- United States

- /

- Marine and Shipping

- /

- NasdaqGS:CCEC

Will New Dividend Reinvestment Plan and Fleet Moves Reshape Capital Clean Energy Carriers' (CCEC) Value Story?

Reviewed by Sasha Jovanovic

- Capital Clean Energy Carriers Corp. recently declared a US$0.15 per share cash dividend for the third quarter of 2025, payable November 13 to shareholders of record as of November 3, and introduced a Dividend Reinvestment Plan enabling direct reinvestment into additional shares.

- The company also reported expanding its LNG fleet, completed a profitable vessel sale to reduce debt, and appointed a new board director, reflecting strengthened financial flexibility and an ongoing commitment to clean energy shipping solutions.

- We'll explore how the new Dividend Reinvestment Plan highlights Capital Clean Energy Carriers' evolving investment narrative and commitment to returning value.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Capital Clean Energy Carriers Investment Narrative Recap

Investors in Capital Clean Energy Carriers need to believe in sustained demand for low- and zero-carbon shipping, supported by policy trends and contract backlogs. The recent dividend declaration and Dividend Reinvestment Plan underscore the company’s intent to return value, but have little material impact on the most pressing short term catalyst: successful long-term vessel employment contracts in emerging markets; the biggest near-term risk remains exposure to floating rate debt and persistent interest rate volatility.

Among recent developments, the profitable sale of the M/V Manzanillo Express, used to reduce US$90.4 million in outstanding debt, is especially relevant given the company's funding structure. Managing debt effectively remains central to supporting future fleet investments and maintaining flexibility as the clean energy shipping market evolves.

However, investors should be aware that even with prudent financial moves, the company’s high exposure to floating rate interest costs...

Read the full narrative on Capital Clean Energy Carriers (it's free!)

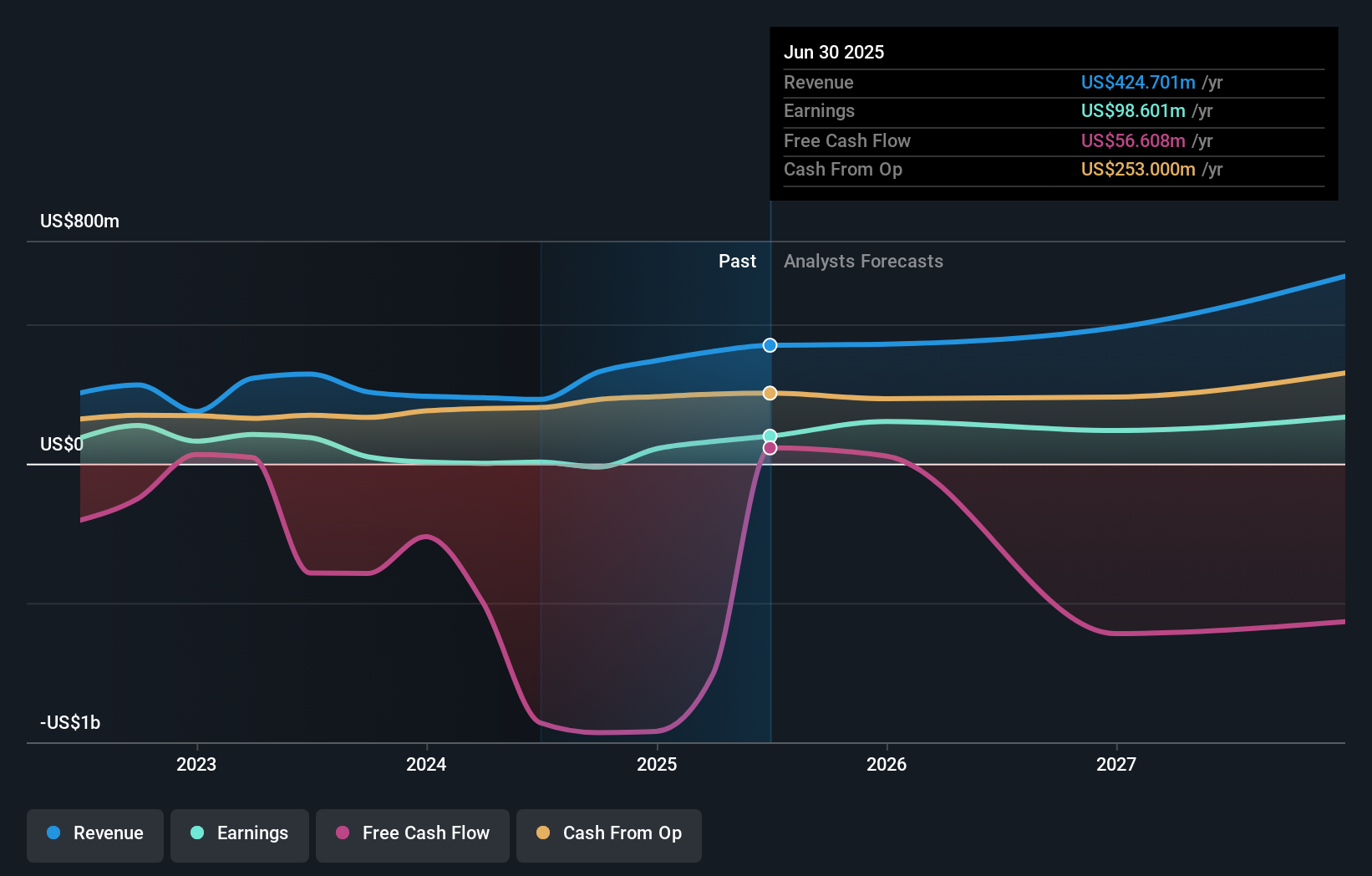

Capital Clean Energy Carriers is projected to reach $683.8 million in revenue and $161.0 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 17.2% and reflects a $62.4 million increase in earnings from the current $98.6 million.

Uncover how Capital Clean Energy Carriers' forecasts yield a $25.80 fair value, a 16% upside to its current price.

Exploring Other Perspectives

All ten fair value estimates from the Simply Wall St Community place Capital Clean Energy Carriers at US$25.80 per share. While many agree on valuation, persistent high floating interest rates could shape future performance in ways individual projections may not capture.

Explore another fair value estimate on Capital Clean Energy Carriers - why the stock might be worth just $25.80!

Build Your Own Capital Clean Energy Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Clean Energy Carriers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Capital Clean Energy Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Clean Energy Carriers' overall financial health at a glance.

No Opportunity In Capital Clean Energy Carriers?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCEC

Capital Clean Energy Carriers

A shipping company, provides marine transportation services in Greece.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives