- United States

- /

- Logistics

- /

- NasdaqGS:CHRW

Assessing C.H. Robinson’s (CHRW) Valuation Following Launch of AI-Driven Cross-Border Freight Service

Reviewed by Simply Wall St

As you weigh your next move with C.H. Robinson Worldwide (CHRW), there is a new variable in play. The company just rolled out a cross-border freight service designed to address some of the toughest pain points for shippers moving goods between Mexico, the United States, and Canada. By consolidating less-than-truckload shipments in Mexico and using AI-driven route optimization, C.H. Robinson aims to cut costs, boost visibility, and help clients navigate tariff hurdles more effectively. For investors, this expansion could be a meaningful signal of where the company is headed.

This announcement comes during a year when C.H. Robinson's stock has steadily climbed, rising 35% over the past 12 months. Weekly and monthly momentum is positive as well, suggesting growing optimism or a reassessment of underlying risk. While breakthrough services like this new offering can draw headlines, they also fit into a longer trend of the company leveraging technology to separate itself from rivals in a dynamic supply chain industry.

With shares gaining ground and new products aiming to unlock even more value, the big question now is whether investors are looking at genuine upside or if the market is already pricing in much of this growth potential. What do you think? Is CHRW offering a timely entry, or is the easy money already off the table?

Most Popular Narrative: 12.6% Overvalued

According to the most widely followed narrative, shares of C.H. Robinson Worldwide are currently trading at a premium of 12.6% to their fair value, using a discount rate of 7.4% and factoring in expected growth in revenue and earnings as projected by analyst consensus.

Scaling of proprietary digital capabilities and deployment of automated, self-serve logistics tools improves data-driven pricing, rapid quote response, and customer supply chain visibility. This leads to market share gains and higher wallet share, positively impacting future revenue growth.

What is fueling this high valuation? The narrative is built on transformative automation, ambitious profitability targets, and a future profit multiple that typically signals significant confidence in earnings growth. Eager to see the bold analyst forecasts behind this price? Unpack their future assumptions and discover the figures that drive this controversial fair value.

Result: Fair Value of $117.56 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, lingering uncertainty around global trade policies and rapid advances in rival logistics technology could present challenges to C.H. Robinson’s current growth narrative and premium valuation.

Find out about the key risks to this C.H. Robinson Worldwide narrative.Another View: Our DCF Model Flips the Script

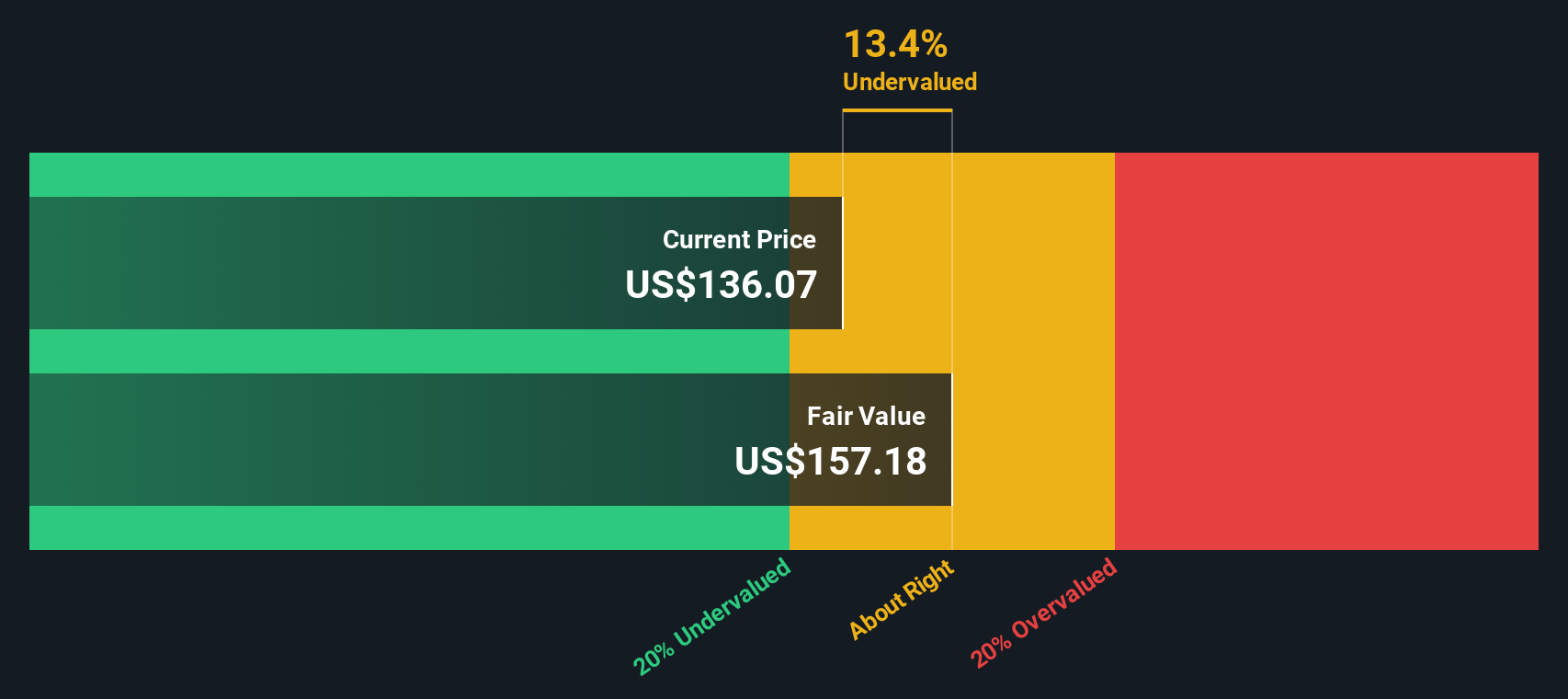

Taking a different approach, our SWS DCF model paints a more optimistic picture and indicates shares may actually be undervalued. With two models telling opposite stories, which outlook do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own C.H. Robinson Worldwide Narrative

If you want to dig deeper, the tools are at your fingertips. Explore the numbers for yourself and shape your own perspective in just minutes. Do it your way

A great starting point for your C.H. Robinson Worldwide research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't settle for ordinary opportunities when you can target investments tailored for your strategy. Unearth high-potential stocks and stay ahead of the crowd using these powerful tools:

- Spot undervalued gems using insights from undervalued stocks based on cash flows. Capitalize on stocks that might be trading below their true worth.

- Tap into the booming world of artificial intelligence by checking out game-changers highlighted in AI penny stocks. This approach is perfect for riding the next wave of tech disruption.

- Accelerate your portfolio’s income with steady performers delivering consistent yields via dividend stocks with yields > 3%. Secure your share of attractive dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRW

C.H. Robinson Worldwide

Provides freight transportation and related logistics and supply chain services in the United States and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives