AT&T (T) Valuation in Focus as Company Reveals New Spectrum Plans and Long-Term Strategy

Reviewed by Simply Wall St

AT&T (T) just caught the market’s eye by announcing a special call focused on its latest spectrum acquisition plans, along with an overview of the company’s long-term strategy. For investors, these meetings can sometimes be all talk and little action. However, when management highlights future growth drivers and outlines a roadmap for shareholder returns, it often signals something worth paying attention to. With the telecom landscape shifting and competition remaining fierce, even a hint of forward-thinking strategy can influence sentiment around the stock.

Taking a step back from the event, it’s useful to check in on the market’s current view. Over the past year, AT&T has delivered a 53% total return, a pace that stands out for a company of its scale. Momentum has picked up significantly this year, with steady gains in recent months. All this comes after a period of more modest moves, and aside from standard board changes, major news has been limited until now. This may add to the sense that investors are ready for something new.

The question is, after a strong run this year, does AT&T’s strategy update reveal real value, or is the market already factoring in all the future upside?

Most Popular Narrative: 5% Undervalued

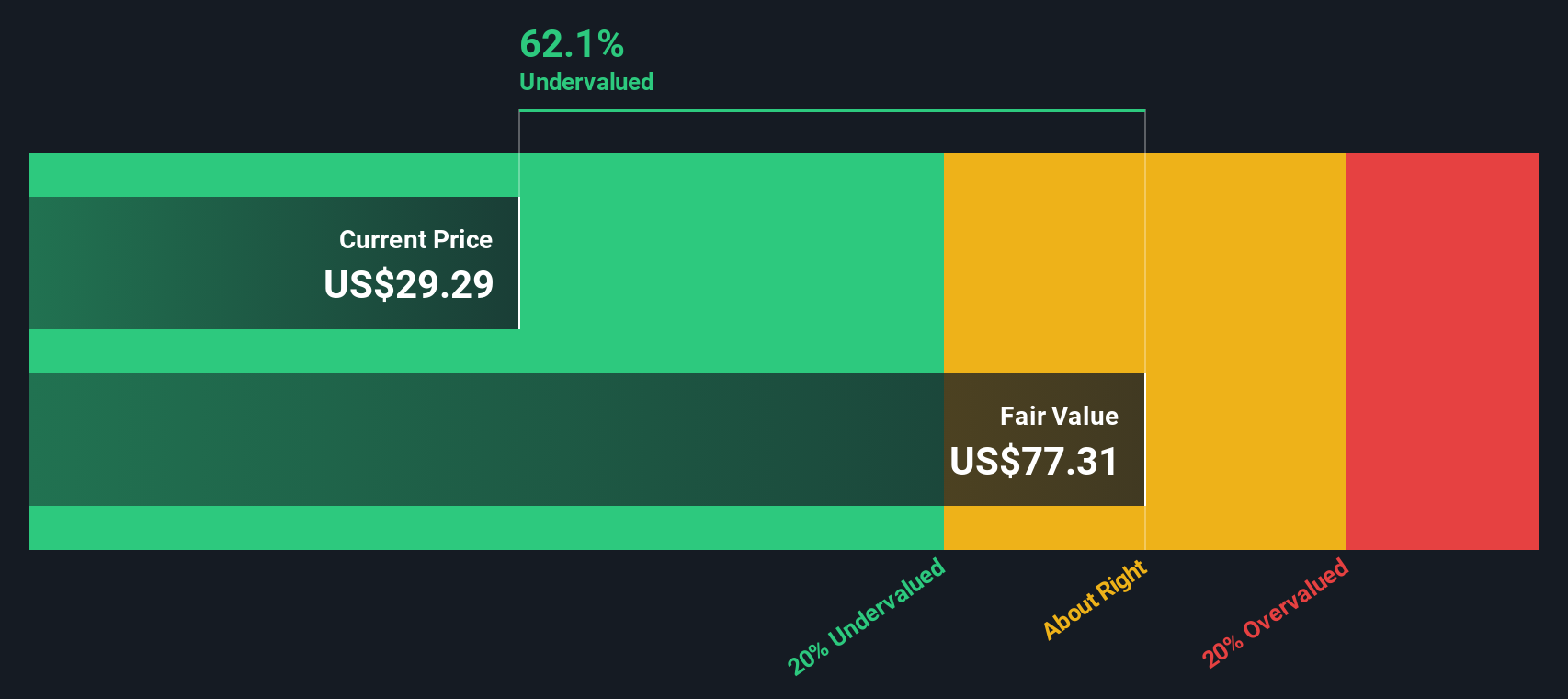

According to community narrative, AT&T is currently trading below what analysts consider its fair value. The valuation suggests limited upside but some room for appreciation.

Accelerated investments in 5G and fiber infrastructure, supported by recent pro-investment legislation and tax savings, are expanding AT&T's addressable market and improving its ability to capture growing mobile data, video streaming, IoT, and enterprise connectivity demand. This is directly fueling recurring revenue and future topline growth.

Wondering what’s driving this bullish stance on AT&T’s valuation? There is a pivotal set of forward-looking growth expectations underpinning this narrative, pointing to major upgrades in network capabilities, improved margins, and a profit trajectory that could shift how investors see the stock. Want to see which financial forecasts are unlocking this premium? The story behind this fair value is more intriguing than you think.

Result: Fair Value of $30.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent wireless subscriber churn or disappointing returns from ambitious fiber expansion plans could quickly shift sentiment regarding AT&T’s outlook.

Find out about the key risks to this AT&T narrative.Another View: SWS DCF Model Offers a Different Perspective

While analysts see AT&T as slightly undervalued based on future earnings estimates, our DCF model offers a much more bullish picture. This method factors in projected cash flows and suggests more value than some expect. Which approach will the market trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AT&T Narrative

If you see things differently, or enjoy diving into your own research, you can craft a personalized view on AT&T in just a few minutes. Do it your way.

A great starting point for your AT&T research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your portfolio. Step out and spot tomorrow’s winners before everyone else. The Simply Wall Street Screener uncovers unique opportunities you might miss by sticking to the usual list. Power up your strategy with these standout investment themes right now:

- Secure more consistent cash flow by targeting companies offering dividend stocks with yields > 3% for long-term income.

- Tap into the booming world of disruptive technology by seeking out quantum computing stocks making headlines with next-level breakthroughs.

- Seize value opportunities other investors overlook by using our tool for undervalued stocks based on cash flows that stand out based on their real financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:T

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives