- United States

- /

- Transportation

- /

- NasdaqGS:CSX

Will CSX’s (CSX) New Platinum Site Designation Reflect a Shifting Industrial Development Strategy?

Reviewed by Sasha Jovanovic

- CSX announced that the 365-acre Westgate Super Site in Dothan, Alabama, has been designated as a Platinum CSX Select Site, confirming it as development-ready with robust infrastructure and direct rail access for advanced manufacturing operations.

- This recognition highlights CSX’s ongoing commitment to expanding its industrial site portfolio, supporting regional economic growth, supply chain resilience, and job creation in key markets.

- We'll explore how the new Platinum Select Site designation could influence CSX's focus on expanding its industrial development initiatives.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

CSX Investment Narrative Recap

CSX’s appeal as an investment centers on its ability to drive growth through network efficiency, robust infrastructure, and access to industrial development opportunities. While the Platinum CSX Select Site designation for the Westgate Super Site reinforces the company’s expansion of its industrial site portfolio, it does not influence the most pressing short-term catalyst: the timely completion of key infrastructure projects. The biggest risk for CSX remains operational and revenue disruptions caused by delays with major projects and persistent economic headwinds, impacts that this latest site designation alone does not materially offset.

The recent announcement of the Howard Street Tunnel expansion’s reopening is arguably more consequential for immediate investor concerns. As this $450 million upgrade aims to streamline East Coast freight operations and generate meaningful annual cost savings, its successful execution is likely to have a greater near-term influence on CSX’s operational performance than new site designations, particularly as the recovery of network fluidity is a critical near-term catalyst.

However, investors should be aware that while infrastructure upgrades promise long-term advantages, delays or cost overruns may...

Read the full narrative on CSX (it's free!)

CSX's narrative projects $15.7 billion in revenue and $3.9 billion in earnings by 2028. This requires a 3.6% yearly revenue growth and an earnings increase of $0.8 billion from $3.1 billion.

Uncover how CSX's forecasts yield a $39.20 fair value, a 12% upside to its current price.

Exploring Other Perspectives

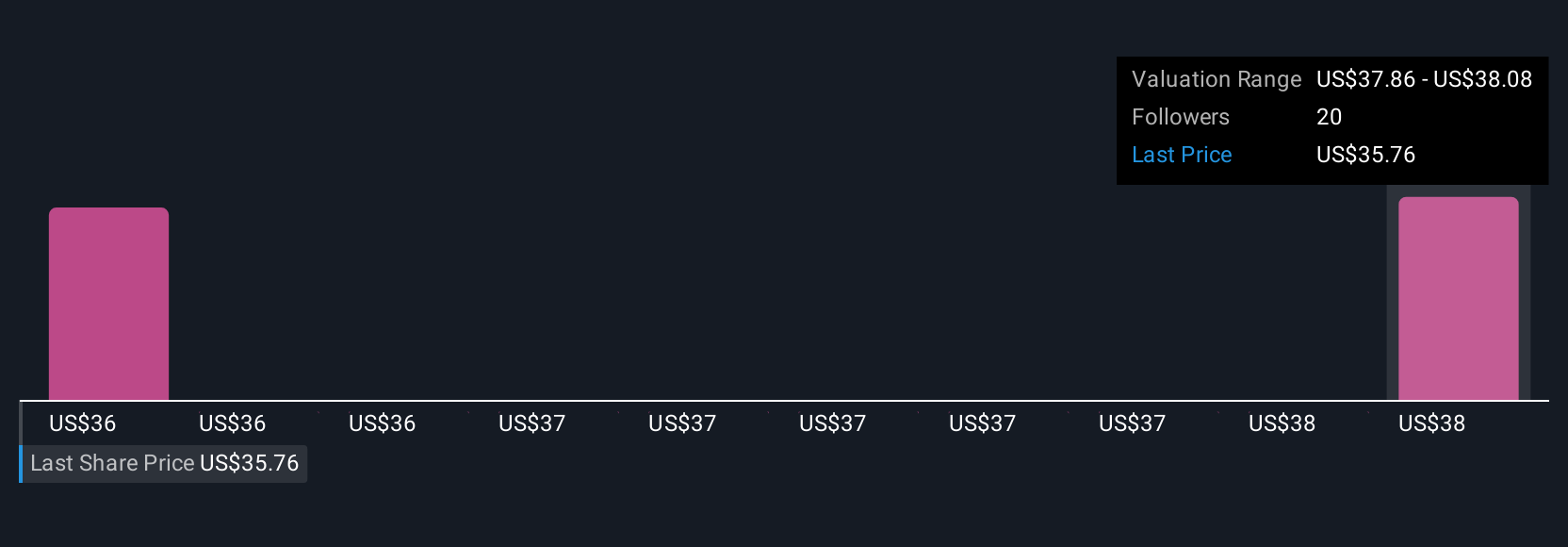

Simply Wall St Community members estimate CSX’s fair value between US$34.47 and US$39.20, based on two independent forecasts. These varied viewpoints highlight how operational execution on critical projects could shape results in ways analysts and individual investors weigh quite differently, explore the full range of opinions.

Explore 2 other fair value estimates on CSX - why the stock might be worth as much as 12% more than the current price!

Build Your Own CSX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSX research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CSX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSX's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives