- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX) Valuation Check as Shares Quietly Rebound on Improving Freight Demand Sentiment

Reviewed by Simply Wall St

CSX (CSX) shares have been quietly grinding higher recently, with the stock up around 7% over the past 3 months and roughly 15% over the past year, outpacing many industrial peers.

See our latest analysis for CSX.

The latest 30 day share price return of 6.59% and a 1 year total shareholder return of 15.22% suggest that momentum in CSX has been quietly rebuilding as investors grow more comfortable with its freight demand outlook and earnings resilience.

If you are weighing CSX against other transport focused names, it could also be worth scanning aerospace and defense stocks for more ideas riding similar economic and infrastructure themes.

With earnings growing faster than revenue and the share price still trading at a modest discount to analyst targets, investors face a key question: is CSX still undervalued or is the market already pricing in future growth?

Most Popular Narrative Narrative: 8% Undervalued

With CSX last closing at $36.54 against a narrative fair value near $39.54, the story assumes more upside than the current market price implies.

There is growing confidence that CSX's operational initiatives, including the ONECSX program and network efficiency efforts, can translate into structurally higher margins, stronger free cash flow, and a more resilient earnings base over the next several years.

Want to see how steady revenue gains, rising margins, and a richer future earnings multiple all tie together into that higher fair value? The full narrative exposes the specific growth path, long term profitability assumptions, and valuation bridge that connect today’s price to that upside target.

Result: Fair Value of $39.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on infrastructure projects staying on track and industrial demand holding up, both of which are vulnerable to weather disruptions and macro uncertainty.

Find out about the key risks to this CSX narrative.

Another Lens on Value

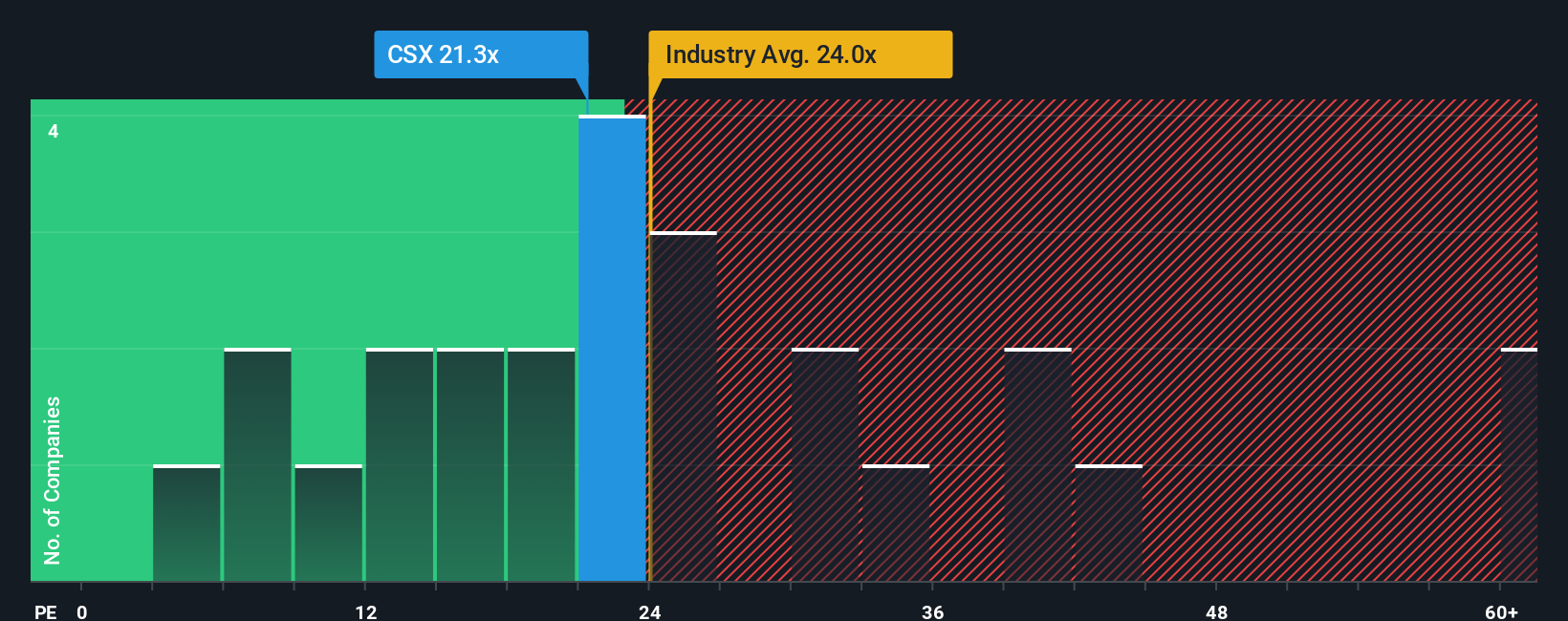

On earnings multiples, CSX is less obviously cheap. The stock trades at about 23.4 times earnings versus the US Transportation industry at 30 times, but above a fair ratio of 20.2 times and slightly richer than peers at 22.3 times. This leaves less margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CSX Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your CSX research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research with CSX alone. Use the Simply Wall Street Screener to pinpoint fresh opportunities that match your style before others move first.

- Capture potential income now by scanning these 10 dividend stocks with yields > 3% that combine attractive yields with businesses built for long term payouts.

- Position your portfolio for structural growth by targeting these 24 AI penny stocks poised to benefit from accelerating adoption of intelligent automation and data driven products.

- Strengthen your margin of safety by focusing on these 899 undervalued stocks based on cash flows where current prices sit meaningfully below estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Established dividend payer with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion