Verizon (VZ) Shares Quietly Rise 6%: Exploring Its Valuation and Upside Potential

Reviewed by Simply Wall St

It’s not every day that Verizon Communications (VZ) quietly adds over 6% in a single month, so investors are understandably looking at the stock and wondering what might be behind its recent run. No dramatic headlines are grabbing market attention, yet this steady climb is enough to raise eyebrows. This is especially notable with the wireless giant’s year-to-date performance sitting at an impressive 12%. With market sentiment changing and risk perceptions evolving, these moves suggest that expectations for Verizon may be shifting beneath the surface.

Over the past year, Verizon’s stock has delivered a solid 17% total return, outpacing the S&P 500’s modest gains in the same period. Momentum has been particularly strong over the past month, in contrast to the long, flat performance that defined much of the past five years. The company’s recent financial data shows slow but positive revenue growth paired with a nearly 6% rise in net income. This supports the idea that fundamentals may be driving a gradual re-rating by the market.

The real question is whether this move signals an undervalued opportunity, or if the market is already pricing in all the upside for Verizon from here.

Most Popular Narrative: 7.5% Undervalued

According to community narrative, Verizon Communications is currently considered undervalued by analysts, with fair value driven by expectations for improved earnings and stable future growth. The prevailing view is that there is moderate upside potential based on consensus assumptions.

The rapid expansion of fixed wireless access (FWA) and fiber broadband, as evidenced by accelerating subscriber growth (over 5 million FWA subscribers, strong broadband net additions, and the pending Frontier acquisition), positions Verizon to capitalize on surging demand for high-quality home and business connectivity. As more devices, smart homes, and bandwidth-intensive applications proliferate, this is expected to support future service revenue and ARPU growth.

What is fueling this target valuation? The narrative centers on bold expectations for revenue and margin expansion, as well as a forward-looking earnings target that may surprise many. Learn about the assumptions behind this analyst forecast and the reasons some believe Verizon could exceed expectations in the coming years. To understand the quantitative factors behind these projections, explore the full story and see how analysts calculated this valuation.

Result: Fair Value of $48.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated capital costs and fierce competition could threaten Verizon’s earnings momentum. This may put pressure on long-term growth projections and current valuations.

Find out about the key risks to this Verizon Communications narrative.Another View: What Does Our DCF Model Say?

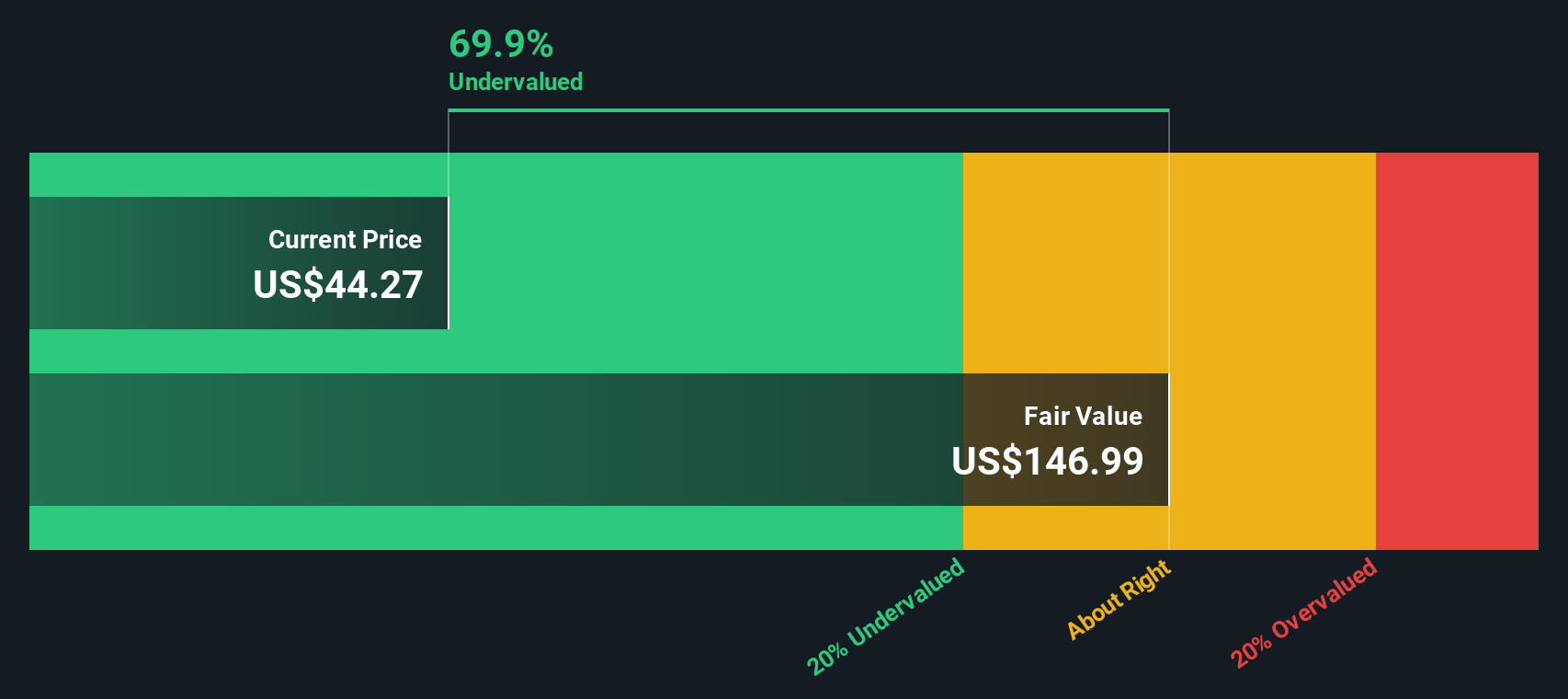

While analysts’ price targets suggest Verizon is moderately undervalued, our DCF model provides a different perspective. According to this method, Verizon is trading well below its calculated fair value, which points to deeper upside potential. Should this gap affect your outlook, or do the market risks have greater importance?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Verizon Communications for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Verizon Communications Narrative

If you'd rather dig into the numbers yourself or want to shape your own perspective, you can build your own narrative in just a few minutes with do it your way.

A great starting point for your Verizon Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by while the market keeps moving. Expand your watchlist with stocks that fit your goals and stay ahead of the curve with tailored picks from the Simply Wall Street Screener. Start your next investment move with confidence by checking out these thoughtfully selected ideas:

- Target consistent income by reviewing the latest dividend stocks with yields > 3% that are offering yields greater than 3%, ideal for investors focused on steady cash flow.

- Tap into the future of healthcare by seeing which innovative healthcare AI stocks are harnessing AI to shape tomorrow’s medical breakthroughs and patient outcomes.

- Harness technology’s next leap by evaluating top-performing quantum computing stocks poised for growth as quantum computing goes mainstream and transforms how industries solve complex problems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives