- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:UNIT

Uniti Group (UNIT): Evaluating Valuation After Strategic MDC San Diego Expansion Boosts Cross-Border Network Connectivity

Reviewed by Simply Wall St

Uniti Group (UNIT) has drawn investor attention after unveiling an expansion of its wholesale business through a new partnership at MDC San Diego. The initiative boosts connectivity between the U.S. and Mexico and aims for stronger, more resilient cross-border fiber routes.

See our latest analysis for Uniti Group.

Uniti Group’s expansion at MDC San Diego has turned some heads, coming just as its share price staged a 6.2% rise over the past week. This is a rare bright spot in an otherwise tough year, with a total shareholder return of -34.1% over the last twelve months. While recent news signals growth ambitions and fresh momentum, the overall performance still reflects investor caution. However, any sustained uptick could hint at changing sentiment around the company’s long-term prospects.

If this kind of strategic shift in telecom infrastructure interests you, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The market has taken notice, with Uniti’s share price still trading noticeably below analyst targets. Is this an overlooked value play, or is the market already factoring in the company’s expected growth from these bold moves?

Most Popular Narrative: 19.7% Undervalued

With the narrative fair value at $7.48 and shares last closing at $6.00, analysts see notable upside driven by recent business expansion and shifting financial expectations. Market watchers are weighing whether Uniti’s growth strategy can deliver on these projections.

Robust and expanding deal pipeline with hyperscalers ($1.5 billion in total contract value, 40% of sales funnel), along with rising lease-up opportunities and cross-selling with Windstream, is expected to drive higher-margin, low-capex, long-term contracts. This could boost EBITDA and net earnings as industry demand for bandwidth and low-latency networks escalates.

Curious how bullish projections for future earnings and growth margins translate into such a significant fair value bump? A handful of key assumptions are doing the heavy lifting. But only by reading the full narrative will you uncover what’s fueling this striking upside and whether the growth thesis is rock solid or built on shifting assumptions.

Result: Fair Value of $7.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in legacy revenues or a spike in construction costs could quickly undermine optimism about Uniti Group’s expanding fiber ambitions.

Find out about the key risks to this Uniti Group narrative.

Another View: Multiples Tell a Different Story

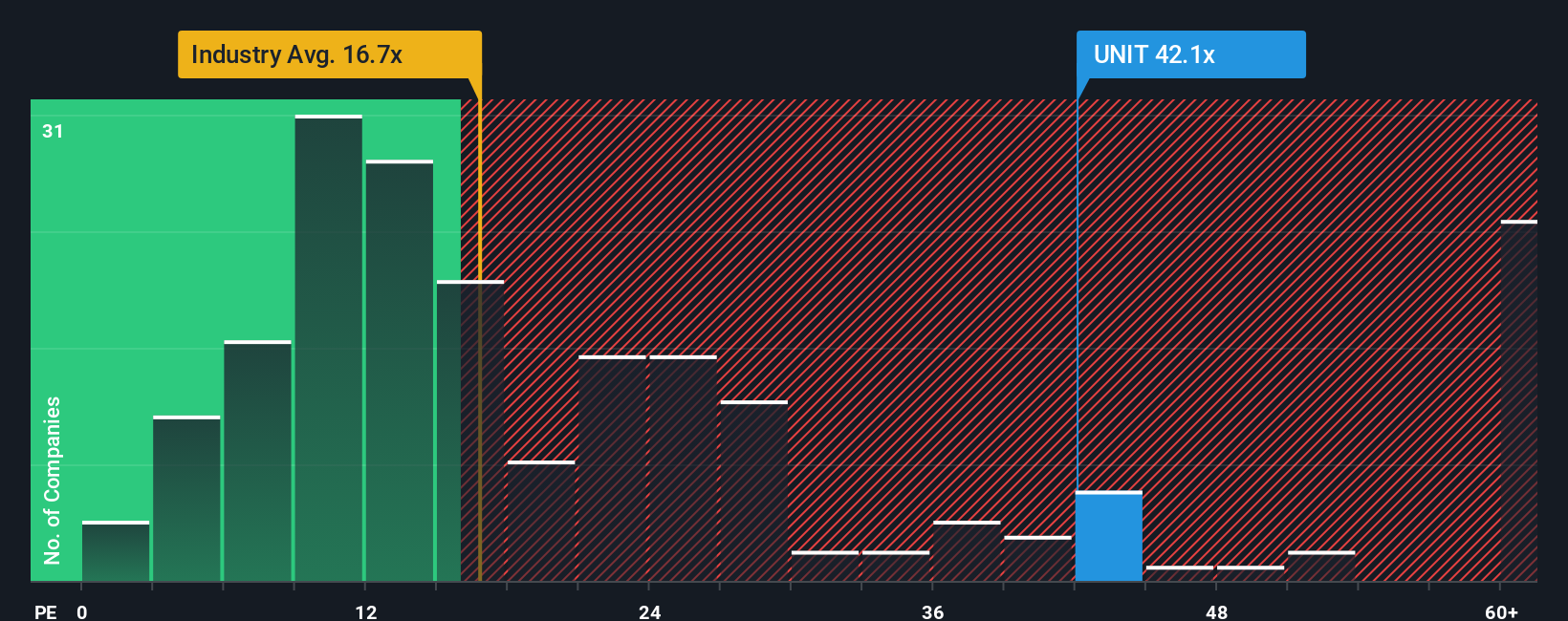

Looking at Uniti Group's valuation through the lens of its price-to-earnings ratio paints a more cautious picture. At 42.1x, the ratio is considerably higher than both its peers (14.2x) and the broader global telecom industry (16.8x). Even when compared to the fair ratio of 14x, Uniti appears expensive. This gap highlights potential risks if the market shifts toward more typical valuation levels. Could these premium multiples be justified by growth, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Uniti Group Narrative

If you see things differently or want to dig deeper into the data on your terms, building your own view is quick and straightforward. Do it your way

A great starting point for your Uniti Group research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for one opportunity? Give yourself an edge by sizing up other promising stocks that fit your strategy using Simply Wall Street’s powerful screener tools.

- Tap into steady income streams and uncover reliable performers with these 17 dividend stocks with yields > 3%, offering yields above 3% for your portfolio.

- Supercharge your search for next-generation breakthroughs by checking out these 27 AI penny stocks, packed with industry disruptors in artificial intelligence.

- Position yourself ahead of the curve by exploring these 80 cryptocurrency and blockchain stocks, featuring companies at the forefront of digital currency and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UNIT

Uniti Group

A premier insurgent fiber provider dedicated to enabling mission-critical connectivity across the United States.

Moderate risk with limited growth.

Similar Companies

Market Insights

Community Narratives