- United States

- /

- Logistics

- /

- NasdaqGS:CHRW

C.H. Robinson Worldwide (CHRW) Unveils Cross-Border Service with AI-Driven Freight Savings

Reviewed by Simply Wall St

C.H. Robinson Worldwide (CHRW) recently launched a new cross-border service, which aims to enhance efficiency for shippers with up to 40% savings and improved freight visibility by up to 48 hours. This initiative likely added weight to the broader 34% price move over the last quarter, aligning with significant market performance trends, where major indices like the S&P 500 and Nasdaq achieved record highs following favorable macroeconomic indicators, including anticipated interest rate cuts. The company’s service innovations, alongside market enthusiasm, contributed to its robust quarterly price performance.

We've identified 1 weakness for C.H. Robinson Worldwide that you should be aware of.

The launch of C.H. Robinson Worldwide's new cross-border service is a strong alignment with its focus on AI-driven logistics enhancements, potentially impacting both revenue and earnings positively. The improved efficiency and cost savings offered by the service could enhance customer retention and drive market share gains, thereby supporting the company's growth narrative.

Over the past five years, C.H. Robinson’s total return, including share price and dividends, was 39.08%. This growth context provides a broader view of the company's performance. In comparison to the short-term gains, the one-year result had the shares outperform the U.S. Logistics industry, which experienced a decline. These results highlight C.H. Robinson's resilience and competitive position within the market.

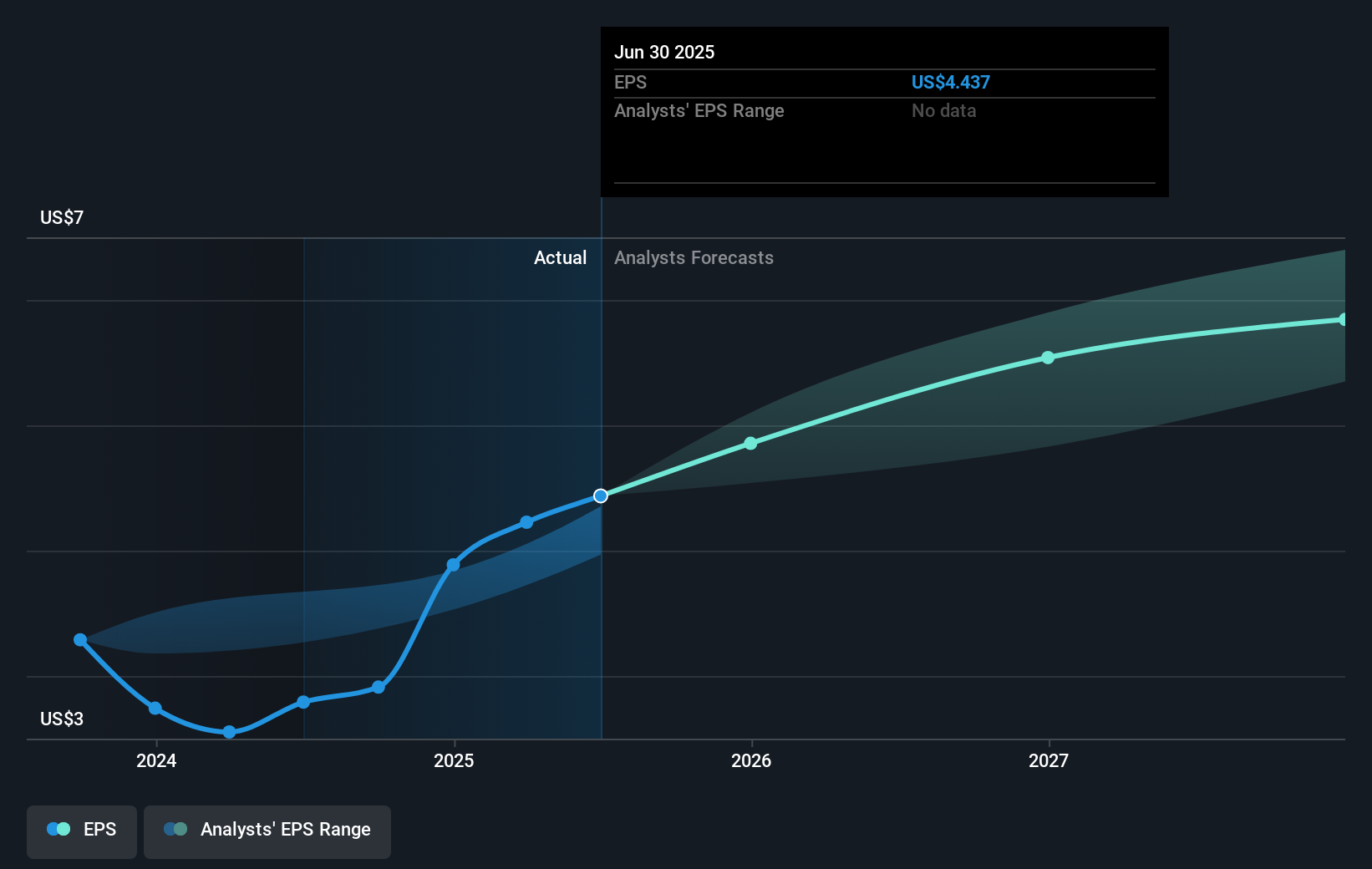

The recent share price performance of C.H. Robinson needs to be contextualized against the analyst consensus price target. With the current share price at US$127.64 and the target at US$117.56, this represents a discount of 7.9%, suggesting market optimism. However, consensus estimates imply that the company's future earnings would need to justify higher valuations, emphasizing the importance of meeting forecast growth and operational efficiency targets.

Understand C.H. Robinson Worldwide's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRW

C.H. Robinson Worldwide

Provides freight transportation and related logistics and supply chain services in the United States and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives