- United States

- /

- Transportation

- /

- NasdaqGS:CSX

Should You Hold CSX After a 12% Year to Date Climb in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with CSX stock right now? You're not alone. After another month of strong gains, with shares up 6.2% over the last 30 days and a year-to-date return at a solid 12.3%, investors are wondering if the growth train has enough steam left or if it’s time to lock in some profits. Despite a slight dip of 1.3% this past week, CSX has delivered a healthy 46.7% total return over the past five years. This performance puts it ahead of many peers in the transportation sector.

There has also been noteworthy industry chatter around freight demand and supply chain adjustments. This discussion has kept investor attention focused on rail companies like CSX. While nothing explosive has hit the headlines lately, the ongoing conversation about logistics disruptions and infrastructure investments is influencing how the market thinks about CSX’s risk and potential.

Before making your next move, it is crucial to know not just how much the stock has climbed, but also whether it is still trading at a bargain. According to our current metrics, CSX scores a 1 out of 6 on key valuation checks, which suggests that by most methods, it is not deeply undervalued right now. However, it is important not to jump to conclusions. We will now look at how CSX stacks up on several valuation approaches, and at the end, I will share a perspective on valuation that goes beyond the usual scorecard and could change how you see this stock altogether.

CSX scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CSX Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. It gives a sense of what the business is fundamentally worth based on its ability to generate cash in the years ahead.

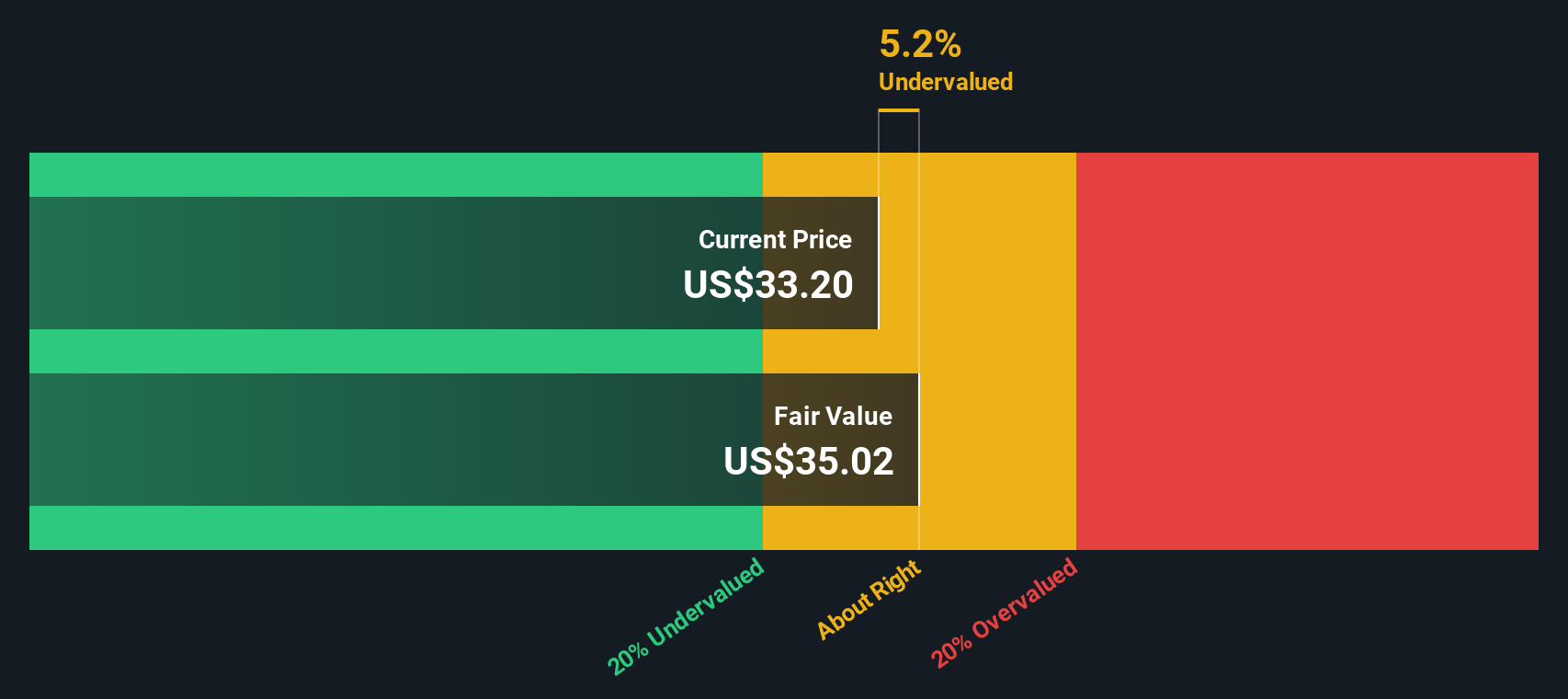

For CSX, the current Free Cash Flow stands at $2.1 billion. Analyst estimates see significant growth ahead, with projections reaching $3.1 billion by 2026 and $3.7 billion by 2029. After the next five years, projections are extended using reasonable growth assumptions. The 10-year outlook suggests Free Cash Flow will approach $4.6 billion by 2035. All figures are in US dollars.

Using these projections, the DCF model calculates an intrinsic value of $33.17 per share for CSX. This is about 8.9% lower than the current share price, indicating CSX is slightly overvalued by this measure. However, with the difference under 10%, it is not a dramatic mismatch.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out CSX's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: CSX Price vs Earnings (PE Ratio)

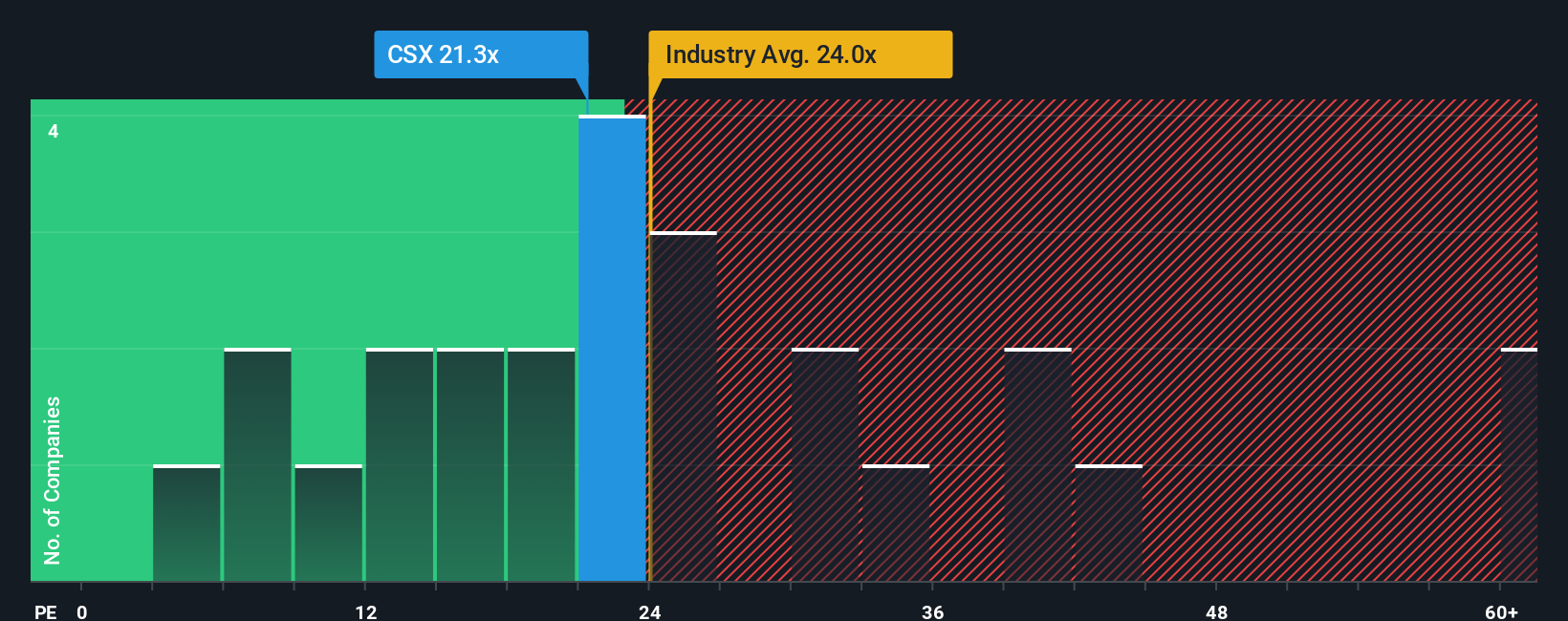

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies like CSX. This ratio is especially useful because it directly connects a company’s market value to its earnings, making it easier to compare across businesses with steady profits.

While looking at the PE ratio alone can be insightful, it is important to remember that what counts as a “fair” PE depends on more than just earnings. Growth prospects, overall risk, and industry dynamics all shape what a reasonable PE should be. Faster-growing or less risky companies can often support a higher PE, while slower or riskier ones tend to trade at lower multiples.

CSX currently trades at a PE of 23.2x. This sits above the average of its transportation peers at 19.6x, but below the industry average of 26.3x. Rather than just comparing to market averages, Simply Wall St uses a Fair Ratio to judge value more accurately. CSX’s Fair Ratio is 19.0x, a proprietary calculation based on factors including earnings growth, profit margins, its industry, market cap, and risks. The Fair Ratio offers a more precise benchmark than a simple peer or industry average, since it tailors the “right” multiple for CSX’s unique business profile.

With a PE ratio close to its Fair Ratio, just over 4x higher, the difference is not large enough to call the shares overvalued or undervalued by this measure. That means, by Simply Wall St’s preferred valuation multiple, CSX looks about right at current levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CSX Narrative

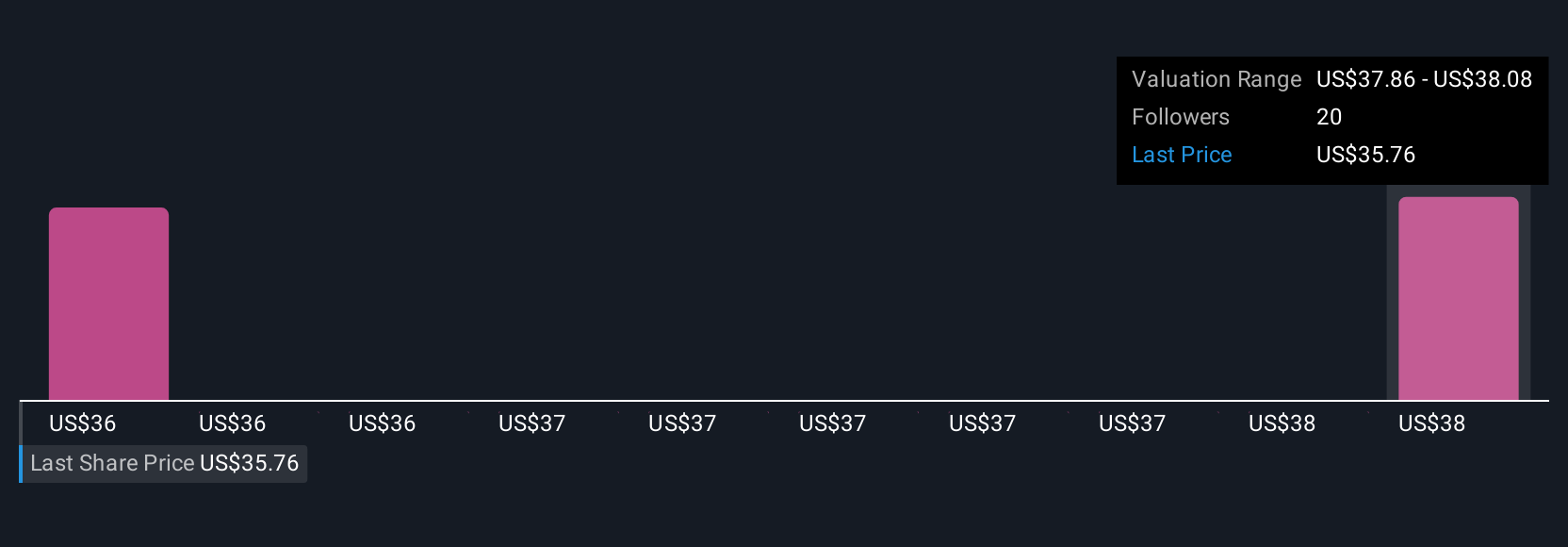

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative takes the numbers out of isolation and connects them to a story, reflecting your perspective on a company's future through your estimates of its fair value, revenue, earnings, and margins. Narratives help you see the bigger picture by linking CSX’s business reality, a financial forecast, and a fair value in one place. This approach can make investment decisions easier and more grounded.

Narratives are available right now to all users on Simply Wall St’s Community page, where millions of investors compare their outlooks, share insights, and understand what’s driving each estimate. By comparing a Narrative's Fair Value against the current share price, you can spot when CSX might be overvalued or undervalued, and decide whether to buy, hold, or sell. Another advantage is that Narratives update automatically as new information, such as company announcements or earnings, becomes available, allowing your perspective to adapt with the market.

For example, the most optimistic Narrative currently values CSX at $44 per share, shaped by expectations that major projects like the Howard Street Tunnel will drive efficiency. In contrast, the most cautious perspective assigns a value of just $27, focusing on risks such as infrastructure delays and volatile commodity markets.

Do you think there's more to the story for CSX? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Established dividend payer with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion