- United States

- /

- Airlines

- /

- NasdaqGS:AAL

The past five years for American Airlines Group (NASDAQ:AAL) investors has not been profitable

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. To wit, the American Airlines Group Inc. (NASDAQ:AAL) share price managed to fall 65% over five long years. We certainly feel for shareholders who bought near the top. And some of the more recent buyers are probably worried, too, with the stock falling 31% in the last year. Unfortunately the share price momentum is still quite negative, with prices down 23% in thirty days.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for American Airlines Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, American Airlines Group moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 8.0% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

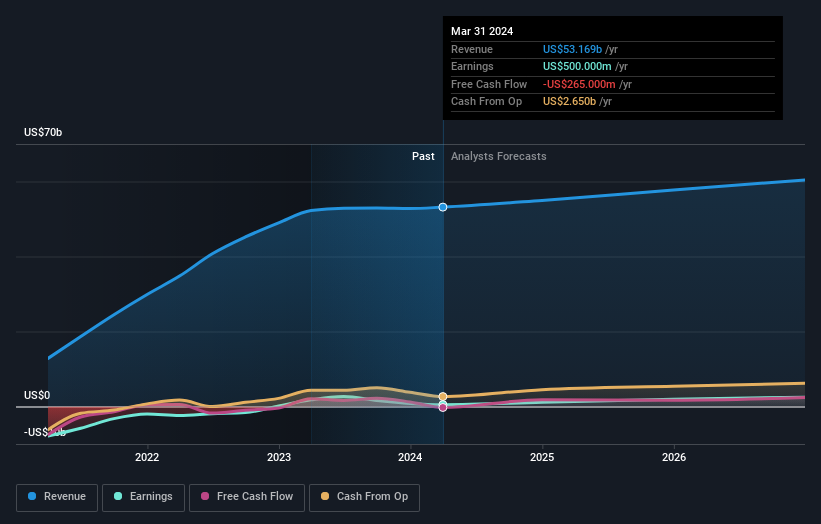

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

American Airlines Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling American Airlines Group stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Investors in American Airlines Group had a tough year, with a total loss of 31%, against a market gain of about 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for American Airlines Group (2 are a bit concerning) that you should be aware of.

But note: American Airlines Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives