The Bull Case For AT&T (T) Could Change Following First Wireless Rollout in NYC Subway Tunnels

Reviewed by Sasha Jovanovic

- Boldyn Networks recently announced, in a collaboration with AT&T, the successful expansion of cellular connectivity in New York City's historic Joralemon Street subway tunnel, with the G line to follow, making AT&T the first provider to offer wireless service in these critical underground transit routes.

- This early rollout signals a major advancement in urban transit connectivity and highlights AT&T's focus on leading infrastructure investments that benefit millions of daily commuters in Brooklyn, Manhattan, and Queens.

- We'll explore how AT&T's role as the first subway tunnel wireless provider could enhance its long-term urban connectivity narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

AT&T Investment Narrative Recap

To be a shareholder in AT&T today, you need to believe in the long-term value of its 5G and fiber investments, driving sustainable gains in network scale, customer retention, and recurring revenue. The move to bring AT&T wireless connectivity to historic NYC transit tunnels is a proof point for the company's infrastructure ambitions, but it does not dramatically change the most important near-term catalyst: stabilizing subscriber churn amid tougher competition. Likewise, this news does not materially alter the biggest risk, persistent pricing and customer losses in core wireless segments.

Among recent announcements, AT&T’s board declared a quarterly dividend of US$0.2775 per share, reinforcing the company’s commitment to returning cash to shareholders. While dividends remain a steady feature, ongoing wireless infrastructure upgrades like the Boldyn Networks partnership highlight AT&T’s drive to protect and grow its urban market share, closely aligned with investors’ focus on subscriber trends and margin health.

However, investors should watch for renewed churn pressure, especially as...

Read the full narrative on AT&T (it's free!)

AT&T's narrative projects $130.6 billion in revenue and $17.0 billion in earnings by 2028. This requires 1.7% yearly revenue growth and a $4.3 billion earnings increase from the current $12.7 billion.

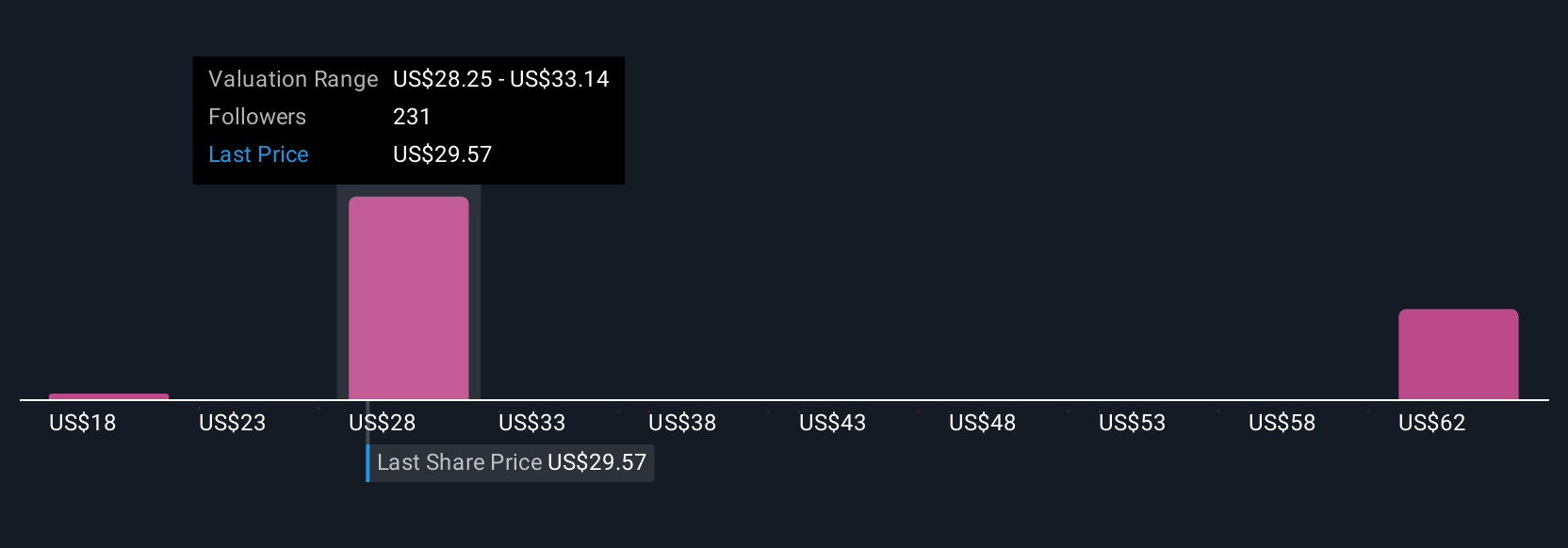

Uncover how AT&T's forecasts yield a $30.62 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Some analysts had a far more optimistic outlook, projecting AT&T’s revenue could hit US$130.2 billion and earnings US$17.6 billion by 2028, largely hinging on accelerated 5G and fiber rollouts. This aligns with the view that major connectivity projects could spark stronger market share gains. Remember, expectations, and the real world results, often diverge as circumstances change, so you’ll want to weigh several viewpoints as the story continues to unfold.

Explore 16 other fair value estimates on AT&T - why the stock might be worth over 2x more than the current price!

Build Your Own AT&T Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AT&T research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AT&T research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AT&T's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives