The Struggle between Debt and Dividends for the New AT&T (NYSE:T)

After the Warner spinoff, AT&T Inc. (NYSE:T) cut forward dividends to US$1.11, which implies a 5.6% yield. While investors are mostly focused on the dividends, in order to get a better picture of the stability of AT&T, we will quickly present the earnings outlook, as well as take a look at their debt levels.

For a quick overview, here are the key takeaways from our analysis:

- AT&T will stabilize income after the spinoff and the company is likely to focus on its core business.

- The dividend remains high (5.6% yield) and will likely be affordable given the net income moat.

- Future projects may be approached with more diligence, as the costs of refinancing the US$182b debt burden may increase more than half.

In essence, we want to establish what will the future earnings look like for AT&T, and to what extent their long term debt is risky. The earnings give us a hint on the maximum dividend capacity for the company, and the debt burden shows the fixed costs which it might have to refinance at higher interest rates in the future.

See our latest analysis for AT&T

AT&T's Future Income

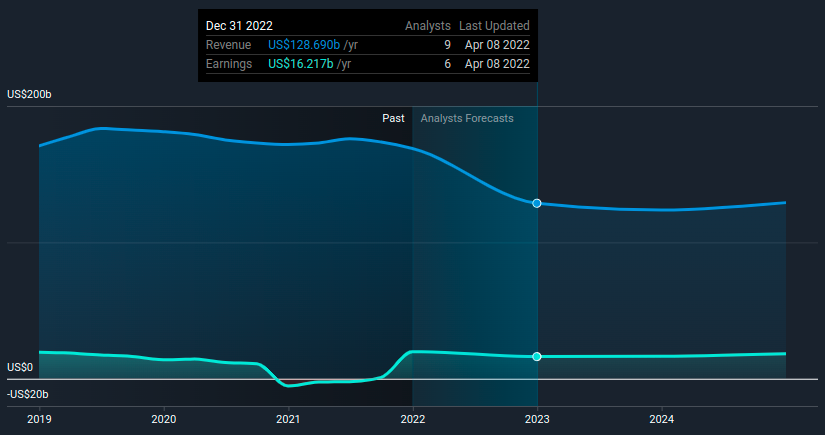

Revenues are projected to be cut from US$168.8b to US$128.7b in 2023, this 24% decline is due to the spinning off of the media segment. However, net income is only expected to drop 18.4%, from US$19.87b to US$16.21b, which means that the company is likely spinning off a less reliable segment.

For the future, AT&T's net income is projected to stabilize, and move from US$16b to US$18b in 2025. Costs of operations and the focus on new CapEx projects will become much more focused and management will be dealing within their industry.

For dividend investors, the future payout ratio is estimated to be around 50%, which means that the company should retain about US$8b future net income to fund investments and have some moat should they need to refinance at higher interest rates.

AT&T's Debt Analysis

The image below, which you can click on for greater detail, shows that at December 2021 AT&T had debt of US$182.1b, up from US$155.2b in one year. On the flip side, it has US$21.2b in cash leading to net debt of about US$160.9b.

AT&T's book debt to equity ratio is 99%, however this is a lagging figure and, as of today the debt to market value of equity is 130%, and their market debt to capital is 56.5%. A company like AT&T can sustain heavy debt levels because it has regular earnings and a large amount of assets, however, it does seem that the company is pushing towards the high end of their debt capacity, and it may find it harder to finance large CapEx projects if it doesn't manage its debt levels.

There is also interest rate risk, since the current riskfree rate (as measured by the US 10-Yr T.Bond) has reached 2.78%, a 71% increase since January 2022. This means that when refinancing debt, the interest payments can slowly start increasing from US$6.884b annually up to US$11.8b (assuming rates stay at this level and the company needs to refinance the majority of debt soon).

It is unclear whether analysts have factored-in these possible developments in their net income estimates, and it is something to keep in mind when considering AT&T.

Conclusion

The spinning off of AT&T's media segment also cuts away a lot of variable income and industry risk, however it is a testimony that management made a mistake when acquiring the company and shareholders will likely not forget anytime soon.

As a result, the stock has been suffering in the last 2 years. This is a vicious cycle which enforces a higher cost of equity for the company, whose effects may be amplified in bad times. The cost of debt is also rising, leading to higher refinancing costs in the future, which have the capacity to hurt the bottom line. Luckily, AT&T has a sufficient net-income moat, and can work to stabilize the company in the future.

The company will probably focus on improving infrastructure, efficiency and core operations, which is why shareholders may experience a recovery in the future.

Be aware that AT&T is showing 3 warning signs in our investment analysis , and 1 of those is concerning...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:T

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)