- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US (TMUS) Partners With Southwest For Free Inflight WiFi On All Flights

Reviewed by Simply Wall St

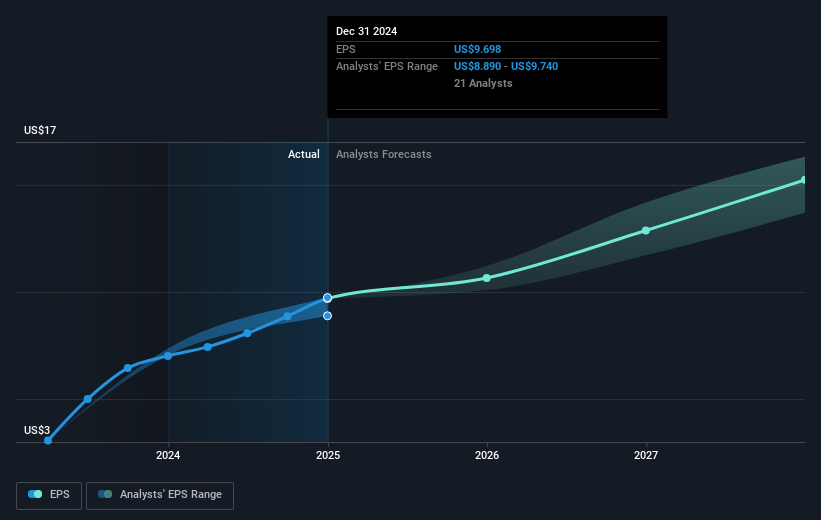

T-Mobile US (TMUS) recently made headlines by announcing a partnership with Southwest Airlines, offering free WiFi to Rapid Rewards Members starting in late October 2025. Alongside this partnership, T-Mobile provided earnings guidance projecting service revenues of $400 million for the third quarter. Over the past month, TMUS's stock saw a 4.8% increase, aligning with overall positive market movements, as evidenced by the steady rise of tech stocks in the S&P 500 and Nasdaq amid general expectations of Federal Reserve interest rate cuts. T-Mobile's initiatives in expanding connectivity and enhancing customer experience likely complemented these trends.

With T-Mobile US's recent partnership with Southwest Airlines offering free WiFi, the company fortifies its customer value proposition by enhancing connectivity and user experience. This initiative could bolster future revenue streams as customers increasingly seek integrated services, potentially impacting revenue and earnings forecasts positively. While the company's service revenues are projected at US$400 million for Q3, the focus on quality and customer-first initiatives highlights potential long-term growth benefits.

Over the past five years, T-Mobile has delivered a robust total shareholder return of nearly 130%, which underscores its capacity to maintain shareholder value. Comparatively, the company's performance over the past year shows it underperformed the US Wireless Telecom industry, which returned 28.7%. However, considering the technological advancements and expanding service offerings, the long-term results depict a positive trajectory.

Currently, T-Mobile's share price stands at US$252.66, presenting a modest upside relative to the analyst consensus price target of US$272.12, reflecting a 7.7% potential increase. Given the analysts' mixed sentiments with price targets ranging from US$200 to US$309, the current market perception seems to align closely with the middle ground of these projections. The extended focus on 5G and T-Fiber could deliver incremental service revenue growth, aligning with their expectations of future expansion and enhanced profitability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026