- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:LILA

Liberty Latin America (NASDAQ:LILA) Has A Somewhat Strained Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Liberty Latin America Ltd. (NASDAQ:LILA) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out the opportunities and risks within the US Telecom industry.

How Much Debt Does Liberty Latin America Carry?

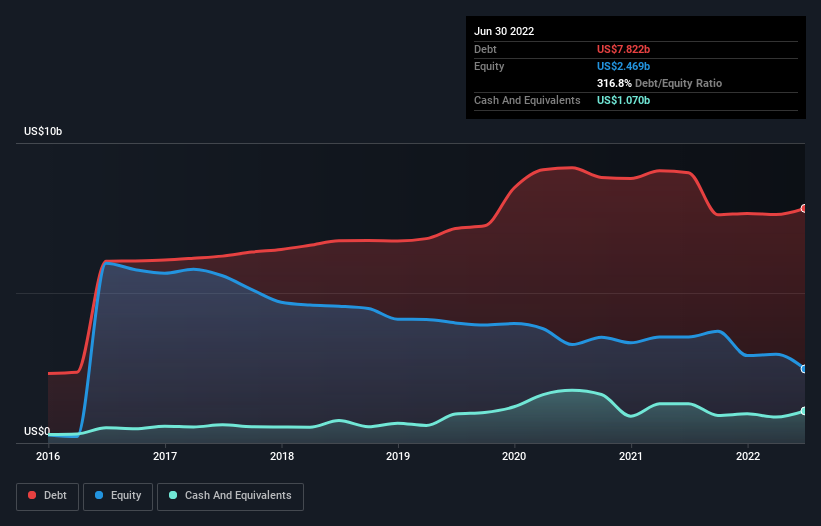

You can click the graphic below for the historical numbers, but it shows that Liberty Latin America had US$7.82b of debt in June 2022, down from US$9.01b, one year before. On the flip side, it has US$1.07b in cash leading to net debt of about US$6.75b.

How Strong Is Liberty Latin America's Balance Sheet?

We can see from the most recent balance sheet that Liberty Latin America had liabilities of US$1.52b falling due within a year, and liabilities of US$11.0b due beyond that. Offsetting these obligations, it had cash of US$1.07b as well as receivables valued at US$730.7m due within 12 months. So its liabilities total US$10.7b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$1.63b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Liberty Latin America would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Liberty Latin America's net debt to EBITDA ratio of 4.1, we think its super-low interest cover of 1.4 times is a sign of high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. On a lighter note, we note that Liberty Latin America grew its EBIT by 23% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Liberty Latin America's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Liberty Latin America's free cash flow amounted to 30% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

On the face of it, Liberty Latin America's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, it seems to us that Liberty Latin America's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Given our hesitation about the stock, it would be good to know if Liberty Latin America insiders have sold any shares recently. You click here to find out if insiders have sold recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LILA

Liberty Latin America

Provides fixed, mobile, and subsea telecommunications services in Puerto Rico, Panama, Costa Rica, Jamaica, Latin America and the Caribbean, the Bahamas, Trinidad and Tobago, Barbados, Curacao, Chile, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives