Did Verizon's Historic Layoffs and Retail Shift Just Reshape the VZ Investment Narrative?

Reviewed by Sasha Jovanovic

- Verizon Communications recently announced plans to eliminate 15,000 jobs, about 15% of its workforce, and convert 180 company-owned retail stores into franchises, marking the largest layoff in its history under its new CEO.

- This restructuring effort signals a significant shift in Verizon's approach to managing costs and responding to intensified competition and slowing customer growth in the telecommunications sector.

- We'll explore how this historic workforce reduction could reshape Verizon's investment narrative by focusing on cost structure and operational efficiency.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Verizon Communications Investment Narrative Recap

To be a Verizon shareholder today, you need to believe that cost control and operational efficiency can offset a saturated wireless market and increased competition from lower-priced rivals. The recent workforce reduction and shift to franchise-owned stores may bolster near-term margins but does not materially change the biggest current catalyst, continued rapid expansion in fixed wireless access and fiber broadband, or the most pressing risk of erosion in wireless subscriber growth if churn remains elevated.

Among the latest announcements, Verizon’s collaboration with Validic to strengthen technology-driven health and remote patient monitoring stands out. This move aligns with the ongoing catalyst of leveraging advanced connectivity to expand new enterprise and adjacent service revenue streams, which could help diversify Verizon’s top-line beyond traditional wireless segments facing maturity.

Yet, contrary to the promise of efficiency gains, investors should be aware that persistent customer churn...

Read the full narrative on Verizon Communications (it's free!)

Verizon Communications is projected to reach $144.5 billion in revenue and $22.1 billion in earnings by 2028. This forecast assumes a 1.8% annual revenue growth rate and a $3.9 billion increase in earnings from the current earnings of $18.2 billion.

Uncover how Verizon Communications' forecasts yield a $47.52 fair value, a 16% upside to its current price.

Exploring Other Perspectives

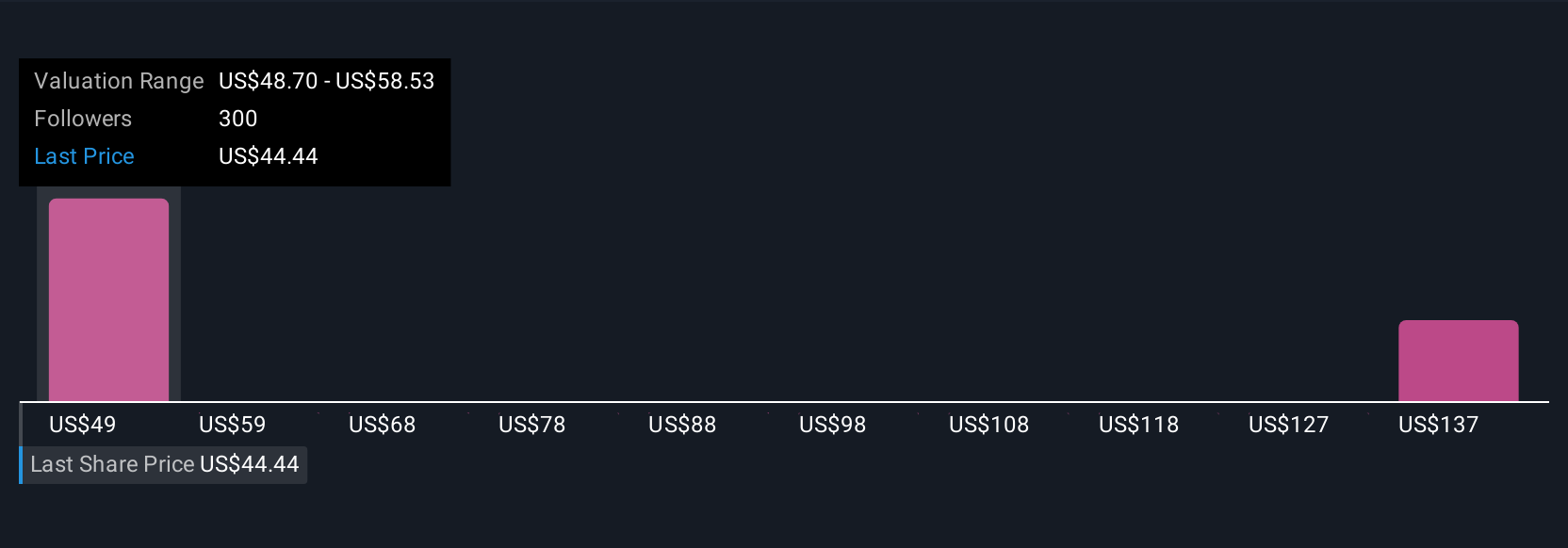

Simply Wall St Community members estimate Verizon’s fair value between US$46.38 and US$108.36, across 16 individual views. Against this wide spectrum, persistent subscriber churn and price competition remain key factors shaping future performance and make it critical to consider several perspectives before forming your outlook.

Explore 16 other fair value estimates on Verizon Communications - why the stock might be worth over 2x more than the current price!

Build Your Own Verizon Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verizon Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verizon Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verizon Communications' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.