- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Why Iridium Communications (IRDM) Is Down 9.0% After Institutional Investors Cut Positions On Growth, Leverage Concerns

Reviewed by Sasha Jovanovic

- In recent months, institutional investors including Riverwater Partners and ARK Invest have reduced or exited positions in Iridium Communications, citing slowing growth, rising leverage, and tougher competitive conditions in some end markets.

- These moves highlight how quickly sentiment can shift when a company perceived as a long-term satellite connectivity leader begins to show softer growth expectations and a higher risk profile.

- We’ll now examine how institutional selling tied to concerns over Iridium’s slowing growth and higher leverage may reshape its investment narrative.

Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

Iridium Communications Investment Narrative Recap

To own Iridium Communications, you need to believe its low Earth orbit network will stay essential for secure, global connectivity across voice, data, and IoT, even as growth moderates. Recent institutional selling and softer 2025 service revenue guidance highlight that the key near term catalyst is proving Iridium can still grow profitably while managing higher leverage, and that competitive and balance sheet risks are becoming more central to the story, but the core thesis around mission critical coverage remains intact.

The clearest tie to this shift in sentiment was Iridium’s Q2 2025 update, where management cut full year service revenue growth guidance to 3% to 5% from 5% to 7%. That revision, coupled with comments from Riverwater Partners about slowing growth and rising leverage, sharpened investor focus on whether Iridium’s IoT and higher value services can offset pressures in legacy segments and justify its capital structure as new satellite and direct to device competitors ramp up.

Yet behind Iridium’s global network story, investors should also be aware that rising leverage and slower expected growth could pressure...

Read the full narrative on Iridium Communications (it's free!)

Iridium Communications' narrative projects $982.9 million revenue and $174.8 million earnings by 2028. This requires 4.7% yearly revenue growth and a $61.6 million earnings increase from $113.2 million today.

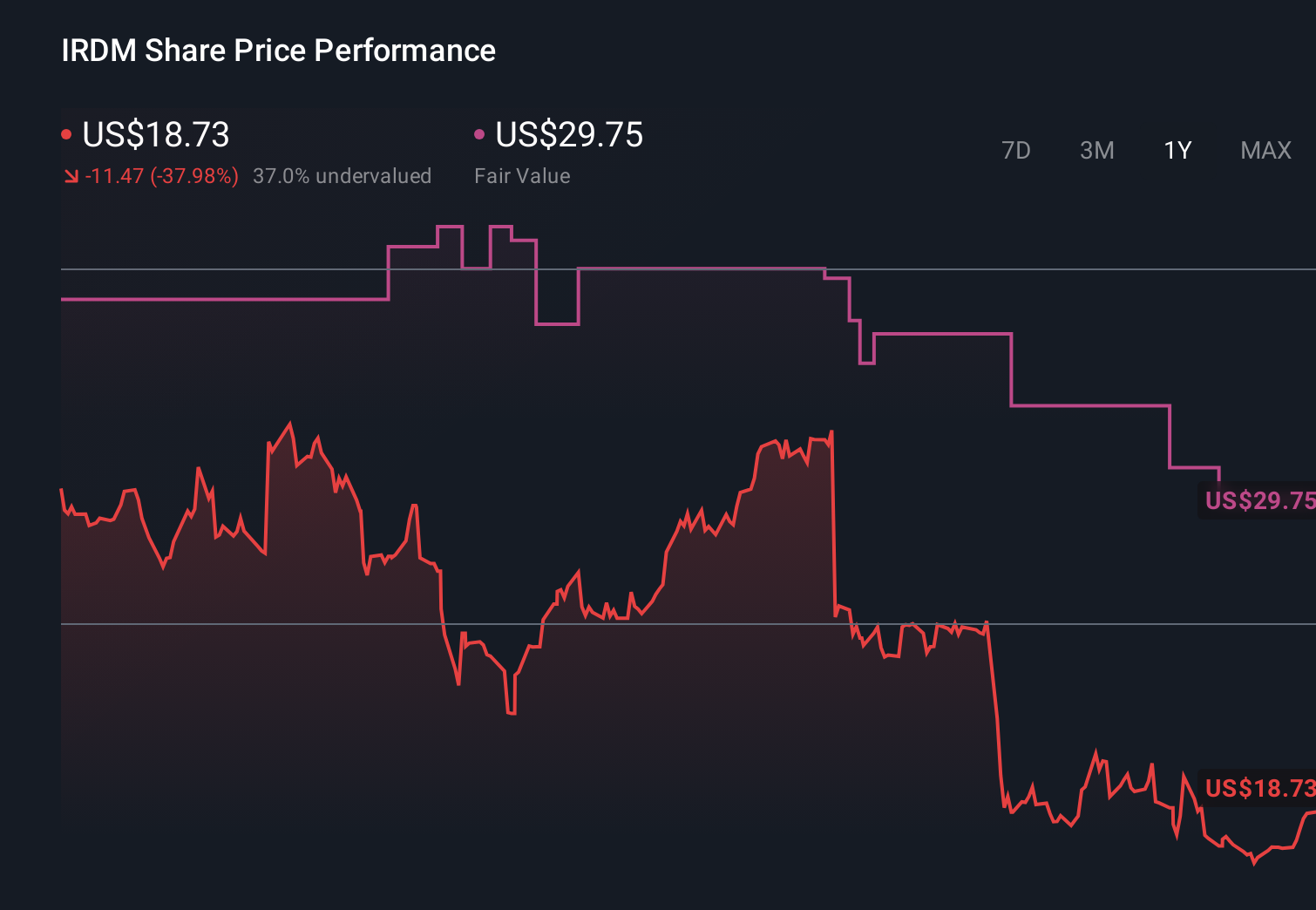

Uncover how Iridium Communications' forecasts yield a $29.75 fair value, a 75% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span roughly US$25 to US$66.70, showing how far apart views on Iridium’s potential really are. Against that backdrop of wide opinion, the recent institutional selling tied to slower growth and higher leverage underlines why it can help to weigh both optimistic IoT adoption scenarios and the risk that competitive and capital intensity pressures limit future performance before making any decision.

Explore 7 other fair value estimates on Iridium Communications - why the stock might be worth over 3x more than the current price!

Build Your Own Iridium Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Iridium Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iridium Communications' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion