- United States

- /

- Wireless Telecom

- /

- NasdaqCM:SURG

Recent 15% pullback isn't enough to hurt long-term SurgePays (NASDAQ:SURG) shareholders, they're still up 172% over 1 year

The SurgePays, Inc. (NASDAQ:SURG) share price has had a bad week, falling 15%. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 172% in that time. So some might not be surprised to see the price retrace some. More important, going forward, is how the business itself is going.

In light of the stock dropping 15% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

View our latest analysis for SurgePays

Given that SurgePays didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year SurgePays saw its revenue grow by 106%. That's stonking growth even when compared to other loss-making stocks. Meanwhile, the market has paid attention, sending the share price soaring 172% in response. It's great to see strong revenue growth, but the question is whether it can be sustained. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

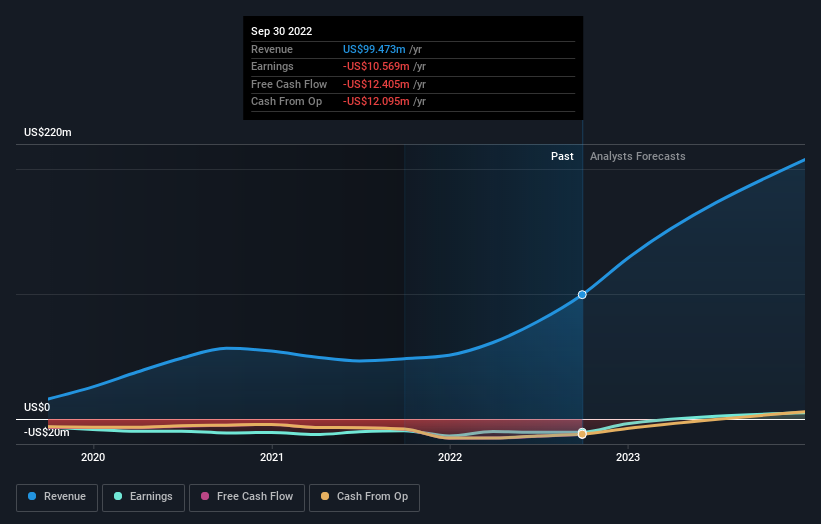

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for SurgePays in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that SurgePays rewarded shareholders with a total shareholder return of 172% over the last year. That certainly beats the loss of about 16% per year over three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for SurgePays (1 is potentially serious!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SURG

SurgePays

Operates as a financial technology and telecom company in the United States.

Undervalued with high growth potential.

Market Insights

Community Narratives