- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:LBTY.A

Liberty Global (LBTY.A) Losses Widen 41% Annually, Reinforcing Bearish Sentiment Heading Into Earnings

Reviewed by Simply Wall St

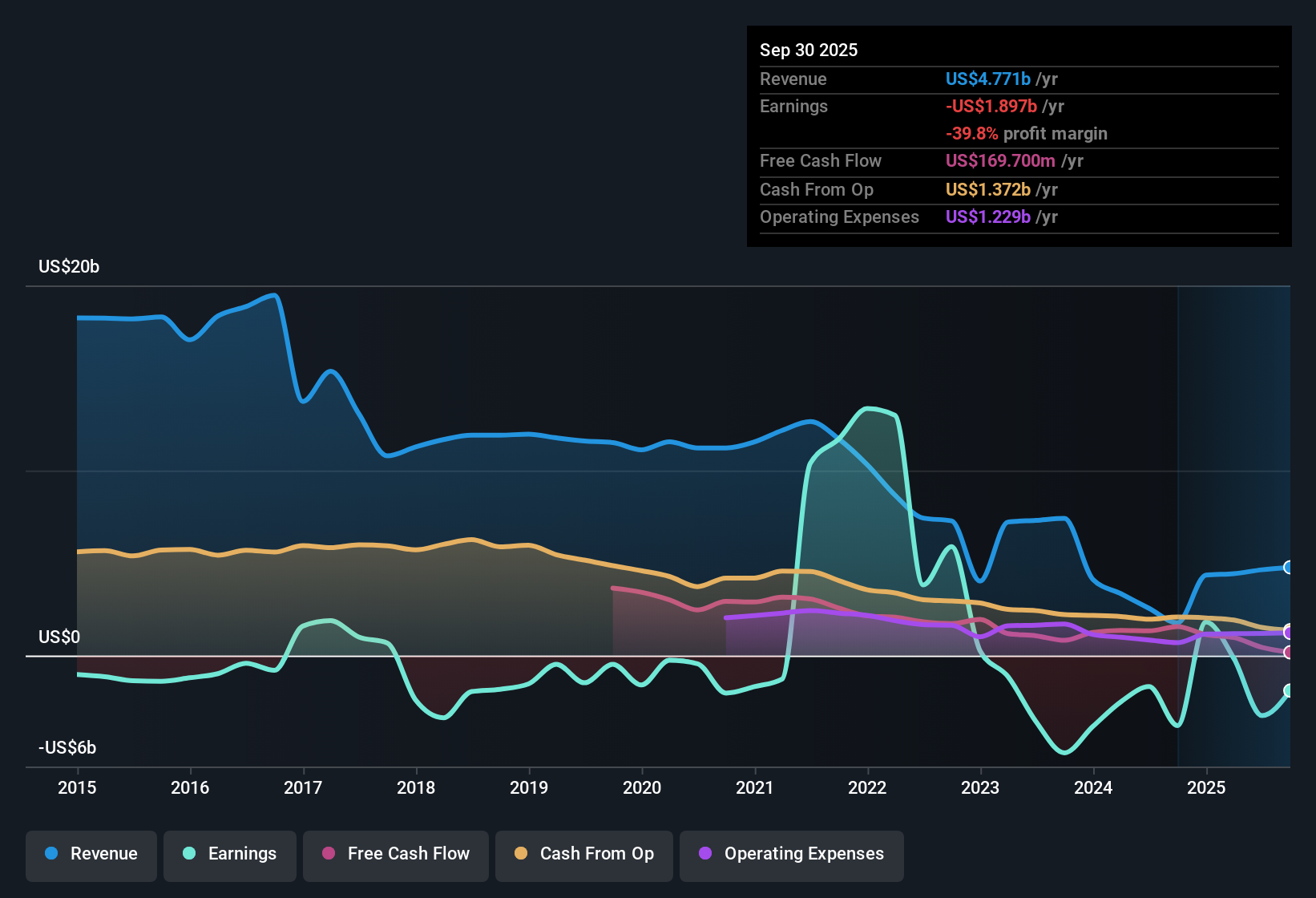

Liberty Global (LBTY.A) reported a continued trend of widening losses, with net losses growing at an average annual rate of 41.1% over the past five years. Forecasts call for ongoing unprofitability and a further 1.8% annual decline in revenue over the next few years. The company’s net profit margin and earnings growth show no sign of a turnaround. Despite operational challenges, value-oriented investors may take note of Liberty Global’s Price-To-Sales ratio of 0.8x, which sits well below the US Telecom industry and peer averages. The share price of $11 is significantly under the estimated fair value of $70.5.

See our full analysis for Liberty Global.Next, let’s see how these headline figures match up against the narratives circulating in the market and whether they support or question the current consensus.

See what the community is saying about Liberty Global

Analyst Price Target and Revenue Recovery Hinge on Key Assumptions

- The analyst consensus price target is $15.43, requiring Liberty Global’s profit margin to rise sharply from -70.2% to the US Telecom industry average of 12.7% by 2028. Earnings are projected to climb from a $3.3 billion loss to $613.2 million, and the PE ratio would need to increase from -1.2x to 9.3x.

- Analysts' consensus view highlights several strategic change drivers that could help bridge this valuation gap:

- Accelerated network upgrades, bundled service rollouts, and asset optimizations are expected to stabilize revenue and boost margins. However, these depend heavily on Liberty Global successfully executing these initiatives amid competitive and regulatory headwinds.

- Corporate simplification and a push for asset spin-offs or IPOs within 12 to 24 months are seen as ways to close the conglomerate discount and unlock shareholder value. This could potentially lift earnings per share and share price if executed well.

Debt and Leverage Risks Loom Over Strategy

- Leverage at the operating company level stands above 4.5x EBITDA for major assets. Combined with modest EBITDA growth and a projected 1.8% annual revenue decline, Liberty Global faces substantial financial vulnerability if interest rates rise or refinancing conditions deteriorate.

- The consensus narrative flags multiple risk factors that may counteract strategic improvements:

- Mounting competition from low-cost providers and regulatory threats to pricing power drive elevated churn and reduce recurring revenues. This could further compress margins despite ongoing cost-reduction and asset-optimization efforts.

- Ongoing and prospective asset sales may lead to reduced scale and top-line pressure, potentially limiting free cash flow and long-term earnings growth even as management attempts to deleverage and return capital to shareholders.

Valuation Discount Remains Despite Profitability Challenges

- Liberty Global trades at a 0.8x Price-To-Sales ratio, notably below US Telecom industry and peer averages of 1.2x. Its $11 share price is significantly less than the $70.50 DCF fair value, creating an unusually wide discount versus sector benchmarks that is rare for a loss-making operator.

- Analysts' consensus view sees this discounted valuation as a double-edged sword:

- The low multiple may attract value-focused investors, but ongoing operating losses and declining revenue raise doubts about whether the business can close the valuation gap without a sharp turnaround in profitability.

- For the analyst price target to be justified, Liberty Global would need to achieve revenue of $4.8 billion and trade at a 9.3x PE ratio by 2028. Both would represent a significant departure from current trends, which makes the upside more speculative than assured.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Liberty Global on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a fresh perspective? Take just a few minutes to shape your own narrative and put your viewpoint into context. Do it your way

A great starting point for your Liberty Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Liberty Global’s high leverage, ongoing losses, and declining revenue signal real financial vulnerability. These factors raise concerns about its ability to weather market stress.

Want lower risk? Use solid balance sheet and fundamentals stocks screener (1983 results) to focus on companies with stronger balance sheets and more resilient financial foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LBTY.A

Liberty Global

Provides broadband internet, video, fixed-line telephony, and mobile communications services to residential and business customers.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives