- United States

- /

- Airlines

- /

- NasdaqGS:AAL

STARLUX Partnership and Taipei-Phoenix Route Might Change The Case For Investing In American Airlines (AAL)

Reviewed by Simply Wall St

- In August 2025, STARLUX Airlines announced a new interline partnership with American Airlines, enabling single-ticket booking and through-check luggage across extensive North American and transpacific routes, timed with the launch of STARLUX’s Taipei-Phoenix nonstop service using Airbus A350 aircraft.

- This collaboration allows seamless connectivity for travelers between major U.S. cities and Taipei, leveraging Phoenix as a key hub and integrating both carriers’ networks for expanded international access.

- We'll explore how American Airlines' expanded international connectivity through STARLUX may influence its long-term growth narrative and global route strategy.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

American Airlines Group Investment Narrative Recap

For shareholders, the core belief rests on American Airlines' ability to deliver revenue and margin recovery as its US market position stabilizes, while managing high debt and cost pressures. The new STARLUX partnership signals a push to boost international connectivity, potentially supporting premium and ancillary revenue channels. However, in the short term, the impact may not be enough to offset the main catalyst, core domestic demand recovery, or the biggest risk, which remains margin pressure from labor costs and limited financial flexibility.

Recent capacity and fleet expansion plans, announced in July 2025, highlight American's ongoing investment in operational scale, tying closely to the airline's efforts to capture incremental international traffic and diversify away from softer US leisure demand. Whether these moves will meaningfully improve revenue and offset elevated costs hinges on sustained execution as airline competition intensifies.

However, investors should also be aware of American's sizeable debt load and capital commitments, which could ...

Read the full narrative on American Airlines Group (it's free!)

American Airlines Group is projected to reach $61.7 billion in revenue and $1.8 billion in earnings by 2028. This projection requires a 4.4% annual revenue growth rate and a $1.2 billion increase in earnings from the current $567 million.

Uncover how American Airlines Group's forecasts yield a $13.31 fair value, in line with its current price.

Exploring Other Perspectives

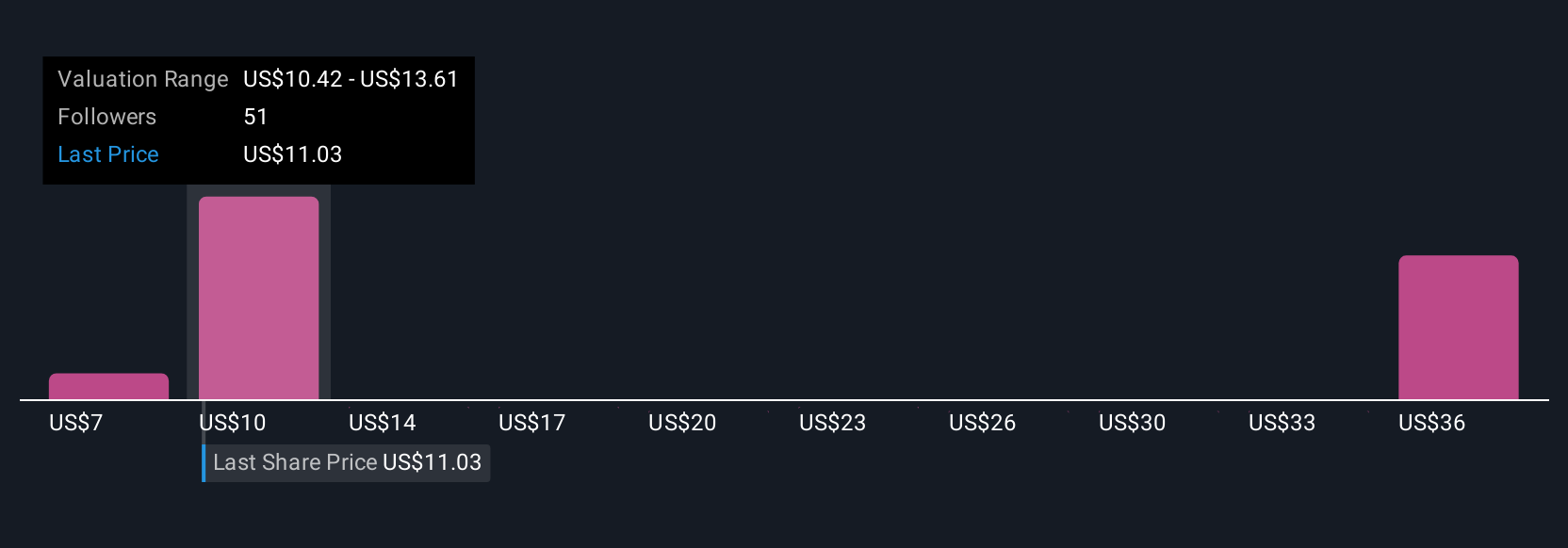

Simply Wall St Community members have shared 12 fair value estimates for American Airlines, ranging widely from US$7.23 to US$35.36 per share. While these figures reflect different expectations, persistent margin risks from higher labor costs loom large and could shape long-term profitability across scenarios presented by the community.

Explore 12 other fair value estimates on American Airlines Group - why the stock might be worth over 2x more than the current price!

Build Your Own American Airlines Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Airlines Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Airlines Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives