Lacklustre Performance Is Driving IHS Holding Limited's (NYSE:IHS) Low P/S

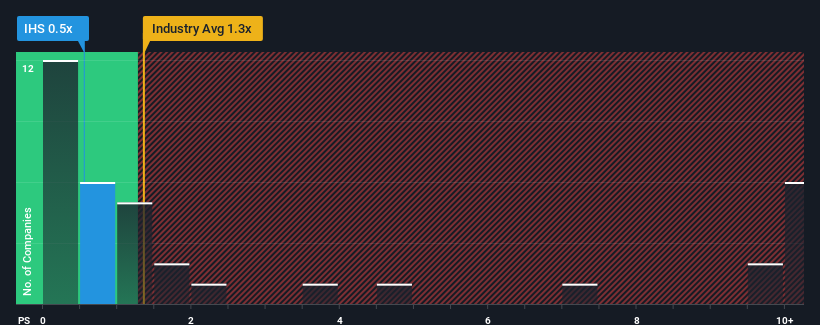

You may think that with a price-to-sales (or "P/S") ratio of 0.5x IHS Holding Limited (NYSE:IHS) is a stock worth checking out, seeing as almost half of all the Telecom companies in the United States have P/S ratios greater than 1.3x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for IHS Holding

What Does IHS Holding's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, IHS Holding has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on IHS Holding will help you uncover what's on the horizon.How Is IHS Holding's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like IHS Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 22% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 1.9% each year over the next three years. With the industry predicted to deliver 187% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that IHS Holding's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of IHS Holding's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for IHS Holding you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IHS

IHS Holding

Develops, owns, and operates shared communications infrastructure in Nigeria, Sub-Saharan Africa, the Middle East and North Africa, and Latin America.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives