- United States

- /

- Wireless Telecom

- /

- NasdaqCM:VEON

Should VEON's (VEON) Addition to S&P Global BMI Index Prompt a Closer Look from Investors?

Reviewed by Sasha Jovanovic

- VEON Ltd. was recently added to the S&P Global BMI Index, following news that the company currently holds a Zacks Rank #1 (Strong Buy) and an A Value grade, suggesting it may be undervalued by the broader market.

- This index inclusion could attract increased institutional interest, further validating VEON's favorable financial outlook and its position as a potential value stock.

- We’ll explore how being added to a major global index may reshape VEON’s investment narrative and institutional appeal.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

VEON Investment Narrative Recap

To be a VEON shareholder, you need to believe in its capacity to capture digital growth across fast-changing emerging markets, against a backdrop of competitive and macroeconomic headwinds. While VEON’s S&P Global BMI Index addition increases its visibility and could support liquidity, this does not materially change the immediate risks of local currency volatility or heavy refinancing requirements that remain in play for the business.

Of recent announcements, VEON’s successful Q2 2025 earnings report stands out, as growth in both revenue and net income suggests continued operating momentum amid restructuring efforts, a key catalyst for market confidence following the index inclusion. However, the company’s exposure to macroeconomic risk in its core markets and continued dependence on debt remains a critical consideration for shareholders navigating short-term uncertainties.

In contrast, investors should be aware that while index inclusion may bring more institutional inflows, it does not insulate VEON from ongoing currency and earnings volatility in key markets such as...

Read the full narrative on VEON (it's free!)

VEON's outlook anticipates $5.1 billion in revenue and $688.2 million in earnings by 2028. This reflects a 7.0% annual revenue growth, but a decrease of $295.8 million in earnings from the current level of $984.0 million.

Uncover how VEON's forecasts yield a $69.64 fair value, a 33% upside to its current price.

Exploring Other Perspectives

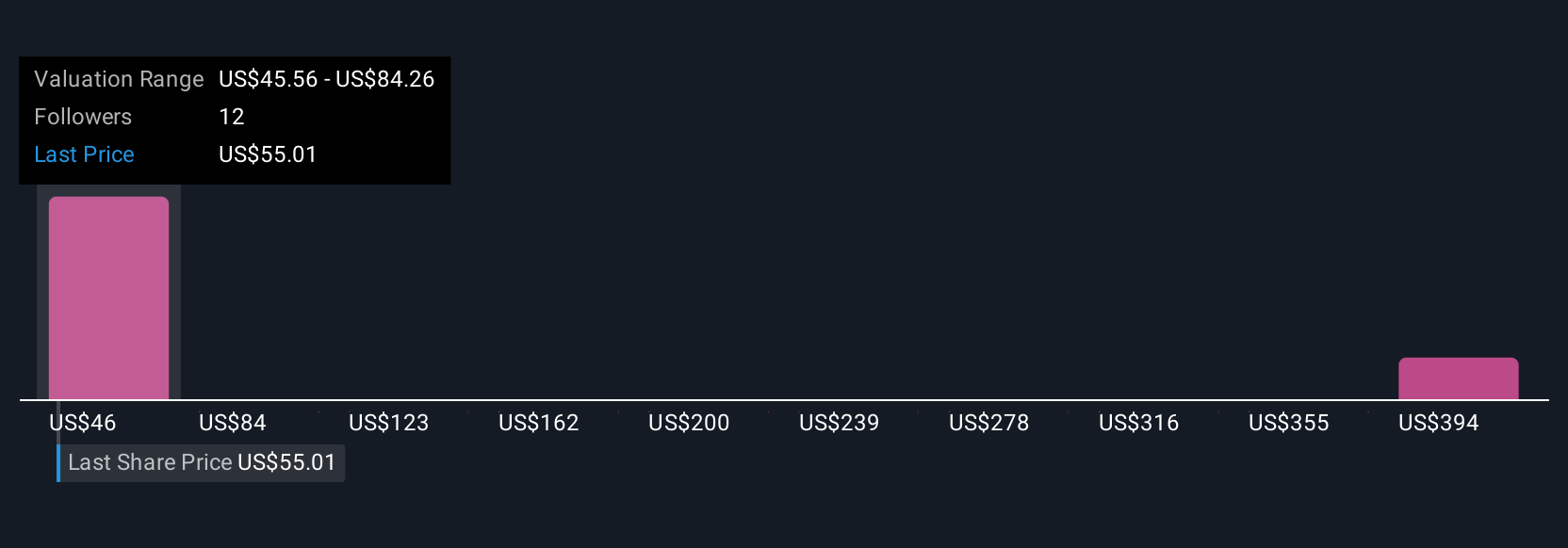

Four community views from the Simply Wall St Community place VEON’s fair value from US$45.56 to US$436.23. While growth in digital services is a major catalyst, opinions reflect genuine uncertainty about how much that can offset margin and currency risks over time, explore what others think and see where your outlook fits.

Explore 4 other fair value estimates on VEON - why the stock might be worth over 8x more than the current price!

Build Your Own VEON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VEON research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free VEON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VEON's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VEON

VEON

A digital operator, provides telecommunications and digital services to corporate and individual customers in Pakistan, Ukraine, Kazakhstan, Uzbekistan, and Bangladesh.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives