- United States

- /

- Wireless Telecom

- /

- NYSE:TDS

Assessing Telephone and Data Systems’ Valuation After Its Expanded Credit Agreement and Added Debt Capacity

Reviewed by Simply Wall St

Telephone and Data Systems (TDS) just rewired its main credit agreement, extending the maturity date, stripping out certain SOFR interest add ons, and opening up an extra $300 million of secured and unsecured borrowing capacity.

See our latest analysis for Telephone and Data Systems.

The refinancing lands at a time when TDS’s share price has quietly rebuilt confidence, with an 11.05% year to date share price return and a striking 308.65% three year total shareholder return. This points to sustained, if bumpier, momentum rather than a short lived pop around this credit move.

If this kind of balance sheet reset has you thinking about what else could rerate, it is worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar opportunities.

With leverage leeway widened, robust multi year returns, and the stock still sitting at a hefty discount to analyst targets, is Telephone and Data Systems quietly mispriced or already discounting a brighter growth future?

Most Popular Narrative: 21.3% Undervalued

With the narrative fair value sitting around $48.67 versus a last close of $38.29, the valuation case leans on a bold transformation story.

The divestiture of UScellular and major spectrum assets has substantially deleveraged TDS's balance sheet, freeing up capital for aggressive expansion in fiber infrastructure and providing flexibility for opportunistic M&A, both of which are positioned to drive long term revenue and earnings growth as broadband demand intensifies.

Want to see what powers that upside call? The narrative banks on a drastic earnings reset, shifting margins, and a future multiple more often reserved for sector leaders. Curious which moving parts really drive that fair value? Read on and unpack the full playbook.

Result: Fair Value of $48.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steep fiber capex and execution risk around pending spectrum sales could still derail margin expansion and delay the rerating that this narrative assumes.

Find out about the key risks to this Telephone and Data Systems narrative.

Another Angle on Valuation

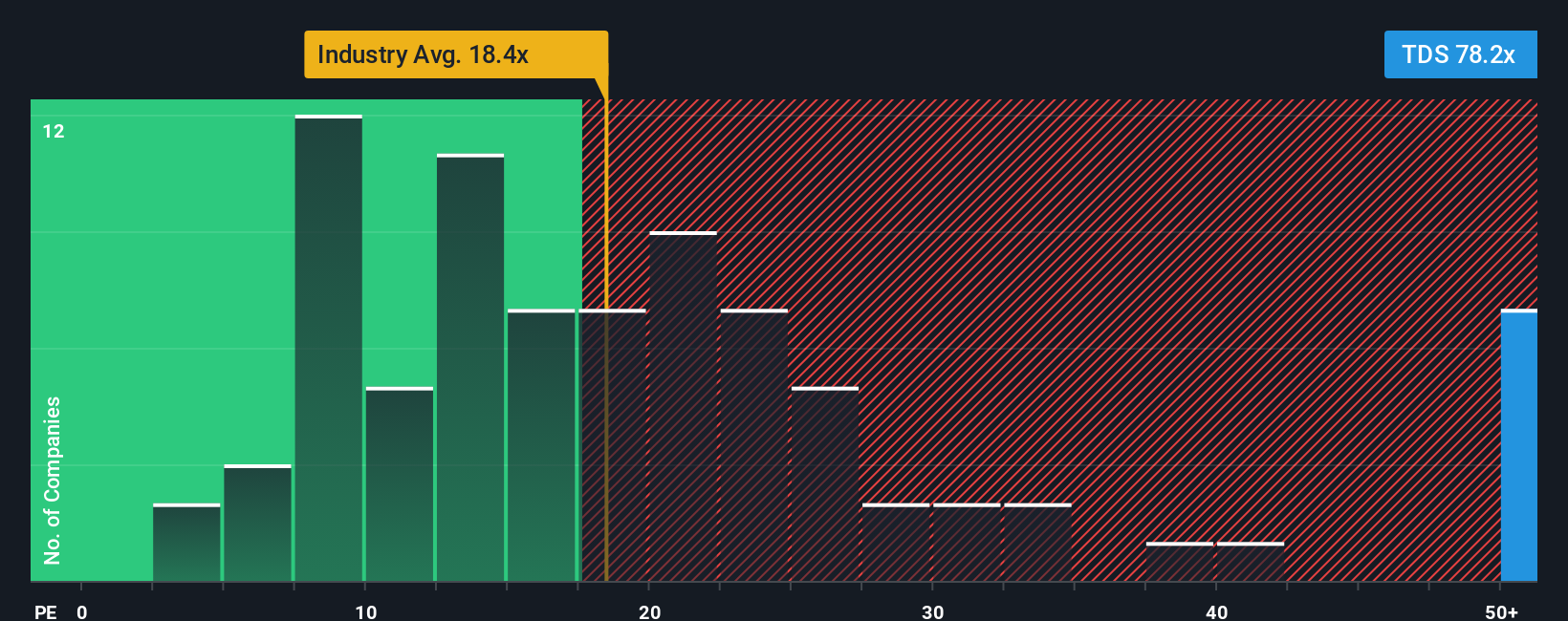

Look past the upbeat narrative and the earnings based lens turns stark. TDS trades on about 78.5 times earnings versus 17.6 times for the global wireless telecom industry and 15.9 times for peers, while its fair ratio sits nearer 37.3 times. That kind of gap suggests meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Telephone and Data Systems Narrative

If you see the story differently or want to stress test the numbers yourself, you can craft a custom view in just a few minutes by using Do it your way.

A great starting point for your Telephone and Data Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in fresh opportunities by using the Simply Wall St Screener to uncover high conviction ideas that other investors are still overlooking.

- Boost your hunt for value by targeting companies that look mispriced based on cash flow strength using these 912 undervalued stocks based on cash flows today.

- Tap into the next wave of innovation by scanning these 26 AI penny stocks that could reshape entire industries with scalable AI-driven business models.

- Strengthen your income strategy by reviewing these 13 dividend stocks with yields > 3% that combine reliable payouts with the potential for long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Telephone and Data Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDS

Telephone and Data Systems

A telecommunications company, provides communications services to consumer, business, and government in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)