We Think Shareholders May Want To Consider A Review Of Verizon Communications Inc.'s (NYSE:VZ) CEO Compensation Package

Key Insights

- Verizon Communications will host its Annual General Meeting on 9th of May

- Salary of US$1.50m is part of CEO Hans Vestberg's total remuneration

- The overall pay is 720% above the industry average

- Verizon Communications' three-year loss to shareholders was 21% while its EPS was down 16% over the past three years

Verizon Communications Inc. (NYSE:VZ) has not performed well recently and CEO Hans Vestberg will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 9th of May. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Verizon Communications

Comparing Verizon Communications Inc.'s CEO Compensation With The Industry

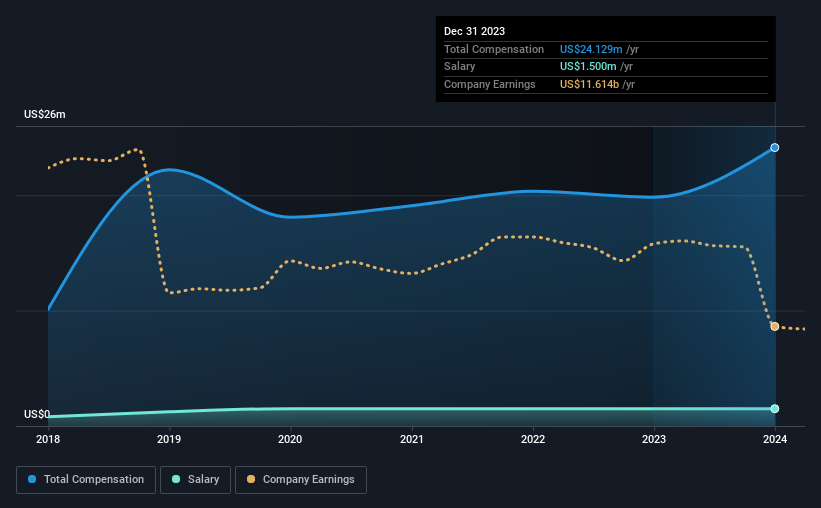

Our data indicates that Verizon Communications Inc. has a market capitalization of US$165b, and total annual CEO compensation was reported as US$24m for the year to December 2023. We note that's an increase of 22% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.5m.

On comparing similar companies in the American Telecom industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$2.9m. Hence, we can conclude that Hans Vestberg is remunerated higher than the industry median. What's more, Hans Vestberg holds US$19m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.5m | US$1.5m | 6% |

| Other | US$23m | US$18m | 94% |

| Total Compensation | US$24m | US$20m | 100% |

Speaking on an industry level, nearly 19% of total compensation represents salary, while the remainder of 81% is other remuneration. In Verizon Communications' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Verizon Communications Inc.'s Growth

Verizon Communications Inc. has reduced its earnings per share by 16% a year over the last three years. It saw its revenue drop 1.6% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Verizon Communications Inc. Been A Good Investment?

Since shareholders would have lost about 21% over three years, some Verizon Communications Inc. investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 5 warning signs for Verizon Communications that you should be aware of before investing.

Switching gears from Verizon Communications, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.