- United States

- /

- Transportation

- /

- NasdaqGS:CSX

How the New CN Partnership and All-Rail Service Has Changed the Investment Story at CSX (CSX)

Reviewed by Simply Wall St

- CSX and Canadian National Railway recently announced a new intermodal rail service agreement to provide an all-rail alternative for international containers moving from Canada’s West Coast through Memphis directly into Nashville, replacing the previous trucking segment.

- This move underscores CSX’s preference for expanding reach and enhancing service through partnerships and infrastructure improvements, rather than pursuing industry mergers.

- We'll explore how the expanded partnership for all-rail service to Nashville may reshape CSX's investment narrative and network reach.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

CSX Investment Narrative Recap

For shareholders of CSX, the investment story is centered on the company's ability to restore growth through strategic partnerships, operational improvements, and steady execution following recent declines in revenue and earnings per share. The new all-rail intermodal service with Canadian National Railway is a positive step toward expanding reach and improving supply chain efficiency, but it is not likely to materially alter the most important short-term catalyst: the timely, successful completion of major infrastructure projects such as the Howard Street Tunnel. The greatest risk remains disruption or delays in these transformational projects, which continue to impact network reliability and costs.

Among the recent announcements, the nearing completion of the Howard Street Tunnel project stands out alongside the CN partnership. Once finished, this upgrade is expected to boost CSX’s network fluidity and support the very efficiencies targeted by these new rail collaborations. Together, these initiatives are integral for service reliability and can strengthen the business’s fundamentals at a time when operational performance is under scrutiny.

However, even as CSX broadens partnerships, the risk of construction delays or cost overruns in critical infrastructure projects is something investors should keep in mind...

Read the full narrative on CSX (it's free!)

CSX's outlook envisions $15.7 billion in revenue and $3.9 billion in earnings by 2028. Achieving this calls for 3.6% annual revenue growth and an increase in earnings of $0.8 billion from the current $3.1 billion.

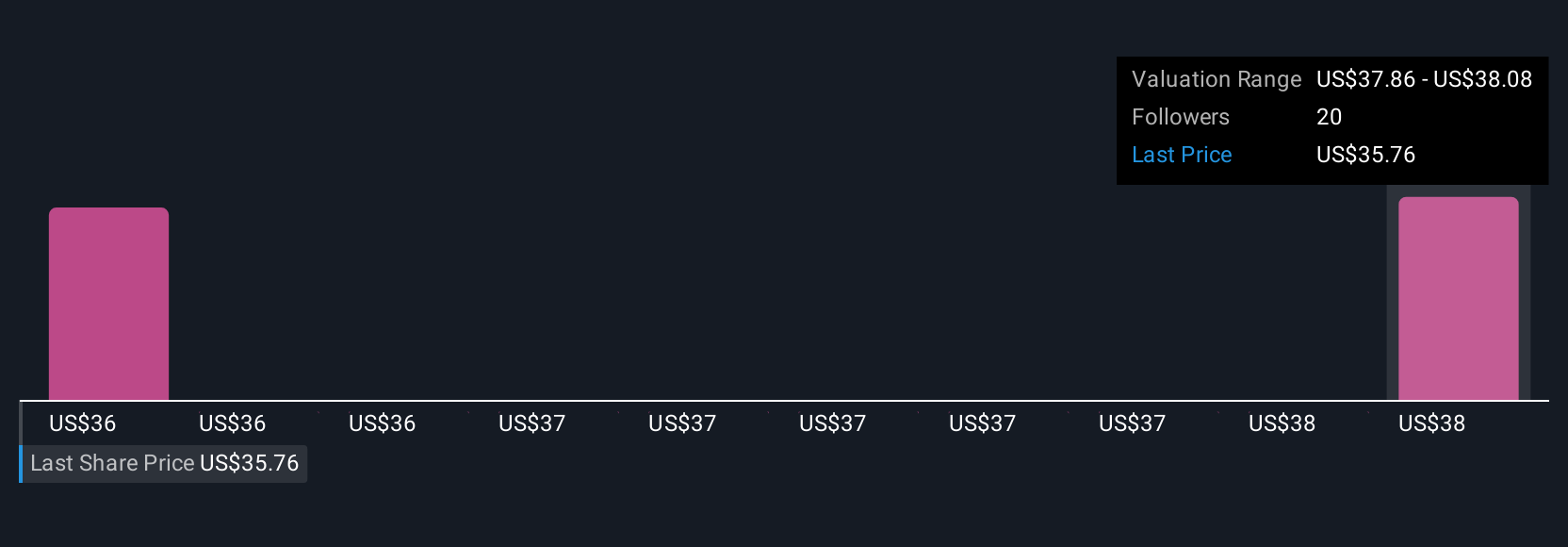

Uncover how CSX's forecasts yield a $37.92 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate CSX's fair value between US$35.17 and US$37.92 per share. While infrastructure improvements remain key, differing assumptions on future growth and risk suggest a range of expectations for CSX’s outlook, consider reviewing a variety of perspectives.

Explore 2 other fair value estimates on CSX - why the stock might be worth as much as 17% more than the current price!

Build Your Own CSX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSX research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CSX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSX's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Established dividend payer with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion