- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX): Assessing Valuation After Executive Appointments Reshape Leadership Team

Reviewed by Simply Wall St

CSX (CSX) shares saw renewed attention after the company announced leadership changes. Kevin Boone has been appointed as chief financial officer, and Maryclare Kenney has been promoted to chief commercial officer. These moves are intended to support the company's long-term strategy.

See our latest analysis for CSX.

CSX’s latest leadership shake-up arrives as the company rides moderate positive momentum. Its share price is up 11.4% year-to-date and the one-year total shareholder return stands at 7%, showing steady, if unspectacular, progress. Investors appear cautiously optimistic that fresh executive direction could spark new growth, building on CSX’s longer-term 25% total return over five years.

If new faces at the top have you wondering what other companies are mixing things up, now’s the perfect moment to widen your search and discover fast growing stocks with high insider ownership.

But with CSX shares up this year and analysts already projecting a nearly 10% upside from here, is the stock a bargain given its fresh leadership and steady financial growth? Or has the market already factored in the next leg of progress?

Most Popular Narrative: 8.6% Undervalued

CSX's most widely followed narrative puts its fair value above the recent closing price, suggesting room for potential upside as new leadership settles in. With investor focus on efficiency, expansion projects, and profitability, a deeper look into these underlying assumptions reveals what could be driving this valuation optimism.

CSX's completion of major infrastructure projects, such as the Howard Street Tunnel and Blue Ridge subdivision rebuild, is expected to improve network fluidity. This could lead to increased operational efficiency and service reliability, which may enhance revenue and margin growth. The anticipated recovery in industrial production, particularly in sectors like steel and auto, could drive increased volume and revenue. CSX is well-positioned to capture this demand due to its extensive network covering key industrial regions.

Why do analysts think CSX could be worth more than the market believes? The answer is not just better leadership. It is a bold vision for growth, improved margins, and a profit trajectory that could catch investors off guard. Curious which big moves and quantitative milestones fuel these bullish forecasts? There is more to the story than meets the eye.

Result: Fair Value of $39.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industry headwinds and unexpected disruptions to infrastructure projects could easily challenge even the most optimistic forecasts for CSX.

Find out about the key risks to this CSX narrative.

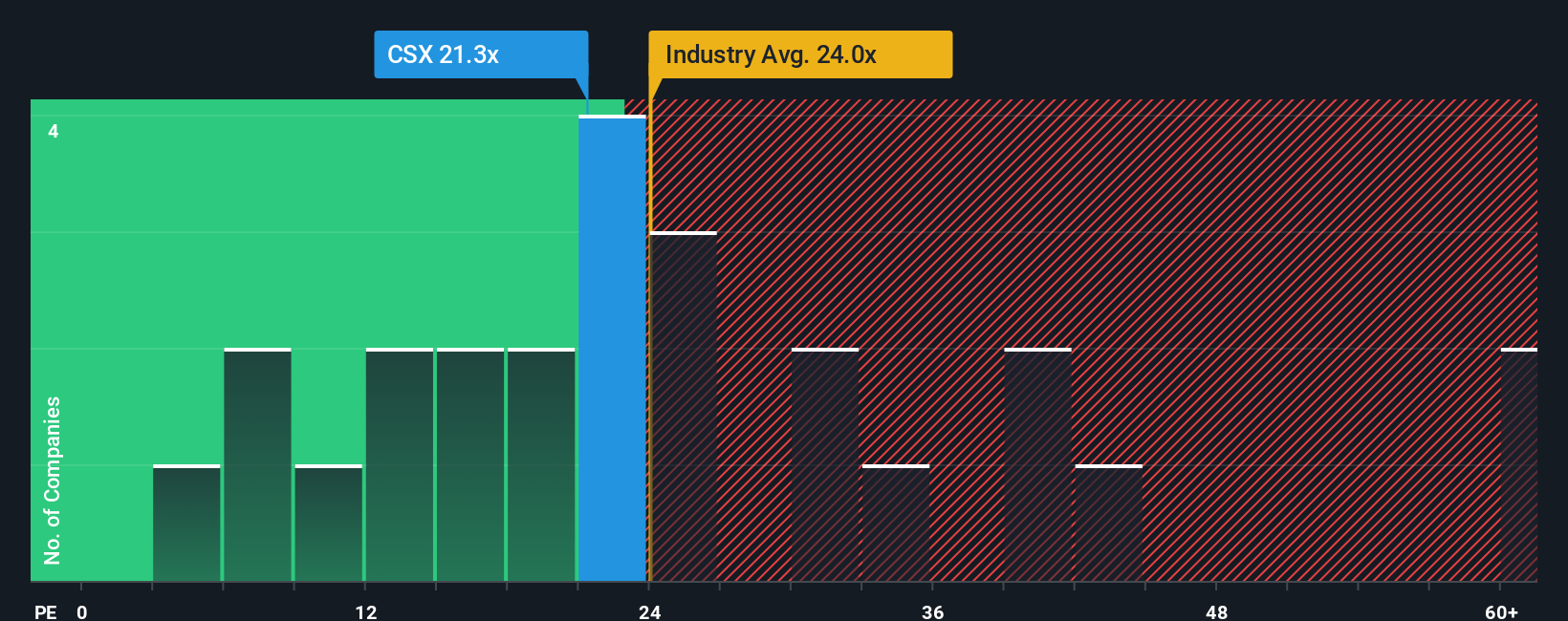

Another View: Market Multiples Tell a Different Story

While analysts see CSX shares as undervalued using future earnings projections, looking at the company’s price-to-earnings ratio tells a more cautious tale. CSX currently trades at 23 times earnings, a noticeable premium to both peers (20.7x) and its fair ratio (19.6x). This could imply valuation risk if future growth does not accelerate.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CSX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CSX Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own CSX story in just a few minutes. Do it your way.

A great starting point for your CSX research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Ready to power up your portfolio? Do not limit yourself to just one opportunity. Some of the best potential moves are waiting for you to spot them. Take action today and see what you could be missing out on.

- Capture rising income potential by jumping into these 18 dividend stocks with yields > 3% offering attractive yields above 3% for strong, steady returns.

- Take advantage of recent breakthroughs and position yourself at the forefront with these 26 AI penny stocks making waves in artificial intelligence.

- Focus on value and spot hidden winners by reviewing these 840 undervalued stocks based on cash flows built on strong cash flow fundamentals many investors overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives