- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US (NasdaqGS:TMUS) Expands 5G Network and Offers New Financial Instruments

Reviewed by Simply Wall St

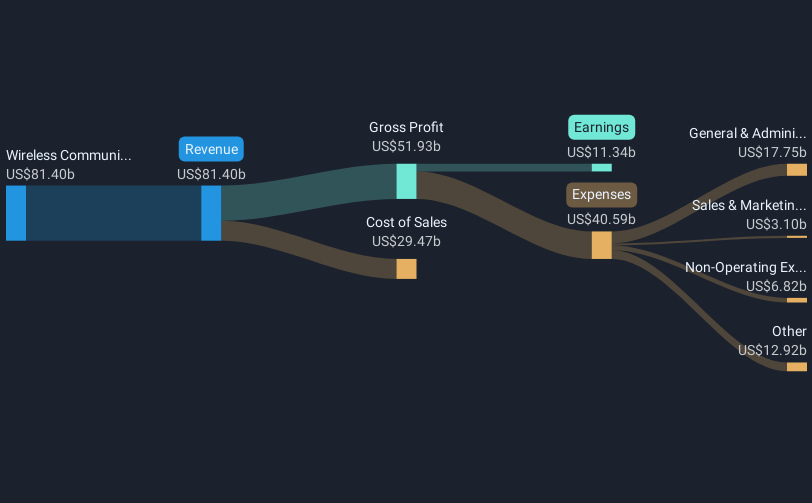

T-Mobile US (NasdaqGS:TMUS) recently extended its debt financing offers and completed a major network expansion in Florida, highlighting its growth in 5G capabilities and community engagement. Concurrently, Ultra Mobile, part of T-Mobile, enhanced its wireless plans, improving data and coverage without price increases. Over the past week, the company's stock rose by 5%, outperforming the broader market’s 3% rise. These developments likely added positive sentiment to investor confidence, aligning with a tech-driven upswing in the Nasdaq, which coincided with significant gains from other tech giants, contributing to the overall positive market trajectory.

T-Mobile US has 1 possible red flag we think you should know about.

T-Mobile US's recent initiatives, including debt financing extensions and a substantial network expansion in Florida, align well with its growth narrative centered around 5G and fiber expansion. These actions could bolster revenue and profitability by enhancing service offerings and customer engagement, potentially driving future earnings growth. The expanded 5G capabilities and improved wireless plans by Ultra Mobile may enhance T-Mobile's competitive position, leading to increased customer acquisition and retention, thereby supporting revenue forecasts. However, competitive pressures and potential tariffs remain risks to margins and earnings.

Over the past five years, T-Mobile's total return, including both share price appreciation and dividends, was 134.29%. This substantial growth over the period highlights the company's robust performance relative to the industry. In the past year, T-Mobile's performance matched the US Wireless Telecom industry, which returned 33.8%, reflecting a strong alignment with industry trends. The recent share price increase of 5% also contributes to its long-term growth trajectory.

In the context of analyst price targets, the current share price of US$253.80, with a consensus target of US$269.25, suggests a modest 5.7% upside. This indicates that analysts view T-Mobile as relatively fairly priced based on projected revenue increases and earnings forecasts. While the share price is close to the target, consistent revenue growth and realization of strategic initiatives could justify further price appreciation. Investors should consider these factors against ongoing risks in their assessments.

Gain insights into T-Mobile US' historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives