- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US' (NASDAQ:TMUS) Short-Term Decline is Not Surprising

After performing in line with the broad market, T-Mobile US, Inc. ( NASDAQ: TMUS ) started retracing through the summer, eventually erasing all the gains.

Despite 5G optimism, in light of the latest earnings results, it seems that more downside might be in front of us.

See our latest analysis for T-Mobile US

Q3 2021 results

The company reported a soft third-quarter result with weaker earnings and profit margins, although revenues improved.

- Revenue: US$19.6b (up 1.8% from 3Q 2020)

- Net income: US$691.0m (down 45% from 3Q 2020)

- Profit margin: 3.5% (down from 6.5% in 3Q 2020)

Higher expenses drove the decrease in the margin. Over the last 3 years, on average, earnings per share have fallen by 22% per year, but its share price has increased by 20% per year, which means it is well ahead of earnings.

The company pointed out that the net income decrease is connected to merger-related costs of US$707M. The merger in question was a Spring Corp all-share deal, valued at US$26b, announced in 2018 and finalized in April 2020.

Meanwhile, with the 5G technology slowly unrolling across the US, T-Mobile expects to have 97% coverage by 2022. Furthermore, the company is simultaneously outperforming the competitors by another essential factor, speed of the connection. T-mobile claims its 5G download speed is 50% faster than Verizon and 30% faster than AT&T.

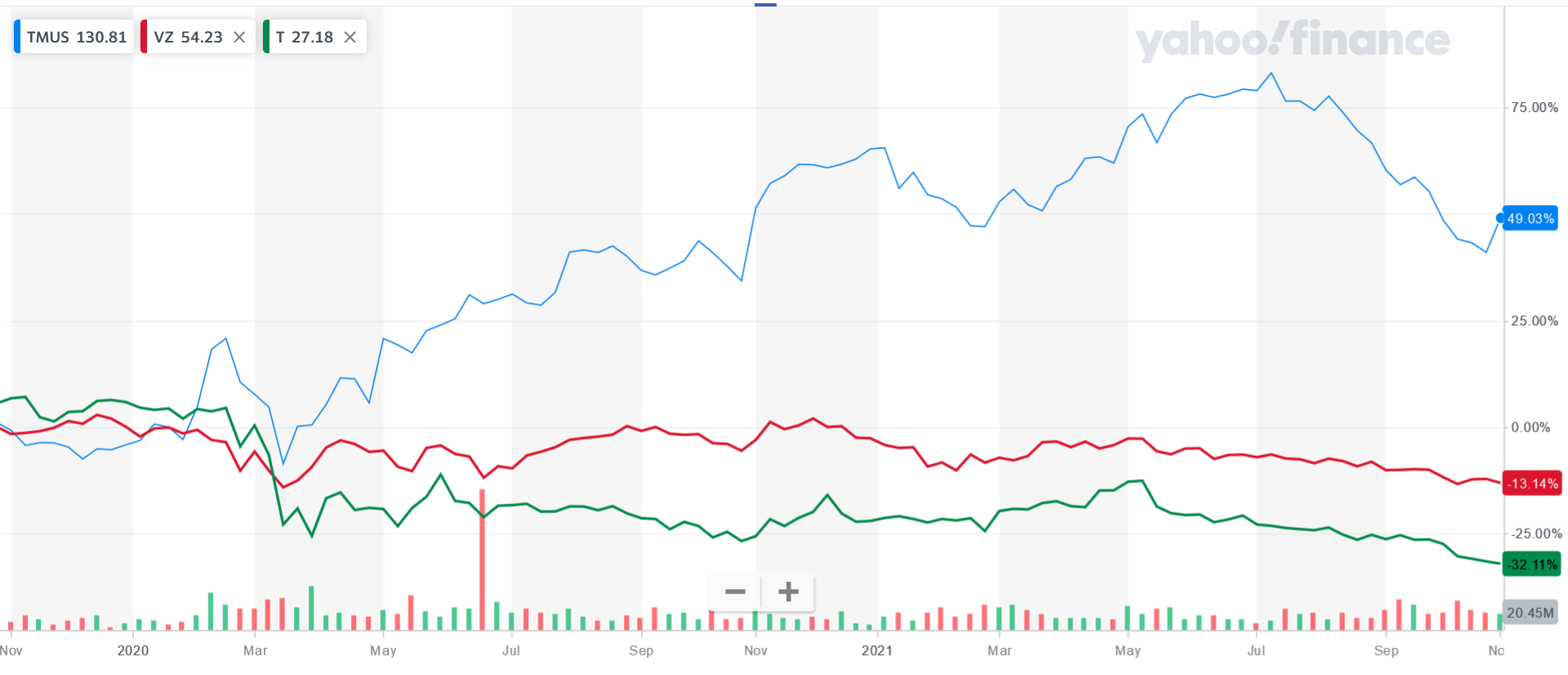

Thus, it is not surprising to see that it outperformed its closest competitors, Verizon and AT&T, in the last 2 years.

A Look Into the Recent Growth

While shareholders might be concerned after seeing the share price drop 14% in the last quarter, but that scarcely detracts from the substantial long-term returns generated by the company over five years. We think most investors would be happy with the 130% return over that period. To some, the recent pullback wouldn't be surprising after such a fast rise. The more important question is whether the stock is too cheap or too expensive today.

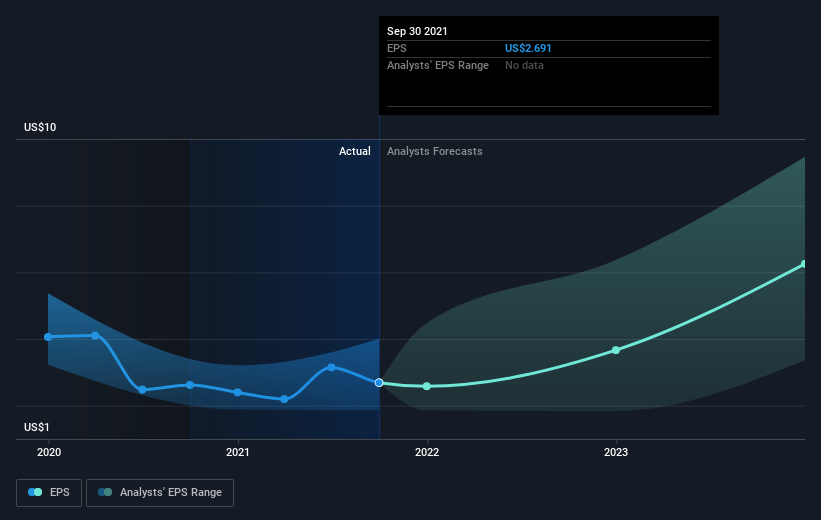

During five years of share price growth, T-Mobile US achieved compound earnings per share (EPS) growth of 11% per year.This EPS growth is lower than the 18% average annual increase in the share price.So it's fair to assume the market has a higher opinion of the business than it did five years ago.And that's hardly shocking given the track record of growth.This optimism is visible in its relatively high P/E ratio of 45.44.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on T-Mobile US' earnings, revenue, and cash flow is a great place to start if you want to investigate the stock further.

A Different Perspective

T-Mobile US provided a TSR of 5.1% over the last twelve months. While this falls short of the market return but in the larger picture, it barely looks like a convergence with the broad market, as the stock has comfortably outperformed the S&P500 index over the last few years.

Furthermore, it is fascinating to see such performance when the company doesn't even pay a dividend - given that its main competitors are known dividend stocks with solid yields.

To truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for T-Mobile US you should know about.

Also, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives