How AT&T's Partnership With Gigs Could Shape Long-Term Subscriber Growth and Recurring Revenue (T)

Reviewed by Simply Wall St

- On September 12, 2025, Gigs announced a partnership with AT&T allowing technology brands like Klarna to embed phone plans directly into their apps using AT&T’s network, with plans managed in-app and supported by AI-driven service.

- This collaboration signals a shift in mobile services distribution, enabling network providers to access new subscribers by integrating connectivity within everyday digital platforms rather than relying on traditional marketing channels.

- We'll explore how embedded phone plans through digital storefronts may alter AT&T's long-term growth opportunities and recurring revenue outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

AT&T Investment Narrative Recap

To be an AT&T shareholder, you need to believe that investments in 5G, fiber expansion, and partnerships like the recent deal with Gigs can unlock fresh growth while shoring up recurring revenue. The headline risk remains wireless subscriber churn and pricing pressure from competitive offers, especially as device financing cycles mature. The Gigs collaboration is intriguing but not likely to materially alter these immediate market risks or the most important catalyst, steady mobility segment growth.

Among recent company moves, AT&T’s new share buyback program is particularly relevant. By announcing a repurchase of 47.2 million shares for US$1.3 billion, the company is showing commitment to returning capital even as it pursues new digital and network investments. How effectively this improves shareholder value depends on long-term revenue stability, especially if the digital distribution play raises, rather than alleviates, churn and margin challenges.

In contrast, investors should be aware that intensified competitive activity and device upgrade cycles may drive higher-than-expected churn rates and pressure margins...

Read the full narrative on AT&T (it's free!)

AT&T's narrative projects $130.6 billion revenue and $17.0 billion earnings by 2028. This requires 1.7% yearly revenue growth and a $4.3 billion earnings increase from $12.7 billion currently.

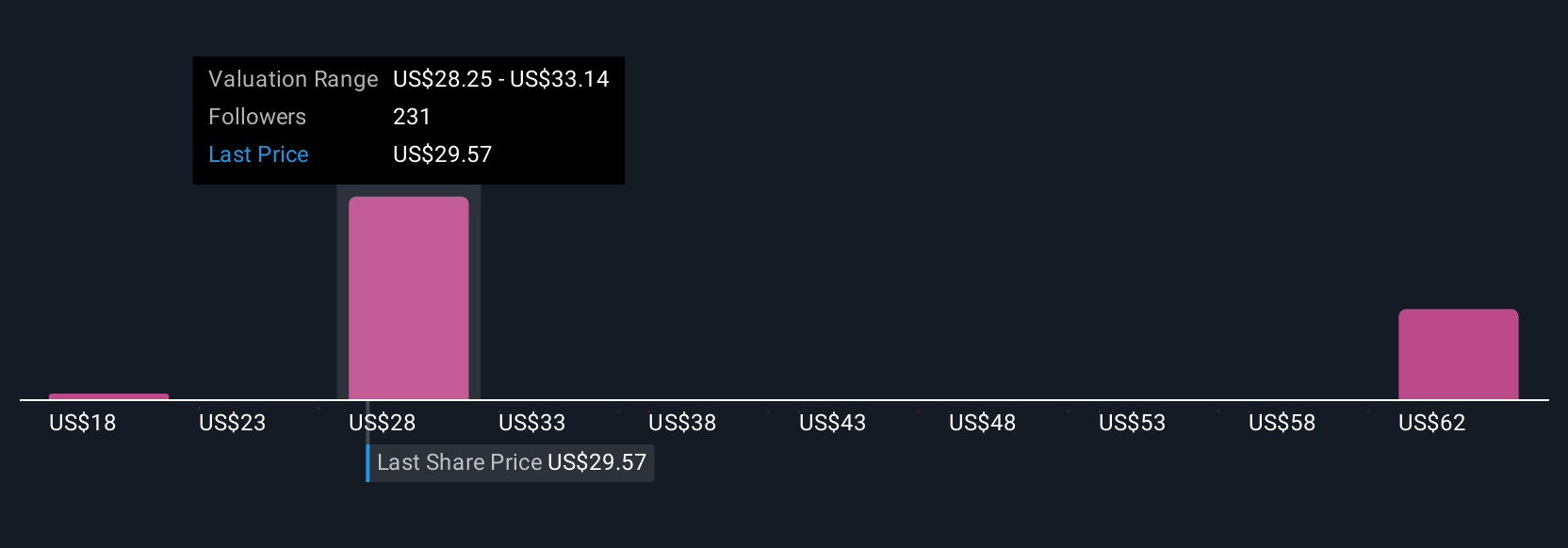

Uncover how AT&T's forecasts yield a $30.62 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Some analysts are much more optimistic, expecting AT&T’s annual revenue to hit US$130.2 billion and earnings to grow to US$17.6 billion by 2028. These bullish forecasts assume efficient fiber deployment and strong cost reductions, but events like the Gigs partnership could shift expectations further. As an investor, it’s important to weigh how each news event may affect these projections, since analyst opinions and future company results can diverge significantly.

Explore 16 other fair value estimates on AT&T - why the stock might be worth 36% less than the current price!

Build Your Own AT&T Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AT&T research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AT&T research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AT&T's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives