Verizon (NYSE:VZ) is Operating Leaner, but Returns On Capital Remain Mediocre

After a promising run earlier this year, Verizon Communications(NYSE: VZ)failed to make a new high and promptly fell back into the same range where the stock has been stuck in the last 5 years.

Although the shareholders have been collecting a hefty dividend that now yields 4.6%, they are likely frustrated by the lack of growth. This article will examine one of the potential reasons by looking at the efficiency of the capital employed.

What is Return On Capital Employed (ROCE)?

ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Verizon Communications:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = US$33b ÷ (US$349b - US$40b) (Based on the trailing twelve months to June 2021).

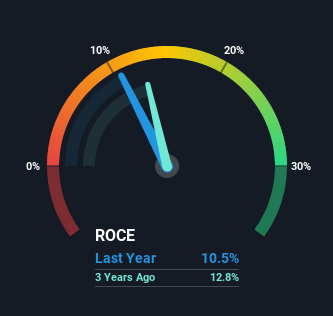

Therefore, Verizon Communications has a ROCE of 11%. That's a pretty standard return, and it's in line with the industry average.

Check out our latest analysis for Verizon Communications

In the above chart, we have measured Verizon Communications' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analyst's predictions in our free report on analyst forecasts for the company.

ROCE Trends

In terms of Verizon Communications' historical ROCE movements, the trend isn't fantastic. To be more specific, ROCE has fallen from 17% over the last five years.

Meanwhile, the business is utilizing more capital, but this hasn't moved the needle much in sales in the past 12 months, so this could reflect longer-term investments. It may take some time before the company starts to see any change in earnings from these investments.

A Look At the Dividend

A 4.6% yield with a good track record should not be ignored. The investors are likely holding the VZ stock for yield purposes.

NYSE: VZ Historic Dividend August 29th, 2021

Furthermore, with a payout ratio of 52%, the dividend is reasonably secure from potential turmoils, and there remains a place for growth.

Leaner Operations but Unimpressive Returns

While the company continues expanding its 5G offering, now present in 78 cities overall, it is struggling to grow its operating revenues that remain at a standstill in the last few years. However, the company has been improving efficiency as it grew its earnings per share. For example, the latest numbers show EPS of US$1.40 at 4,14m shares outstanding, while 2 years ago it was US$1.26 at 4,136m.

With EPS outpacing the share count growth, but without increasing the revenue, we can conclude that the company is now operating leaner.

While we're somewhat encouraged by Verizon Communications' reinvestment in its own business, we're aware that returns are shrinking. Unsurprisingly, the stock has only gained 29% over the last five years, which potentially indicates that investors are accounting for this going forward. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

If you'd like to know more about Verizon Communications, we've spotted 3 warning signs, and 1 of them doesn't sit too well with us.

While Verizon Communications may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives