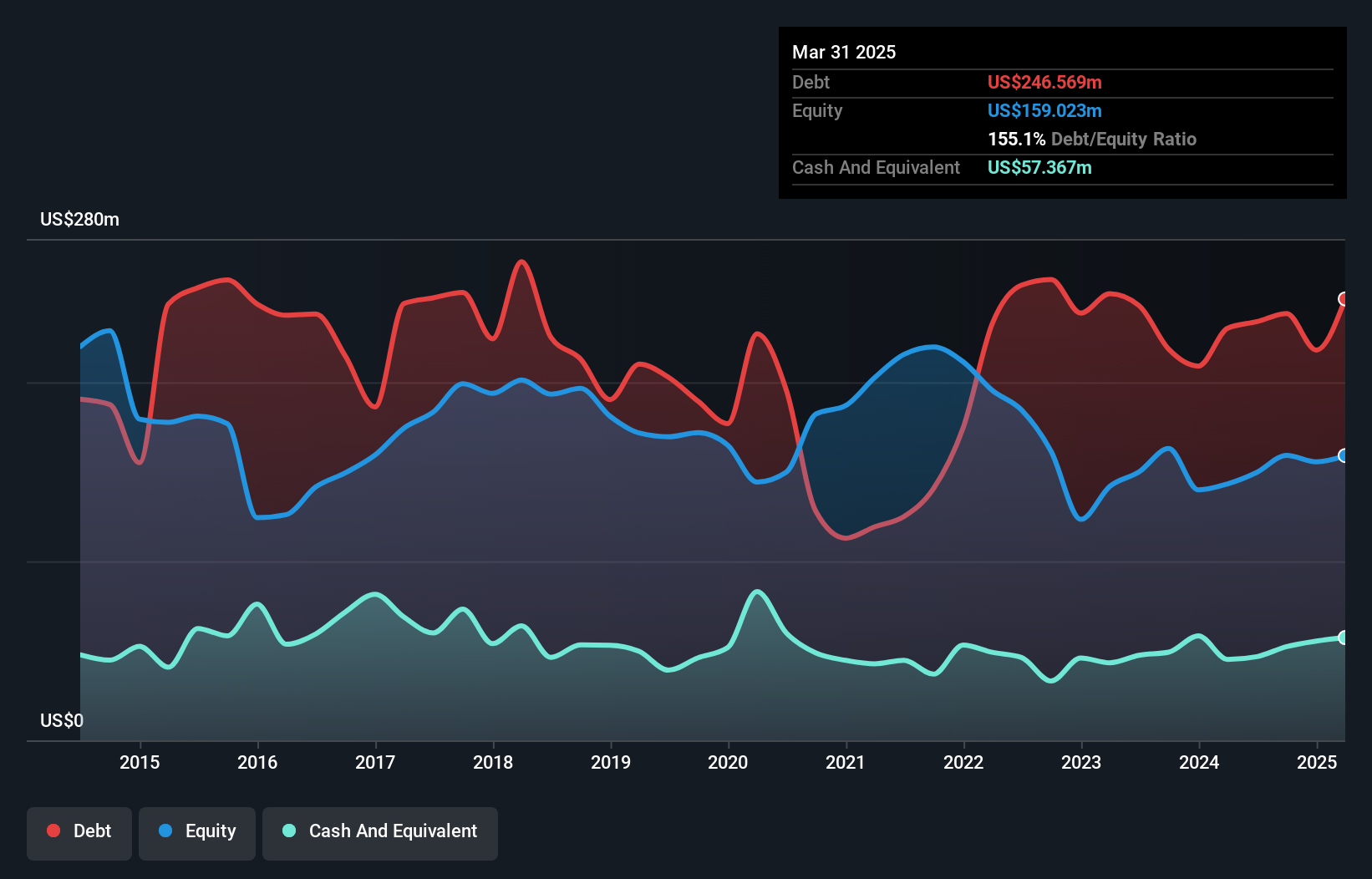

Crawford & Company, a smaller player in the insurance industry, has shown promising performance with earnings growth of 33.7% over the past year, outpacing the industry's 7%. Their net debt to equity ratio stands at a high 119%, though interest payments are comfortably covered by EBIT at 3.6 times. Recent leadership changes include appointing Amy Shore as an independent director, bringing extensive experience from Nationwide Insurance. The company declared a quarterly dividend of US$0.07 per share and reported Q1 revenue of US$323 million with net income rising to US$6.68 million from last year's US$2.84 million.

- Dive into the specifics of Crawford here with our thorough health report.

Gain insights into Crawford's historical performance by reviewing our past performance report.

Key Takeaways

- Unlock our comprehensive list of 284 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euroseas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESEA

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives