- United States

- /

- Logistics

- /

- NasdaqCM:AIRT

Does Air T, Inc.'s (NASDAQ:AIRT) CEO Salary Reflect Performance?

In 2014, Nick Swenson was appointed CEO of Air T, Inc. (NASDAQ:AIRT). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for Air T

How Does Nick Swenson's Compensation Compare With Similar Sized Companies?

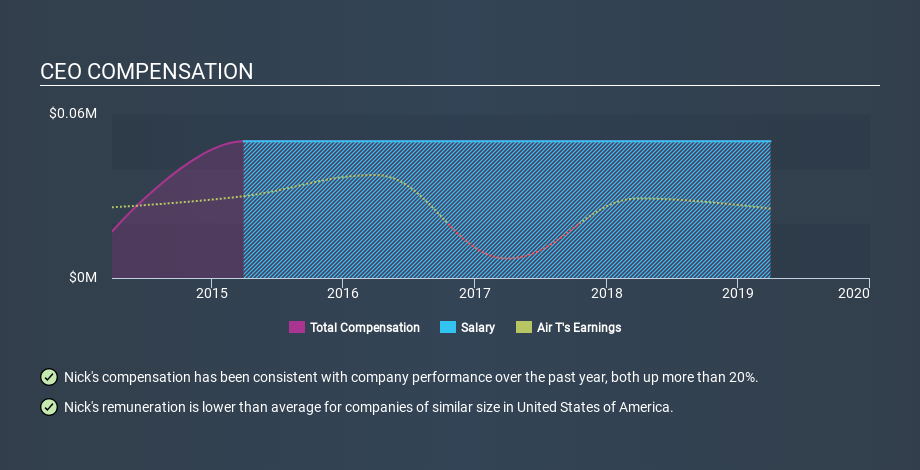

Our data indicates that Air T, Inc. is worth US$37m, and total annual CEO compensation was reported as US$50k for the year to March 2019. Notably, the salary of US$50k is the vast majority of the CEO compensation. We examined a group of similar sized companies, with market capitalizations of below US$200m. The median CEO total compensation in that group is US$589k.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Air T. On a sector level, around 18% of total compensation represents salary and 82% is other remuneration. At the company level, Air T pays Nick Swenson solely through a salary, preferring to go down a conventional route.

At first glance this seems like a real positive for shareholders, since Nick Swenson is paid less than the average total compensation paid by similar sized companies. Though positive, it's important we delve into the performance of the actual business. The graphic below shows how CEO compensation at Air T has changed from year to year.

Is Air T, Inc. Growing?

Over the last three years Air T, Inc. has seen earnings per share (EPS) move in a positive direction by an average of 19% per year (using a line of best fit). Its revenue is up 35% over last year.

This demonstrates that the company has been improving recently. A good result. The combination of strong revenue growth with medium-term earnings per share improvement certainly points to the kind of growth I like to see. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Air T, Inc. Been A Good Investment?

Air T, Inc. has not done too badly by shareholders, with a total return of 1.1%, over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

It looks like Air T, Inc. pays its CEO less than similar sized companies.

Many would consider this to indicate that the pay is modest since the business is growing. The total shareholder return might not be amazing, but that doesn't mean that Nick Swenson is paid too much. It's good to see reasonable payment of the CEO, even while the business improves. But for me, it's even better if insiders are also buying shares with their own cold, hard, cash. Taking a breather from CEO compensation, we've spotted 6 warning signs for Air T (of which 3 are a bit unpleasant!) you should know about in order to have a holistic understanding of the stock.

If you want to buy a stock that is better than Air T, this free list of high return, low debt companies is a great place to look.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqCM:AIRT

Air T

Through its subsidiaries, provides overnight air cargo, ground equipment sale, and commercial jet engines and parts in the United States and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives