- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies (LUMN): Revisiting Valuation After Jim Cramer’s Caution on an Overstretched Rally

Reviewed by Simply Wall St

CNBC’s Jim Cramer just poured some cold water on Lumen Technologies (LUMN), arguing the stock has run too far too fast and that caution is warranted as investors weigh its still fragile turnaround.

See our latest analysis for Lumen Technologies.

The pullback that followed Cramer’s comments comes after a powerful run, with Lumen’s 90 day share price return of roughly 34% and year to date share price return near 39% signaling that momentum has been building. At the same time, the 1 year total shareholder return of about 33% and mixed news on debt tenders and new security products remind investors this is still a high risk turnaround rather than a smooth glide higher.

If you are weighing Lumen’s rebound against other opportunities, this could be a good moment to explore fast growing stocks with high insider ownership as a way to spot more potential turnaround and growth stories.

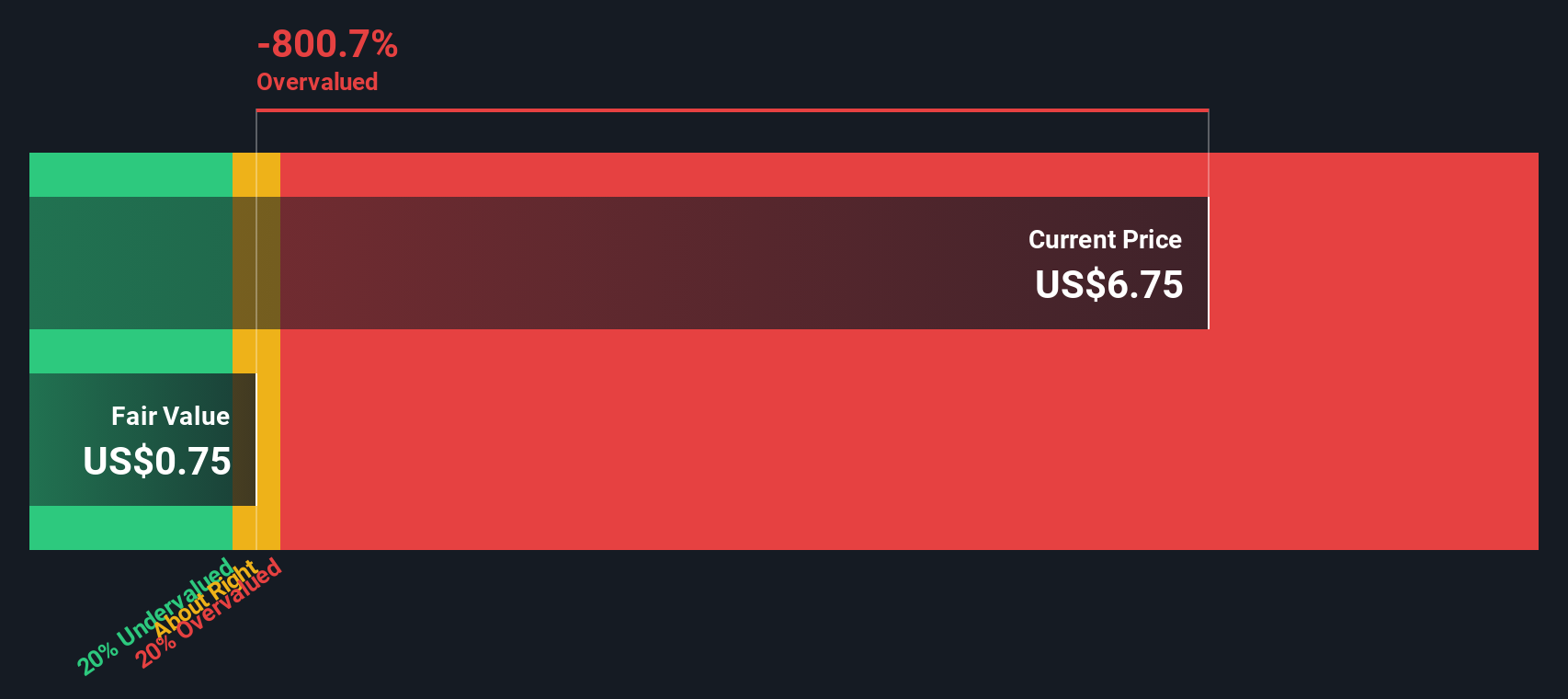

With shares still trading at a hefty intrinsic discount but already above the average analyst target, the key question now is whether Lumen is truly undervalued or if the market is already pricing in a full turnaround.

Most Popular Narrative: 7.4% Overvalued

Compared with the last close at $7.77, the most widely followed narrative sees fair value slightly lower, hinting that recent optimism may be running ahead of itself.

Strategic refinancing, deleveraging, and the pending sale of the consumer fiber to the home business to AT&T will materially strengthen Lumen's balance sheet, reduce interest expense by $300 to $400 million annually, and free up capital for enterprise focused growth initiatives, directly impacting future net earnings and free cash flow.

Want to see what kind of revenue contraction, margin rebuild, and future earnings multiple are baked into that valuation call? The narrative leans on a sharp swing from deep losses toward sector like profitability, then applies a surprisingly restrained earnings multiple to get there. Curious how those moving parts combine into a fair value that still sits below today’s price? Read on to unpack the full playbook behind this turnaround thesis.

Result: Fair Value of $7.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the thesis depends on stabilizing legacy revenue and executing network modernization, and setbacks on either front could quickly undercut today’s valuation case.

Find out about the key risks to this Lumen Technologies narrative.

Another Angle on Value

While the narrative pegs Lumen around $7.23 and slightly overvalued, our DCF model paints a different picture, pointing to fair value closer to $11.28, or roughly 31% above today’s price. Is the market underestimating cash flow potential, or is the DCF being too generous about execution?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lumen Technologies Narrative

If you want to stress test these assumptions yourself, you can dive into the numbers, shape your own thesis in minutes, and Do it your way.

A great starting point for your Lumen Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to identify fresh opportunities that may offer a more diversified approach than focusing on a single turnaround story.

- Explore emerging innovators by scanning these 3629 penny stocks with strong financials that combine smaller market capitalizations with solid fundamentals and potential for meaningful growth.

- Research the next tech wave by reviewing these 24 AI penny stocks that may benefit from increased demand for intelligent automation and data driven platforms.

- Assess your income strategy by focusing on these 10 dividend stocks with yields > 3% that aim to balance regular payouts with sustainable financial profiles over the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion