- United States

- /

- Wireless Telecom

- /

- NasdaqGM:UCL

Improved Earnings Required Before uCloudlink Group Inc. (NASDAQ:UCL) Stock's 36% Jump Looks Justified

Those holding uCloudlink Group Inc. (NASDAQ:UCL) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.7% over the last year.

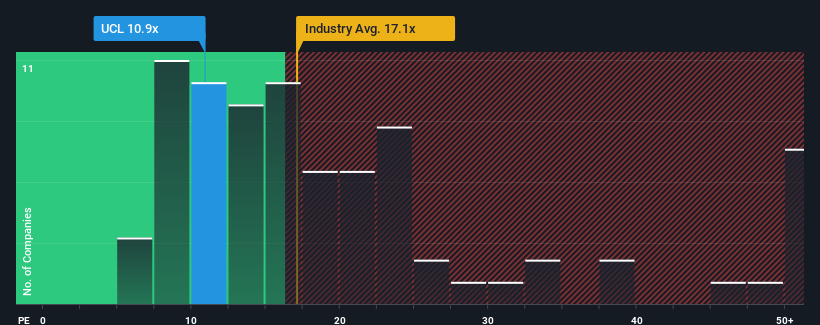

Although its price has surged higher, uCloudlink Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.9x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 33x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Our free stock report includes 3 warning signs investors should be aware of before investing in uCloudlink Group. Read for free now.With earnings growth that's superior to most other companies of late, uCloudlink Group has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for uCloudlink Group

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as uCloudlink Group's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 60% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 150% during the coming year according to the sole analyst following the company. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

In light of this, it's understandable that uCloudlink Group's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift uCloudlink Group's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of uCloudlink Group's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for uCloudlink Group that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if uCloudlink Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:UCL

uCloudlink Group

Operates as a mobile data traffic sharing marketplace in the telecommunications industry.

Outstanding track record with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion