- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:SIFY

Sify Technologies (NasdaqCM:SIFY) Valuation After Q3 Revenue Growth, Wider Loss And Data Center And AI Investments

What the latest earnings mean for Sify Technologies (SIFY) shareholders

Sify Technologies (SIFY) recently reported third quarter earnings that combined higher sales with a wider net loss, along with continued spending on hyperscale data centers, AI focused platforms, and an uncertain IPO timeline for subsidiary Infinite Spaces.

See our latest analysis for Sify Technologies.

At a share price of $13.91, Sify has seen a 23.10% 30 day share price return and a 13.23% year to date share price return. The 1 year total shareholder return of 328% points to strong but potentially cooling momentum after a very large upswing, as investors weigh data center growth plans against continued net losses and funding questions around the Infinite Spaces IPO.

If Sify’s data center and AI push has caught your attention, it could be a moment to scan other tech names through high growth tech and AI stocks as potential additions to your watchlist.

With Sify trading at $13.91 against a US$22 analyst target, and the business still posting a net loss, the real question is whether you are seeing a mispriced opportunity or a market that already reflects ambitious growth expectations.

Most Popular Narrative: 36.8% Undervalued

With Sify trading at US$13.91 against a narrative fair value of US$22, the current price sits well below what this widely followed view assumes.

Sify Technologies is investing in AI capabilities, which may lead to increased demand from enterprises seeking mature network, data center, and digital services. This could impact revenue and earnings as AI workloads develop in India.

Curious what has to happen for that higher value to make sense? The narrative focuses on sharp revenue gains, better margins and a richer future earnings multiple.

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on AI demand materialising as expected and on Sify turning current losses and high SG&A spending into the margin gains the narrative assumes.

Find out about the key risks to this Sify Technologies narrative.

Another view: what the market multiple is saying

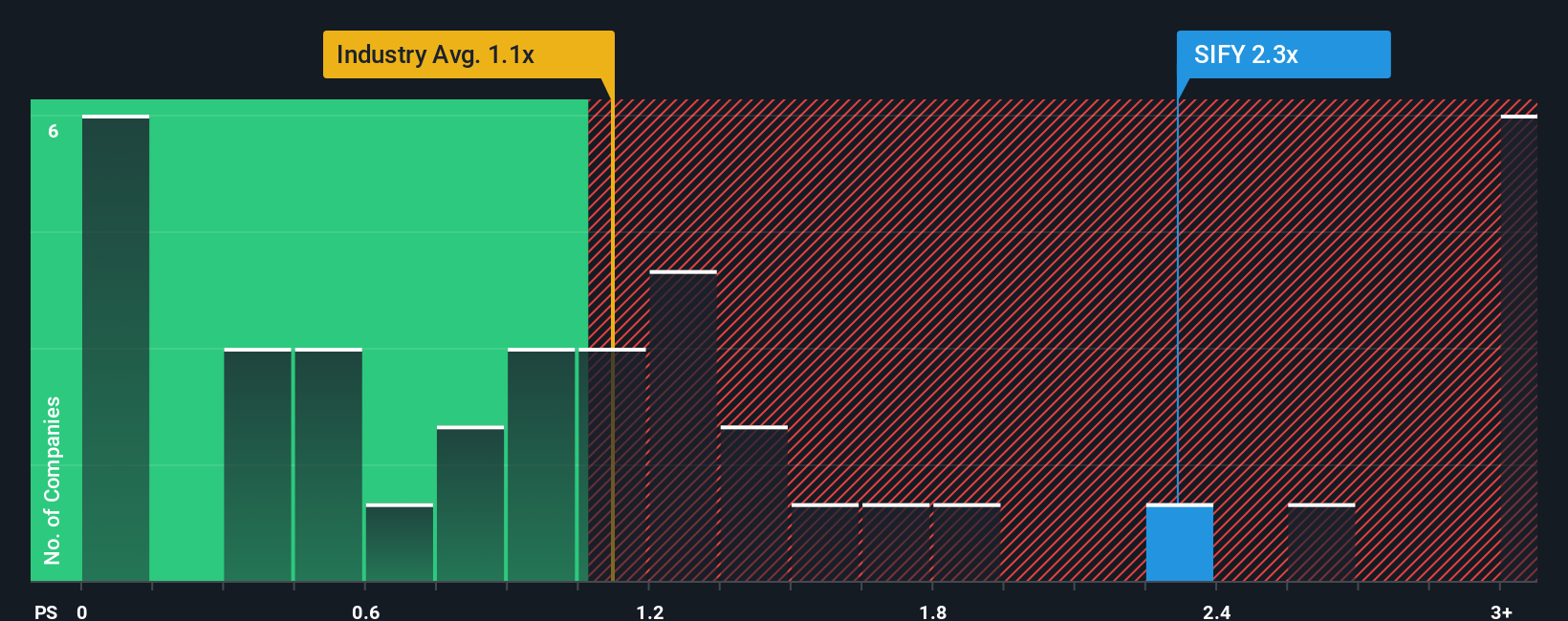

The narrative points to upside, but the current market multiple tells a different story. Sify trades on a P/S of 2.1x, compared with 1.2x for the US Telecom industry and 1.1x for peers. Its fair ratio is 1.5x, which implies limited margin for error if growth or margins slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sify Technologies Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can put together a custom narrative in just a few minutes by starting with Do it your way.

A great starting point for your Sify Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Sify is on your radar, do not stop there. Widening your research set now can help you spot opportunities that others overlook.

- Target potential mispricings by scanning these 875 undervalued stocks based on cash flows that may offer more value than the market currently recognizes.

- Explore technology themes by checking out these 24 AI penny stocks positioned around artificial intelligence and automation trends.

- Position your portfolio for income by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% with supporting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SIFY

Sify Technologies

Offers information and communication technology solutions and services in India and internationally.

High growth potential with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

NVIDIA: Durable Infrastructure in AI Leadership, but Nigh-Perfect Precision is Required

EchoStar's 43.91 fair value will redefine its market position

VTEX - A hidden Latin American growth opportunity?

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026