- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TIGO

With Millicom International Cellular S.A. (NASDAQ:TIGO) It Looks Like You'll Get What You Pay For

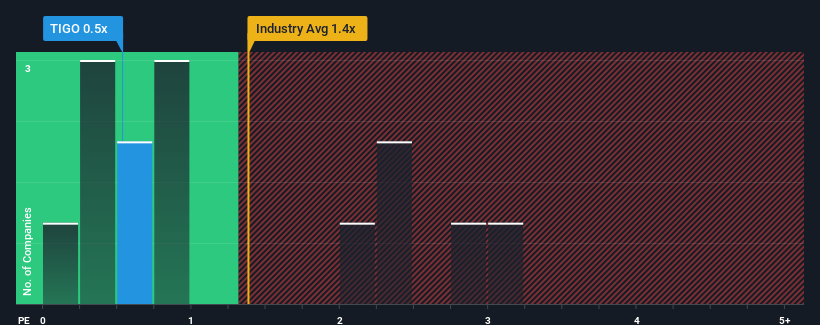

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Wireless Telecom industry in the United States, you could be forgiven for feeling indifferent about Millicom International Cellular S.A.'s (NASDAQ:TIGO) P/S ratio of 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Millicom International Cellular

What Does Millicom International Cellular's P/S Mean For Shareholders?

Millicom International Cellular could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Millicom International Cellular will help you uncover what's on the horizon.How Is Millicom International Cellular's Revenue Growth Trending?

Millicom International Cellular's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 32% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 3.7% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 3.6% per year, which is not materially different.

With this in mind, it makes sense that Millicom International Cellular's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Millicom International Cellular's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Millicom International Cellular's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Wireless Telecom industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Millicom International Cellular (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Millicom International Cellular, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TIGO

Millicom International Cellular

Provides cable and mobile services in Latin America.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives