Verizon Communications (NYSE:VZ) is Depending on Q4 Results to Outperform

After prolonged downward pressure, Verizon Communications Inc.(NYSE: VZ) finally broke below the key level of US$54 before promptly retracing almost wholly.

Although it is too early to proclaim this a value buy opportunity, attractive valuation and the outstanding dividend yield certainly draws attention to the stock.

View our latest analysis for Verizon Communications

Earnings Results

- Non-GAAP EPS: US$1.41 (beat by US$0.05)

- GAAP EPS: US$1.55 (beat by US$0.20)

- Revenue: US$32.9b (miss by US$340m)

Except for a single price target trimming, it is hard to find any significant catalyst for the stock drop, which might explain the subsequent bounce back.

Q3 Earnings Presentation pointed out a few interesting highlights:

- Expanding leadership in 5G adoption

- Raising total wireless service revenue and adjusted EPS guidance

- Keeping the net-zero emissions by 2035 plan

The company outperformed Wall Street's estimates in user acquisition as it gained a net of 699,000 postpaid customers. Due to the solid quarter, the management was confident enough to raise the profit and revenue guidance for 2021, similar to what it did after the last earnings call. The new guidance forecast is now at adjusted EPS of US$5.35 to US$5.40.

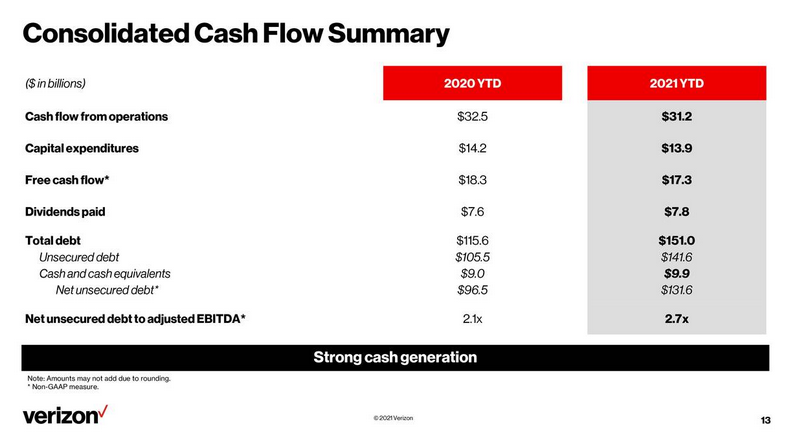

However, it is necessary to point out that while the company claims "strong cash generation," it is decreasing - as evident from their report, comparing 2020 YTD and 2021 YTD. Outstanding results will thus depend on the Q4 performance.

Zooming in on Performance

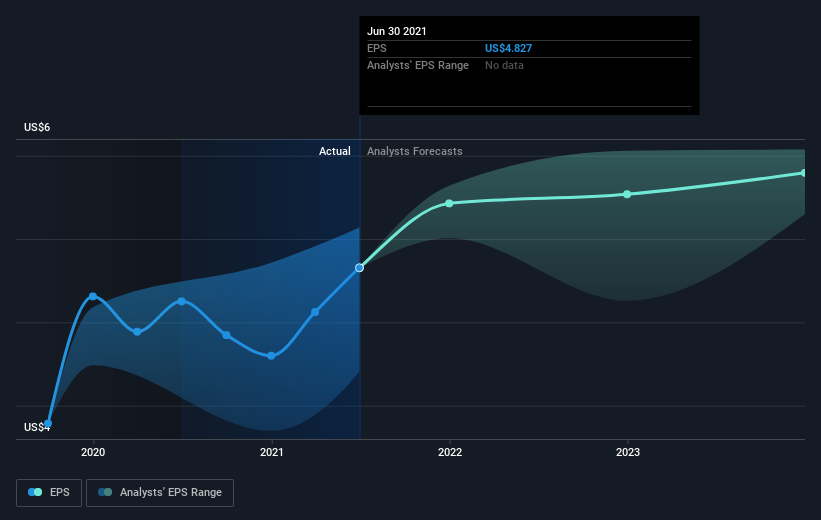

During five years of share price growth, Verizon Communications achieved compound earnings per share (EPS) growth of 6.4% per year. This EPS growth is higher than the 1.8% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock. The reasonably low P/E ratio of 10.84 also suggests market apprehension.

Below, you can see how EPS has changed over time (discover the exact values by clicking on the image).

It might be worthwhile to look at our free report on Verizon Communications' earnings, revenue, and cash flow.

What About Dividends?

It is important to consider the total shareholder return and the share price return for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs.

So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Verizon Communications, the TSR over the last 5 years was 37%, which is better than the share price return mentioned above. This is primarily a result of its dividend payments.

A Different Perspective

Verizon Communications is evidently out of the market favor, with a total loss of 4.4% (including dividends), against a market gain of about 32%.

Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics before getting too interested. While long-term shareholders have made money, with a gain of 6% per year over half a decade, that is still lagging the market averages.

Thus, Verizon remains a situational opportunity for dividend investors and even the more active speculators looking for yield while collecting the premium on covered call options.

But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Verizon Communications that you should be aware of before investing here.

Of course, there are always other opportunities, so you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)