- United States

- /

- Marine and Shipping

- /

- NYSE:EGLE

Analysts Just Shipped A Captivating Upgrade To Their Eagle Bulk Shipping Inc. (NASDAQ:EGLE) Estimates

Eagle Bulk Shipping Inc. (NASDAQ:EGLE) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. Eagle Bulk Shipping has also found favour with investors, with the stock up a notable 14% to US$33.52 over the past week. Could this upgrade be enough to drive the stock even higher?

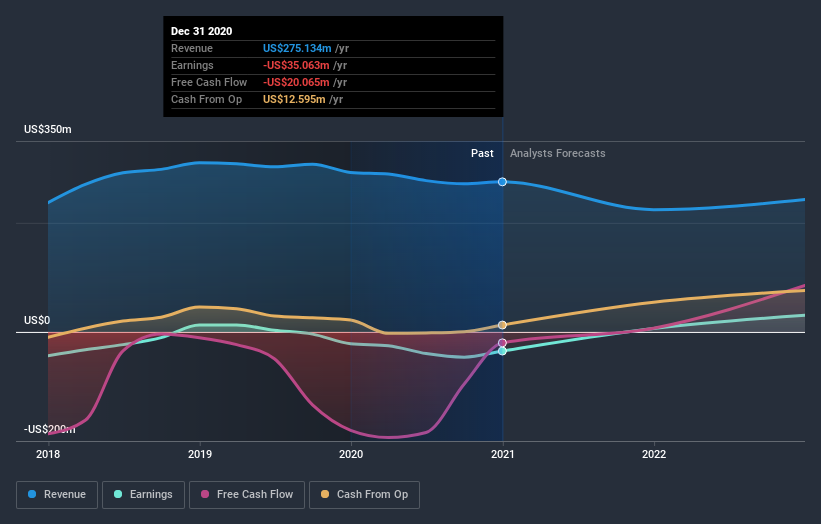

Following the upgrade, the consensus from four analysts covering Eagle Bulk Shipping is for revenues of US$254m in 2021, implying a noticeable 7.7% decline in sales compared to the last 12 months. Losses are expected to turn into profits real soon, with the analysts forecasting US$2.49 in per-share earnings. Prior to this update, the analysts had been forecasting revenues of US$224m and earnings per share (EPS) of US$0.58 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

See our latest analysis for Eagle Bulk Shipping

With these upgrades, we're not surprised to see that the analysts have lifted their price target 30% to US$35.34 per share. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Eagle Bulk Shipping, with the most bullish analyst valuing it at US$30.00 and the most bearish at US$23.00 per share. This is a very narrow spread of estimates, implying either that Eagle Bulk Shipping is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 7.7% by the end of 2021. This indicates a significant reduction from annual growth of 20% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 3.1% per year. It's pretty clear that Eagle Bulk Shipping's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, they also upgraded their revenue estimates, and are forecasting revenues to grow slower than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Eagle Bulk Shipping could be worth investigating further.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Eagle Bulk Shipping going out to 2022, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading Eagle Bulk Shipping or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Eagle Bulk Shipping, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eagle Bulk Shipping might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:EGLE

Eagle Bulk Shipping

Eagle Bulk Shipping Inc. engages in the ocean transportation of dry bulk cargoes worldwide.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives