- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TIGO

Assessing Millicom (NasdaqGS:TIGO): Is the Stock Overvalued After Its Recent 31% Rally?

Reviewed by Kshitija Bhandaru

Millicom International Cellular (NasdaqGS:TIGO) continues to catch investor attention, recently showing a return of nearly 31% over the past 3 months. The stock’s gains have coincided with positive sentiment about its financial performance and growth prospects.

See our latest analysis for Millicom International Cellular.

Millicom’s momentum is building, with a standout 31% gain in the last 90 days underscoring renewed investor confidence. Over the past year, the company delivered a total shareholder return just shy of 100%, signaling substantial long-term growth potential beyond recent price moves.

If you’re scanning for stellar runs like this, you might enjoy seeing what’s next on the radar. Discover fast growing stocks with high insider ownership.

But with such rapid gains, investors face a crucial question: is Millicom still undervalued based on its fundamentals, or has the market already priced in every bit of future growth potential as the stock climbs higher?

Most Popular Narrative: 4% Overvalued

The most widely followed narrative sees Millicom International Cellular’s fair value at $46.51, slightly below the latest close of $48.47. This comparison paints a picture of a company recognition cycle where market optimism and changed expectations may be balancing out previous underappreciation.

Bearish analysts highlight that Millicom continues to exhibit the softest growth outlook compared to its Latin American peers. This casts some doubt on future earnings momentum.

Want to know what assumptions analysts think will drive or limit Millicom’s share price? The core of this narrative lies in steady revenues, tougher margins and a future profit multiple that may surprise even its most ardent fans. Uncover which performance trends and forecasts shape this price view.

Result: Fair Value of $46.51 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a surge in organic growth or a successful margin improvement strategy could quickly challenge these cautious outlooks and spark renewed optimism around Millicom.

Find out about the key risks to this Millicom International Cellular narrative.

Another View: The SWS DCF Model Says Undervalued

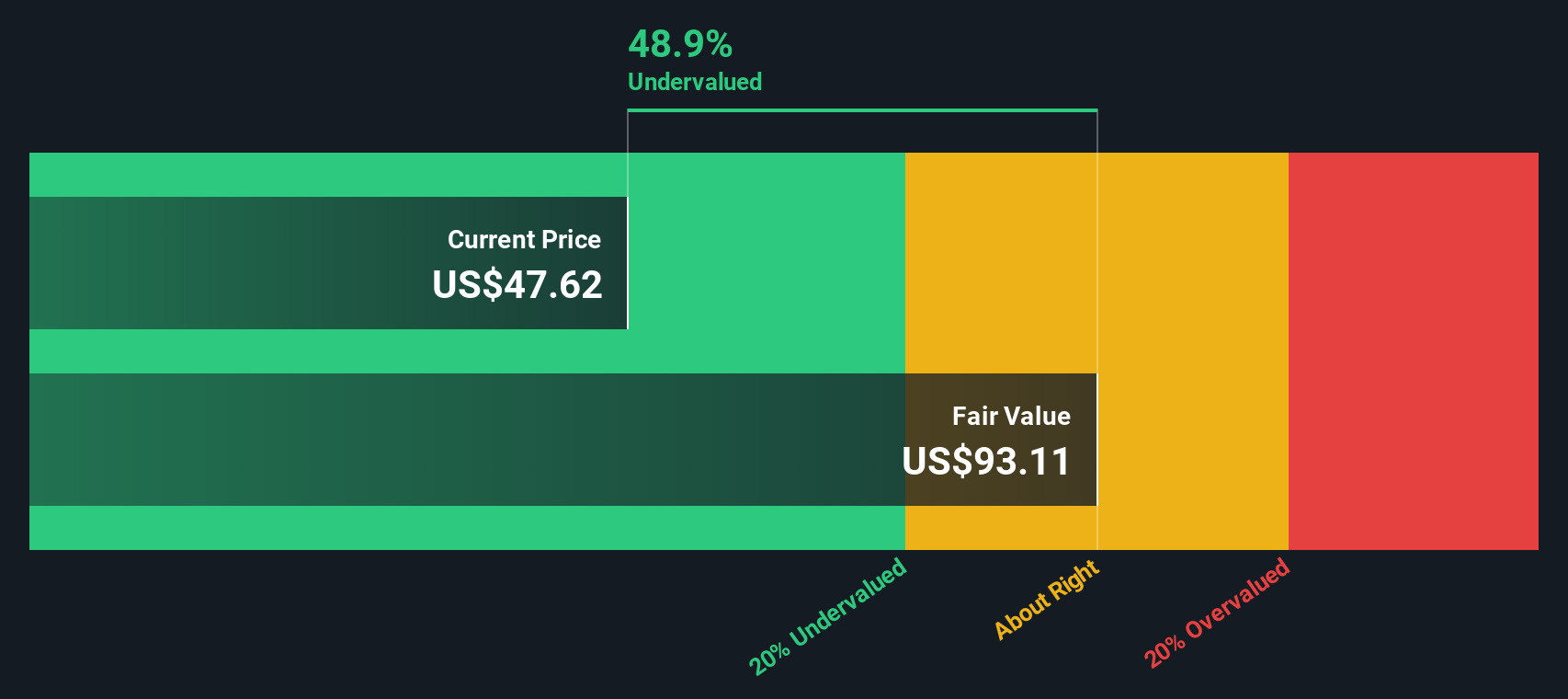

While many focus on peer and industry multiples, our DCF model takes a longer-term look at cash flows. By this view, Millicom appears undervalued, trading at nearly 48% below what the DCF suggests is fair value. Does the market see a risk that the model does not see, or is there hidden upside ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Millicom International Cellular Narrative

If you would rather dig into the numbers yourself or have a different take on Millicom’s outlook, you can shape your own analysis in just a few minutes. Do it your way.

A great starting point for your Millicom International Cellular research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for Your Next Opportunity?

Don’t let great investment opportunities pass you by. The next standout stock could be one click away. Make your move and turn market changes into your advantage.

- Uncover stocks trading well below their true worth when you check out these 895 undervalued stocks based on cash flows for hidden value deals.

- Tap into big yield potential with these 19 dividend stocks with yields > 3% offering companies delivering impressive dividends above 3%.

- Get ahead of the innovation curve and see what’s happening with these 26 quantum computing stocks for your front-row seat to the quantum technology revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TIGO

Millicom International Cellular

Provides cable and mobile services in Latin America.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives