Is Verizon's (VZ) Healthcare 5G Deal Shaping a New Chapter in Its Enterprise Strategy?

Reviewed by Sasha Jovanovic

- In recent days, AdventHealth and Tampa General Hospital, among other leading healthcare organizations, announced they have signed agreements with Verizon Business to deploy Neutral Host and Private 5G Networks at their facilities.

- This move highlights the healthcare sector's rapid digital transformation and the growing demand for high-capacity, secure wireless connectivity to support next-generation medical operations and patient services.

- We'll explore how Verizon's expansion into healthcare enterprise 5G solutions could impact its investment narrative going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Verizon Communications Investment Narrative Recap

To be a Verizon shareholder today, you need to believe in the company's ability to turn wireless and broadband network investments into growing, higher-margin service revenues, especially as the U.S. market matures. While the recent healthcare 5G network deals underscore Verizon's push to monetize new enterprise solutions, they are unlikely to meaningfully impact short-term results; subscriber retention and core wireless profitability remain the main near-term catalysts and risks.

Of recent announcements, the extension of Neutral Host and Private 5G Networks to major healthcare providers stands out for its relevance. This development supports Verizon's narrative around capturing enterprise digital transformation, but also highlights the ongoing challenge to scale these innovations quickly enough to compensate for competitive pressures in the core consumer wireless segment.

However, investors should be aware that, despite new wins in healthcare, ongoing elevated capital expenditure requirements to support such technologies could...

Read the full narrative on Verizon Communications (it's free!)

Verizon Communications is projected to achieve $144.5 billion in revenue and $22.1 billion in earnings by 2028. This outlook assumes annual revenue growth of 1.8% and an earnings increase of $3.9 billion from the current $18.2 billion.

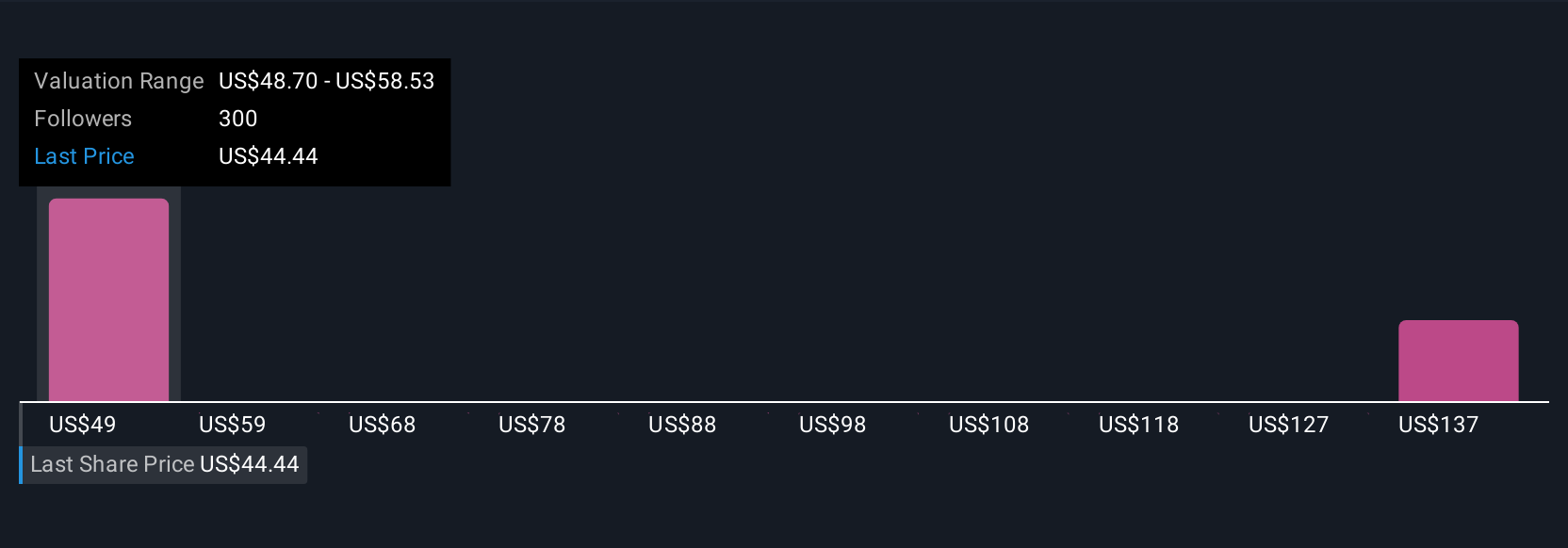

Uncover how Verizon Communications' forecasts yield a $48.61 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Seventeen individual estimates from the Simply Wall St Community place Verizon’s fair value anywhere from US$42.83 to US$128.22 per share. As you weigh this broad range, consider how high network investment needs could affect future returns and the company’s financial flexibility.

Explore 17 other fair value estimates on Verizon Communications - why the stock might be worth over 3x more than the current price!

Build Your Own Verizon Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verizon Communications research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verizon Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verizon Communications' overall financial health at a glance.

No Opportunity In Verizon Communications?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives