- United States

- /

- Wireless Telecom

- /

- NasdaqGM:UCL

Investors Still Aren't Entirely Convinced By uCloudlink Group Inc.'s (NASDAQ:UCL) Revenues Despite 26% Price Jump

uCloudlink Group Inc. (NASDAQ:UCL) shares have had a really impressive month, gaining 26% after a shaky period beforehand. But the last month did very little to improve the 52% share price decline over the last year.

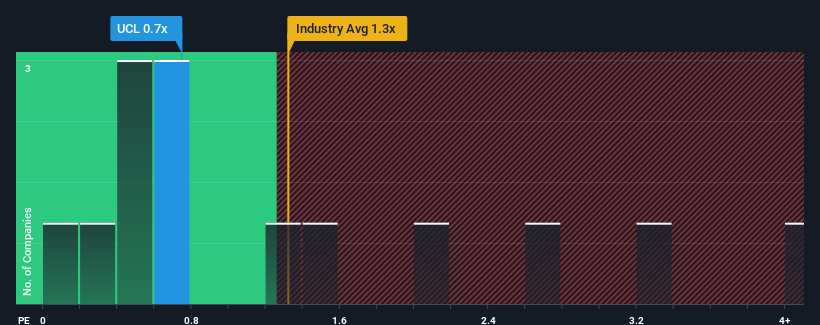

Although its price has surged higher, there still wouldn't be many who think uCloudlink Group's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in the United States' Wireless Telecom industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for uCloudlink Group

How uCloudlink Group Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, uCloudlink Group has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think uCloudlink Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For uCloudlink Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like uCloudlink Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. As a result, it also grew revenue by 16% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 16% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 2.9%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that uCloudlink Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On uCloudlink Group's P/S

uCloudlink Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, uCloudlink Group's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for uCloudlink Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if uCloudlink Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:UCL

uCloudlink Group

Operates as a mobile data traffic sharing marketplace in the telecommunications industry.

Excellent balance sheet with low risk.

Market Insights

Community Narratives